Question: Sorry for multiple questions, if you use excel please show me the formulas so I can learn. (Related to Checkpoint 9.2 and Checkpoint 9.3) (Bond

Sorry for multiple questions, if you use excel please show me the formulas so I can learn.

Sorry for multiple questions, if you use excel please show me the formulas so I can learn.

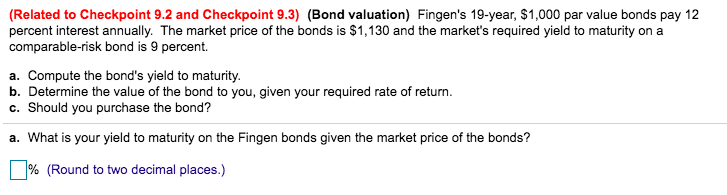

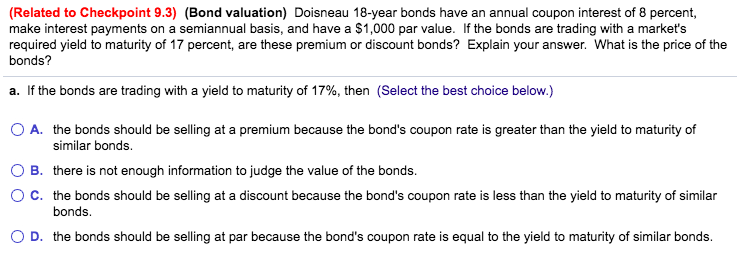

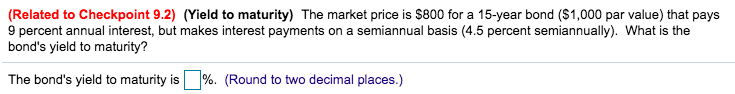

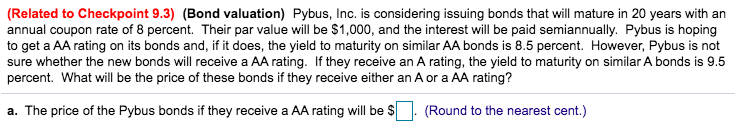

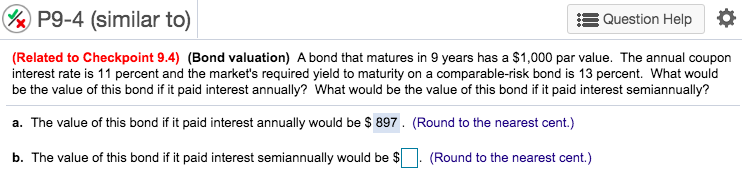

(Related to Checkpoint 9.2 and Checkpoint 9.3) (Bond valuation) Fingen's 19-year, $1,000 par value bonds pay 12 percent interest annually. The market price of the bonds is $1,130 and the market's required yield to maturity on a comparable-risk bond is 9 percent. a. Compute the bond's yield to maturity. b. Determine the value of the bond to you, given your required rate of return. c. Should you purchase the bond? a. What is your yield to maturity on the Fingen bonds given the market price of the bonds? % (Round to two decimal places.) (Related to Checkpoint 9.3) (Bond valuation) Doisneau 18-year bonds have an annual coupon interest of 8 percent, make interest payments on a semiannual basis, and have a $1,000 par value. If the bonds are trading with a market's required yield to maturity of 17 percent, are these premium or discount bonds? Explain your answer. What is the price of the bonds? a. If the bonds are trading with a yield to maturity of 17%, then (Select the best choice below.) O A. the bonds should be selling at a premium because the bond's coupon rate is greater than the yield to maturity of similar bonds. OB. there is not enough information to judge the value of the bonds. OC. the bonds should be selling at a discount because the bond's coupon rate is less than the yield to maturity of similar bonds. OD. the bonds should be selling at par because the bond's coupon rate is equal to the yield to maturity of similar bonds. (Related to Checkpoint 9.2) (Yield to maturity) The market price is $800 for a 15-year bond ($1,000 par value) that pays 9 percent annual interest, but makes interest payments on a semiannual basis (4.5 percent semiannually). What is the bond's yield to maturity? The bond's yield to maturity is %. (Round to two decimal places.) (Related to Checkpoint 9.3) (Bond valuation) Pybus, Inc. is considering issuing bonds that will mature in 20 years with an annual coupon rate of 8 percent. Their par value will be $1,000, and the interest will be paid semiannually. Pybus is hoping to get a AA rating on its bonds and, if it does, the yield to maturity on similar AA bonds is 8.5 percent. However, Pybus is not sure whether the new bonds will receive a AA rating. If they receive an A rating, the yield to maturity on similar A bonds is 9.5 percent. What will be the price of these bonds if they receive either an A or a AA rating? a. The price of the Pybus bonds if they receive a AA rating will be $. (Round to the nearest cent.) P9-4 (similar to) Question Help (Related to Checkpoint 9.4) (Bond valuation) A bond that matures in 9 years has a $1,000 par value. The annual coupon interest rate is 11 percent and the market's required yield to maturity on a comparable-risk bond is 13 percent. What would be the value of this bond if it paid interest annually? What would be the value of this bond if it paid interest semiannually? a. The value of this bond if it paid interest annually would be $ 897. (Round to the nearest cent.) b. The value of this bond if it paid interest semiannually would be $ (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts