Question: I really need help with this please The trial balance of Abad Baru Sdn Bhd (ABSB) as at 31 December 2020 is listed as follows:

I really need help with this please

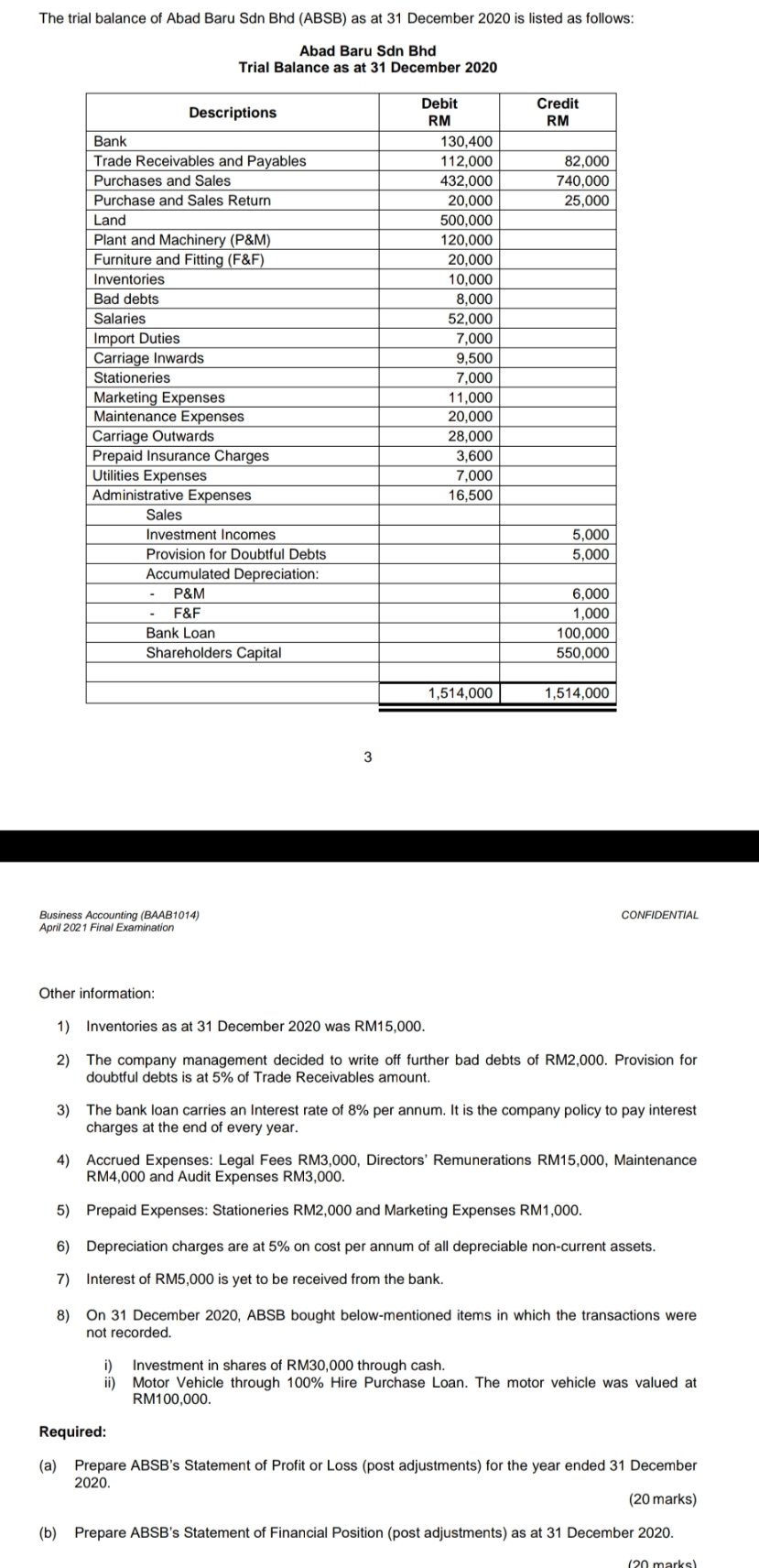

The trial balance of Abad Baru Sdn Bhd (ABSB) as at 31 December 2020 is listed as follows: Abad Baru Sdn Bhd Trial Balance as at 31 December 2020 Descriptions Debit Credit RM RM Bank 130,400 Trade Receivables and Payables 112,000 82,000 Purchases and Sales 432,000 740,000 Purchase and Sales Return 20,000 25,000 Land 500,000 Plant and Machinery (P&M) 120,000 Furniture and Fitting (F&F) 20,000 Inventories 10,000 Bad debts 8,000 Salaries 52,000 Import Duties 7,000 Carriage Inwards 9,500 Stationeries 7,000 Marketing Expenses 11,000 Maintenance Expenses 20,000 Carriage Outwards 28,000 Prepaid Insurance Charges 3,600 Utilities Expenses 7,000 Administrative Expenses 16,500 Sales Investment Incomes 5,000 Provision for Doubtful Debts 5,000 Accumulated Depreciation: P&M 6,000 F&F 1,000 Bank Loan 100,000 Shareholders Capital 650,000 1,514,000 1,514,000 3 Business Accounting (BAAB1014) CONFIDENTIAL April 2021 Final Examination Other information: 1) Inventories as at 31 December 2020 was RM15,000. 2) The company management decided to write off further bad debts of RM2,000. Provision for doubtful debts is at 5% of Trade Receivables amount. 3) The bank loan carries an Interest rate of 8% per annum. It is the company policy to pay interest charges at the end of every year. 4) Accrued Expenses: Legal Fees RM3,000, Directors' Remunerations RM15,000, Maintenance RM4,000 and Audit Expenses RM3,000. 5) Prepaid Expenses: Stationeries RM2,000 and Marketing Expenses RM1,000. 6) Depreciation charges are at 5% on cost per annum of all depreciable non-current assets. 7) Interest of RM5,000 is yet to be received from the bank. 8) On 31 December 2020, ABSB bought below-mentioned items in which the transactions were not recorded. i) Investment in shares of RM30,000 through cash. Motor Vehicle through 100% Hire Purchase Loan. The motor vehicle was valued at RM100,000. Required: (a) Prepare ABSB's Statement of Profit or Loss (post adjustments) for the year ended 31 December 2020. (20 marks) (b) Prepare ABSB's Statement of Financial Position (post adjustments) as at 31 December 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts