Question: I still need help on this part. Can you please explain? f(a) Prepare a monthly manufacturing overhead flexible budget for the year ending December 31,

I still need help on this part. Can you please explain?

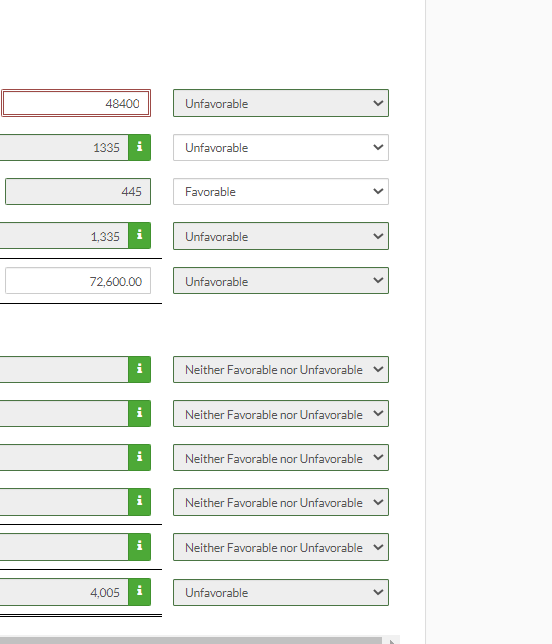

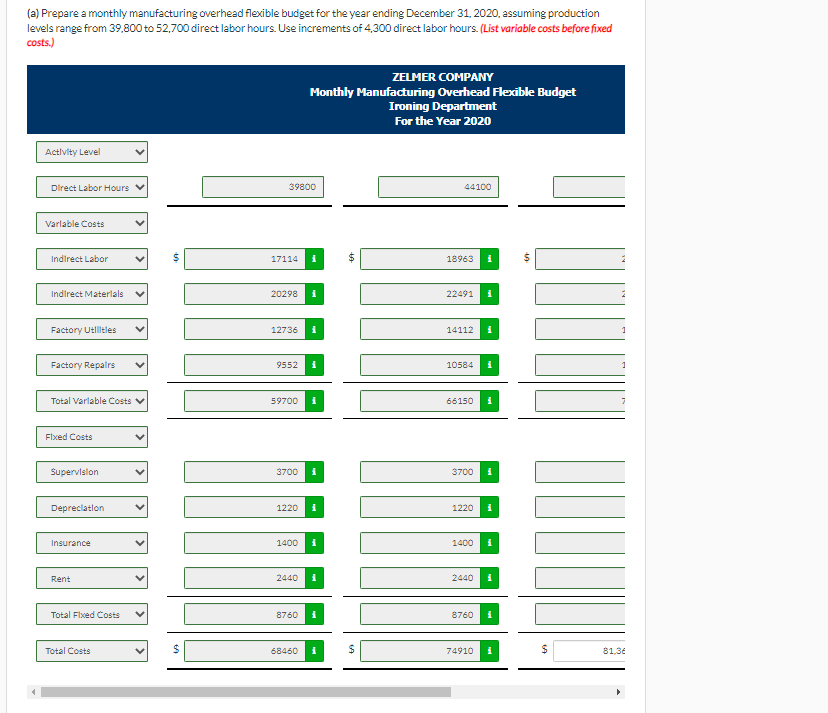

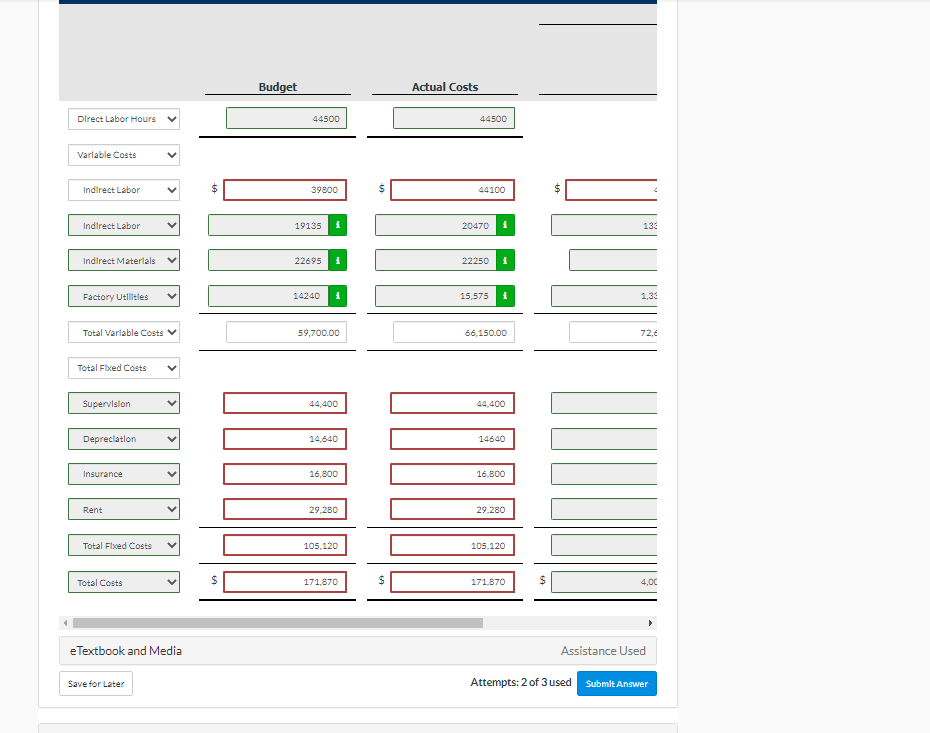

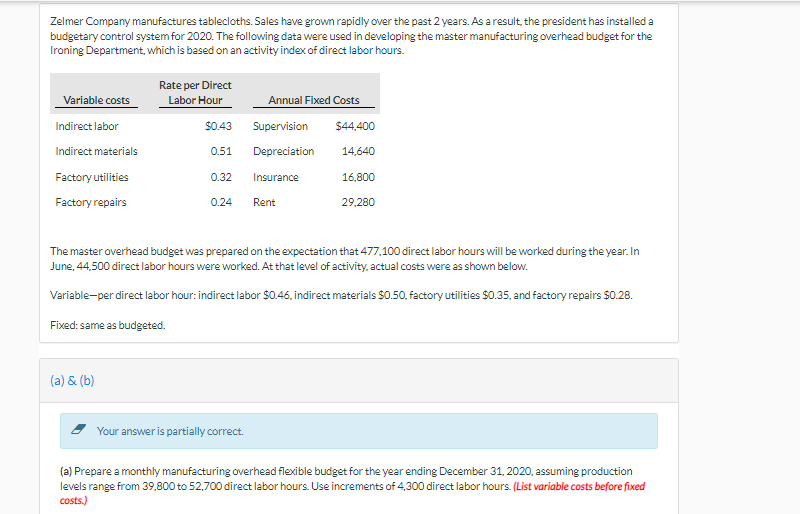

\f(a) Prepare a monthly manufacturing overhead flexible budget for the year ending December 31, 2020, assuming production levels range from 39.800 to 52,700 direct labor hours. Use increments of 4,300 direct labor hours. (List variable costs before fixed costs.) ZELMER COMPANY Monthly Manufacturing Overhead Flexible Budget Ironing Department For the Year 2020 Activity Level Direct Labor Hours w 39800 44100 Variable Costs Indirect Labor 17114 18963 Indirect Materials 20298 22491 i Factory Utilities 1273 i 14112 i Factory Repairs 9552 i 10584 Total Variable Costs w 59700 i 66150 i Fixed Cost Supervision 3700 i 3700 i Depreciation 1220 i 1220 Insurance 1400 i 1400 i Rent 2440 2440 Total Fixed Costs 8760 3760 Total Costs 58460 74910 i $ 81,36Budget Actual Costs Direct Labor Hours v 44500 44500 Variable Costs Indirect Labor 39800 44100 Indirect Labor 19135 i 20470 i Indirect Materials 22695 22250 Factory Utilities 14240 i 15,575 i 1,3: Total Variable Costs v 59,700.00 66,150.00 72.6 Total Fixed Costs Supervision 14,400 44,400 Depreciation 14,640 14640 Insurance 16,800 16,800 Rent 29,280 19,280 Total Fixed Costs 105,120 105,120 Total Costs 171,870 171,870 eTextbook and Media Assistance Used Save for Later Attempts: 2 of 3 used Submit AnswerZelmer Company manufactures tablecloths. Sales have grown rapidly over the past 2 years. As a result, the president has installed a budgetary control system for 2020. The following data were used in developing the master manufacturing overhead budget for the Ironing Department, which is based on an activity index of direct labor hours. Rate per Direct Variable costs Labor Hour Annual Fixed Costs Indirect labor $0.43 Supervision $44.400 Indirect materials 0.51 Depreciation 14.640 Factory utilities 0.32 Insurance 16.800 Factory repairs 0.24 Rent 29.280 The master overhead budget was prepared on the expectation that 477.100 direct labor hours will be worked during the year. In June, 44.500 direct labor hours were worked. At that level of activity, actual costs were as shown below. Variable-per direct labor hour: indirect labor $0.46, indirect materials $0.50, factory utilities $0.35, and factory repairs $0.28. Fixed: same as budgeted. (a) & (b) Your answer is partially correct. (a) Prepare a monthly manufacturing overhead flexible budget for the year ending December 31, 2020, assuming production levels range from 39,800 to 52,700 direct labor hours. Use increments of 4,300 direct labor hours. (List variable costs before fixed costs.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts