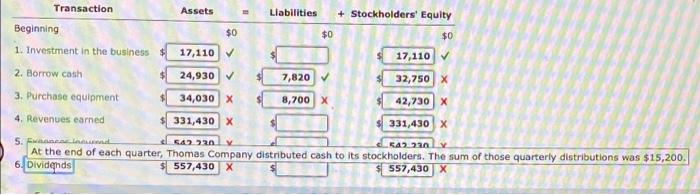

Question: i tried to solve it but I can't. please help me Transactions Consider the following transactions for Thomas Company and their effect on the accounting

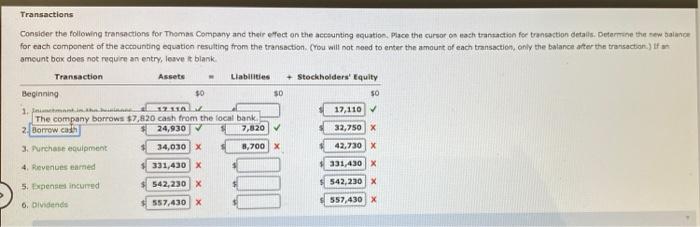

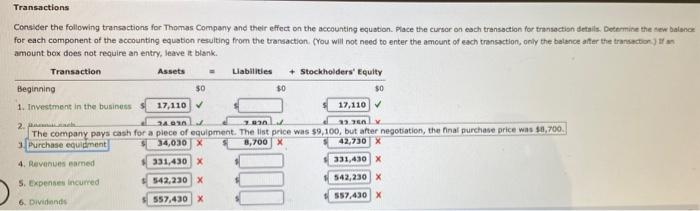

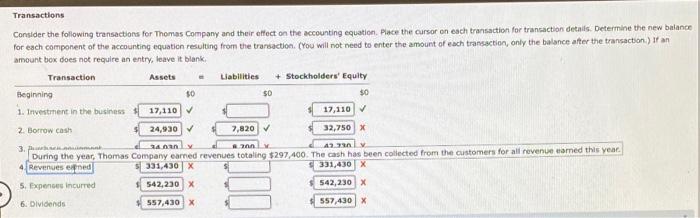

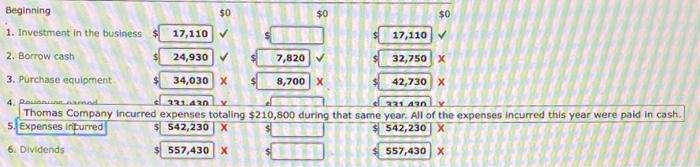

Transactions Consider the following transactions for Thomas Company and their effect on the accounting equation. Place the cursor on each transaction for transaction details. Determine the new balance for each component of the accounting equation resulting from the transaction criou will not need to enter the amount of each transaction only the balance after the transaction:) * amount box does not require an entry leavet blank Transaction Assets Liabilities + Stockholders' Equity Beginning 50 50 50 1. 12110 17.110 The company borrows $7,820 cash from the local bank 2. Borrow cash 24,930 7,020 32,750 x 3. Purchase equipment 34,030 X 8,700 x 42.730 X 4. Revenues earned 331,430 x 331,430 x 5. Expenses incurred 542, 230 x 542, 230 x 6. Dividende 557,430 X 557,430 x Transactions Consider the following transactions for Thomas Company and their effect on the accounting equation. Place the cursar on each transaction for transaction details. Determine the new balance for each component of the accounting equation resulting from the transaction. You will not need to enter the amount of each transaction, only the balance after the transaction) amount box does not require an entry, leave it blank. Transaction Assets Liabilities + Stockholders' Equity Beginning $0 50 1. Investment in the business 17,110 17,110 2. 240 2x The company pays cash for a piece of equipment. The list price was $9,100, but after negotiation, the final purchase price was $8,700. Purchase equipment 34,030 8,700 X 42,730 X 4. Revenues named 331,430 x 331,430 x 5. Expenses incurred 542.230 x 542, 230 X 6. Dividende 557,430 X 557,430 X Dell Transactions Consider the following transactions for Thomas Company and their effect on the accounting equation. Place the cursor on each transaction for transaction details. Determine the new balance for each component of the accounting equation resulting from the transaction. (You will not need to enter the amount of each transaction, only the balance after the transaction ) Ian amount box does not require an entry, leave it blank Transaction Assets Liabilities + Stockholders' Equity Beginning 30 50 $0 1. Investment in the business 17,110 17,110 2. Borrow cash 24,930 7,820 32,750 x 3. 14 only 12.30 During the year, Thomas Company earned revenues totaling $297,400. The cash has been collected from the customers for all revenue tamed this year. 4 Revenues ered 331,430 X 331,430 X 5. Expenses incurred 542, 230 x 542,230 X 6. Dividends 557,430 x 557,430 x UODUO Beginning $0 $0 $0 1. Investment in the business 17,110 17,110 2. Borrow cash 24,930 7,820 32,750 x 3. Purchase equipment 34,030 X 8,700 X 42,730 X 4. mad 22143 Thomas Company incurred expenses totaling $210,800 during that same year. All of the expenses incurred this year were paid in cash. 5. Expenses incurred 542,230 X 542, 230 6. Dividends 557,430 X 557,430X 221.42 Transaction Assets Liabilities + Stockholders' Equity Beginning $0 $0 $0 1. Investment in the business 17,110 17,110 2. Borrow cash 24,930 7,820 32,750 x 3. Purchase equipment 34,030 X 8,700 X 42,730 x 4. Revenues earned 331,430 X 331,430 x 5. FA 54222 R4222 At the end of each quarter, Thomas Company distributed cash to its stockholders. The sum of those quarterly distributions was $15,200. 6. Dividends 557,430 X 557,430

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts