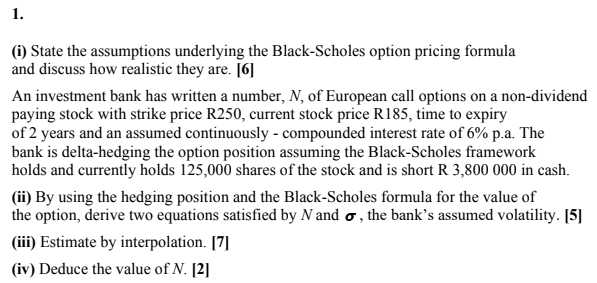

Question: ( i ) State the assumptions underlying the Black - Scholes option pricing formula and discuss how realistic they are. [ 6 ] An investment

i State the assumptions underlying the BlackScholes option pricing formula

and discuss how realistic they are.

An investment bank has written a number, of European call options on a nondividend

paying stock with strike price R current stock price R time to expiry

of years and an assumed continuously compounded interest rate of pa The

bank is deltahedging the option position assuming the BlackScholes framework

holds and currently holds shares of the stock and is short R in cash.

ii By using the hedging position and the BlackScholes formula for the value of

the option, derive two equations satisfied by and the bank's assumed volatility.

iii Estimate by interpolation.

iv Deduce the value of

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock