Question: I need help with this whole exercise, especially part (a) which is the table below that I've attached. Some explanations in the answers are much

I need help with this whole exercise, especially part (a) which is the table below that I've attached. Some explanations in the answers are much appreciated! :)

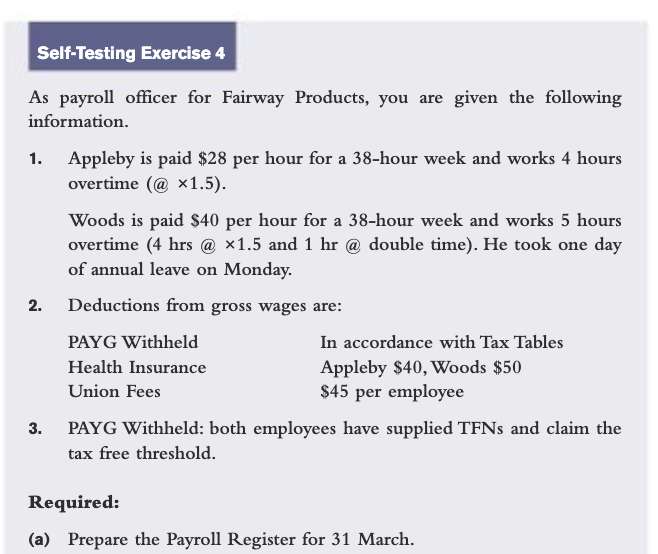

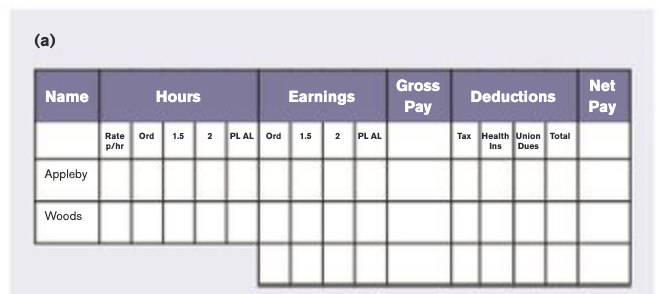

Self-Testing Exercise 4 As payroll ofcer for Fairway Products, you are given the following information. 1. Appleby is paid $28 per hour for a 38-hour week and works 4 hours overtime (@ X15). Woods is paid $40 per hour for a 33-hour week and works 5 hours overtime (4 hrs @ X1.5 and 1 hr @ double time). He took one day of annual leave on Monday. 2. Deductions 'om gross wages are: PAYG Withheld In accordance with Tax Tables Health Insurance Appleby $40, Woods $50 Union Fees $45 per employee 3. PAYG Withheld: both employees have supplied TFNs and claim the tax free threshold. Required: (3) Prepare the Payroll Register for 31 March. (a) Gross Net Name Hours Earnings Deductions Pay Pay Rate Ord 1.5 2 PL AL Ord 1.5 2 PL AL Tax Health Union Total p/hr Ins Dues Appleby Woods

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts