Question: I recieved the answer below for a question I had, but it is incorrect. I think there is an issue starting with Answer D and

I recieved the answer below for a question I had, but it is incorrect. I think there is an issue starting with Answer D and it misses up the rest of the equation. Please make sure not to round intermediate solutions.

Question

5.

value: 16.66 points

| Green Manufacturing, Inc., plans to announce that it will issue $2.04 million of perpetual debt and use the proceeds to repurchase common stock. The bonds will sell at par with a coupon rate of 7 percent. Green is currently an all-equity firm worth $7.02 million with 440,000 shares of common stock outstanding. After the sale of the bonds, Green will maintain the new capital structure indefinitely. Green currently generates annual pretax earnings of $1.54 million. This level of earnings is expected to remain constant in perpetuity. Green is subject to a corporate tax rate of 30 percent. |

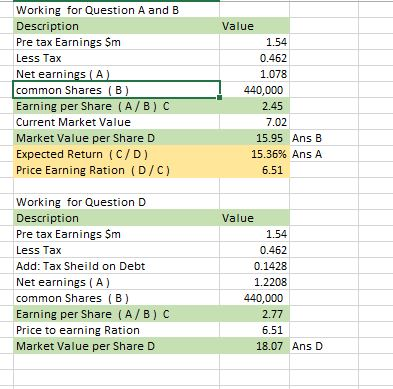

| a. | What is the expected return on Greens equity before the announcement of the debt issue?(Do not round intermediate calculations and round your final answer to 2 decimal places. (e.g., 32.16)) |

| Expected return | % |

| b. | What is the price per share of the firms equity? (Do not round intermediate calculations and round your final answer to 2 decimal places. (e.g., 32.16)) |

| Price per share | $ |

| d. | What is Greens stock price per share immediately after the repurchase announcement? (Do not round intermediate calculations and round your final answer to 2 decimal places. (e.g., 32.16)) |

| New share price | $ |

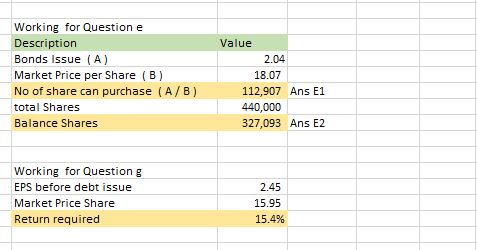

| e-1. | How many shares will Green repurchase as a result of the debt issue? (Do not round intermediate calculations and round your final answer to 2 decimal places. (e.g., 32.16)) |

| Shares repurchased |

| e-2. | How many shares of common stock will remain after the repurchase? (Do not round intermediate calculations and round your final answer to 2 decimal places. (e.g., 32.16)) |

| New shares outstanding |

| g. | What is the required return on Greens equity after the restructuring? (Do not round intermediate calculations and round your final answer to 2 decimal places. (e.g., 32.16)) |

| Required return | % |

Comment

Expert Answer

Anonymous answered this 42 minutes later

Was this answer helpful?

0

1

190 answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts