Question: I really need help with this ASAP.I will rate you if correct (please be correct) - Accounting Income Statement - Cover-to-Cover Cover-to-Cover Company Contribution Margin

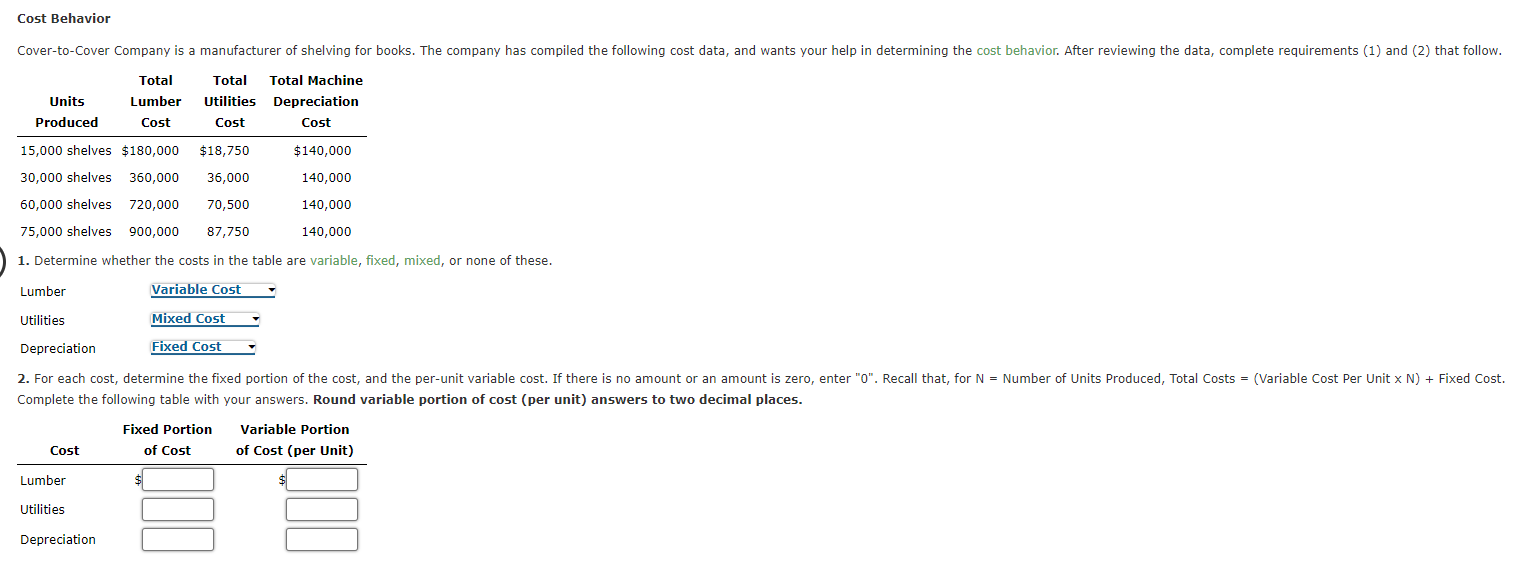

I really need help with this ASAP.I will rate you if correct (please be correct) - Accounting

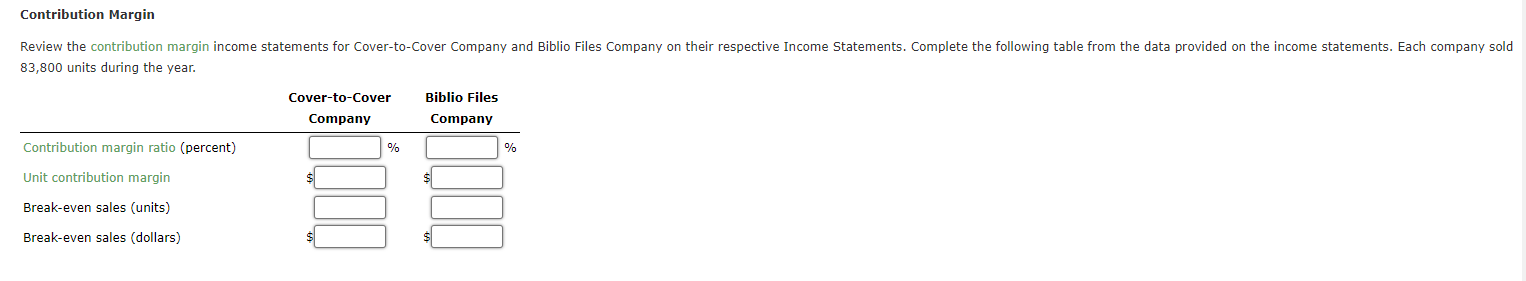

Income Statement - Cover-to-Cover

| Cover-to-Cover Company Contribution Margin Income Statement For the Year Ended December 31, 20Y8 | ||

| Sales | $419,000 | |

| Variable costs: | ||

| Manufacturing expense | $251,400 | |

| Selling expense | 20,950 | |

| Administrative expense | 62,850 | (335,200) |

| Contribution margin | $83,800 | |

| Fixed costs: | ||

| Manufacturing expense | $5,000 | |

| Selling expense | 4,000 | |

| Administrative expense | 11,950 | (20,950) |

| Operating income | $62,850 | |

Income Statement - Biblio Files

| Biblio Files Company Contribution Margin Income Statement For the Year Ended December 31, 20Y8 | ||

| Sales | $419,000 | |

| Variable costs: | ||

| Manufacturing expense | $167,600 | |

| Selling expense | 16,760 | |

| Administrative expense | 67,040 | (251,400) |

| Contribution margin | $167,600 | |

| Fixed costs: | ||

| Manufacturing expense | $86,750 | |

| Selling expense | 8,000 | |

| Administrative expense | 10,000 | (104,750) |

| Operating income | $62,850 | |

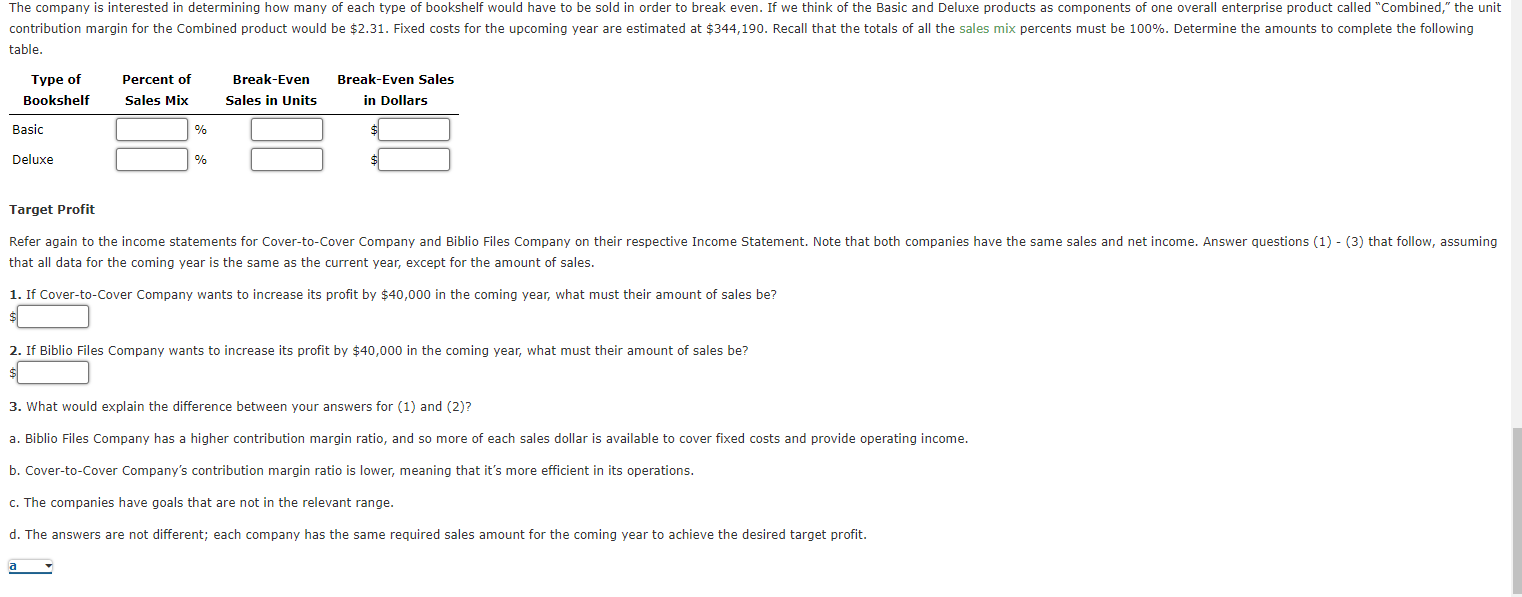

Sales Mix

Biblio Files Company is making plans for its next fiscal year, and decides to sell two new types of bookshelves, Basic and Deluxe. The company has compiled the following estimates for the new product offerings.

| Type of Bookshelf | Sales Price per Unit | Variable Cost per Unit |

| Basic | $5.00 | $1.75 |

| Deluxe | 9.00 | 8.10 |

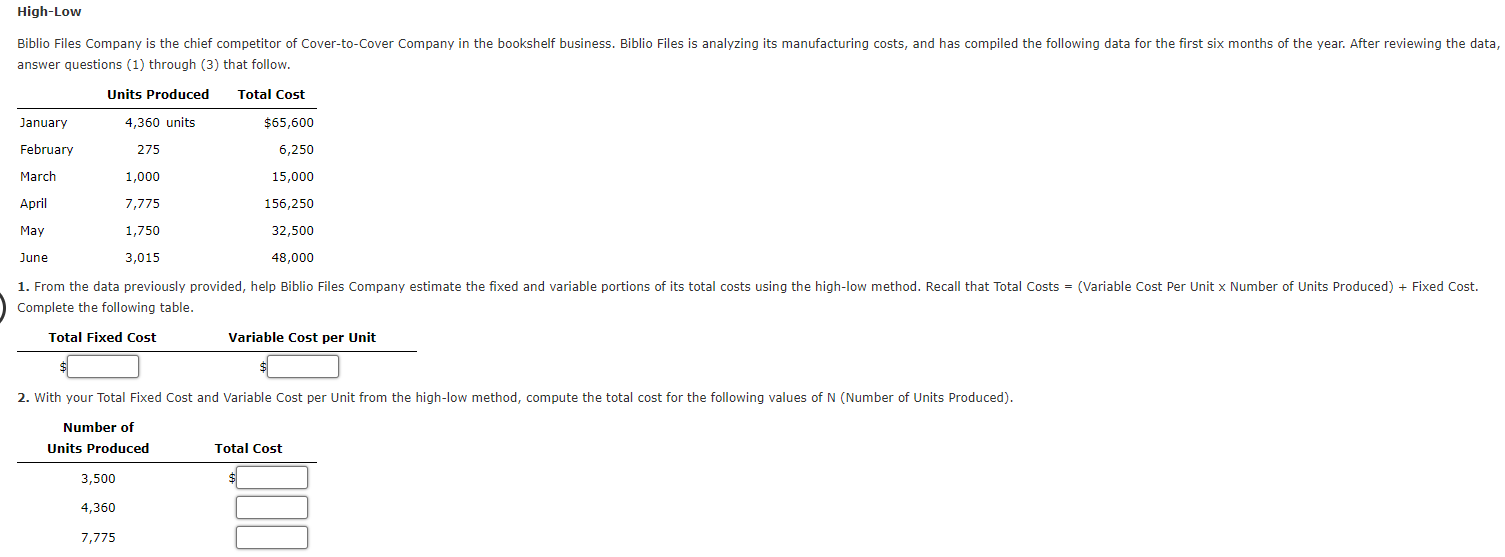

1. Determine whether the costs in the table are variable, fixed, mixed, or none of these. High-Low answer questions (1) through (3) that follow. Complete the following table. 2. With your Total Fixed Cost and Variable Cost per Unit from the high-low method, compute the total cost for the following values of Number of Units Produced). Contribution Margin 83,800 units during the year. \begin{tabular}{lcc} & Cover-to-Cover Company & Biblio Files Company \\ \hline Contribution margin ratio (percent) & \end{tabular} that all data for the coming year is the same as the current year, except for the amount of sales. 1. If Cover-to-Cover Company wants to increase its profit by $40,000 in the coming year, what must their amount of sales be? 2. If Biblio Files Company wants to increase its profit by $40,000 in the coming year, what must their amount of sales be? 3. What would explain the difference between your answers for (1) and (2)? a. Biblio Files Company has a higher contribution margin ratio, and so more of each sales dollar is available to cover fixed costs and provide operating income. b. Cover-to-Cover Company's contribution margin ratio is lower, meaning that it's more efficient in its operations. c. The companies have goals that are not in the relevant range. d. The answers are not different; each company has the same required sales amount for the coming year to achieve the desired target profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts