Question: I really need help with these problems (Yieid to maturity) Fitzgerald's 20-year bonds pay 8 percent interest annually on a $1,000 par value, If the

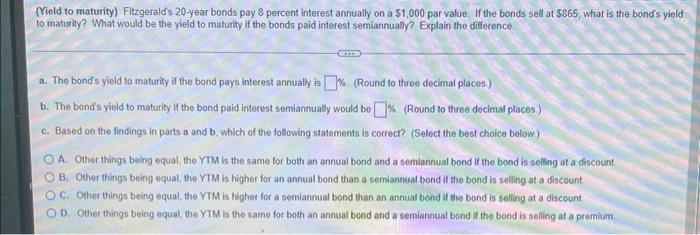

(Yieid to maturity) Fitzgerald's 20-year bonds pay 8 percent interest annually on a $1,000 par value, If the bonds seil at $865, what is the bond's yield to maturity? What would be the yield to maturity if the bonds paid interest semiannually? Explain the difference. a. The bond's yleld to maturity if the bond pays interest annually is \% (Round to three decimat places.) b. The bond's yield to maturity if the bond paid interest semiannually would be %. (Round to three decimal places.) c. Based on the fincings in parts a and b. which of the following statements is correct? (Select the best choice below) A. Other things beling equal, the YTM is the same for both an annonl bond and a somlannual bond if the bond is selling at a discount B. Other things being equal, the YTM is higher for an anneal bond than a semianneal bond if the bond is seliing at a dincount. C. Other things being equal, the YTM is higher for a semiannual bond than an annual bond if the bond is selling at a discount D. Other things being equal, the YTM is the same for both an annuat bond and a semiannual bond if the bond is seling at a premium

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts