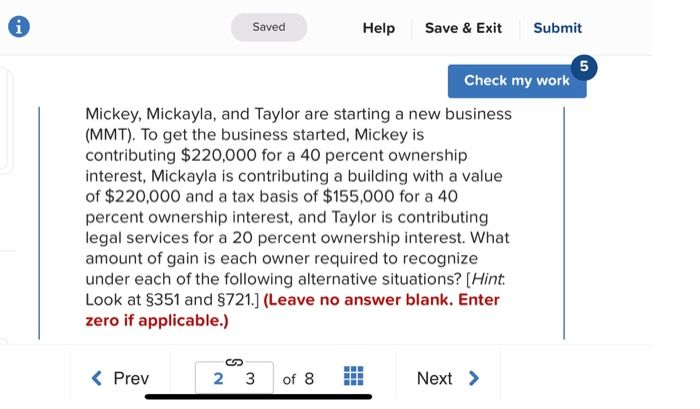

Question: i Saved Help Save & Exit Submit 5 Check my work Mickey, Mickayla, and Taylor are starting a new business (MMT). To get the business

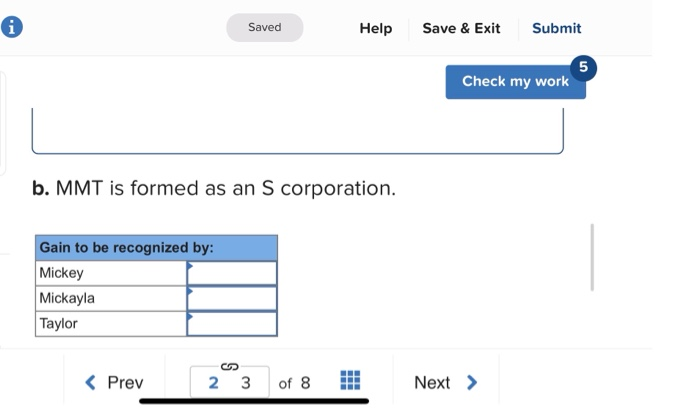

i Saved Help Save & Exit Submit 5 Check my work Mickey, Mickayla, and Taylor are starting a new business (MMT). To get the business started, Mickey is contributing $220,000 for a 40 percent ownership interest, Mickayla is contributing a building with a value of $220,000 and a tax basis of $155,000 for a 40 percent ownership interest, and Taylor is contributing legal services for a 20 percent ownership interest. What amount of gain is each owner required to recognize under each of the following alternative situations? [Hint Look at $351 and $721.) (Leave no answer blank. Enter zero if applicable.) A Saved Help Save & Exit Submit 5 Check my work b. MMT is formed as an S corporation. Gain to be recognized by: Mickey Mickayla Taylor

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts