Question: I understand how to do the problem with formulas, but I don 't understand what my inputs would be on a financial calculator if I

I understand how to do the problem with formulas, but I don't understand what my inputs would be on a financial calculator if I were to NOT use a formula. Going through the same steps for solving this problem that are in the solution, could someone please tell me what the financial calculator inputs (N, I/Y, PV, PMT, and FV) would be for a. Finding FV of stock account b. Finding FV for bond account c. for calculating the withdrawal per month? Please provide inputs for each step & answers + explanations for how you figured out each input.

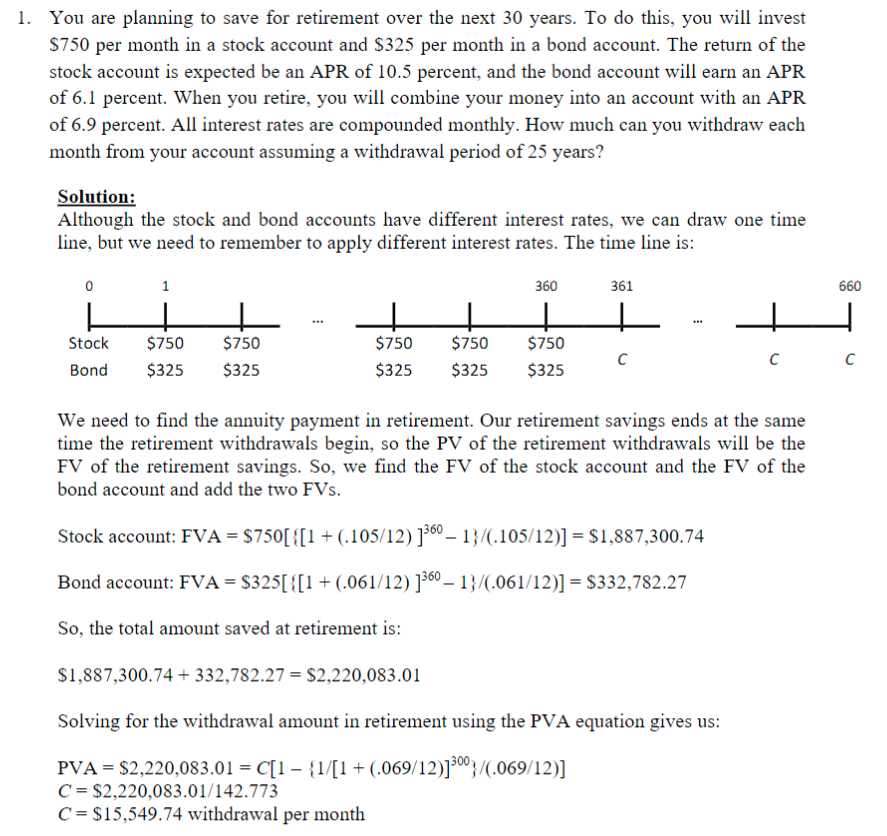

1. You are planning to save for retirement over the next 30 years. To do this, you will invest $750 per month in a stock account and $325 per month in a bond account. The return of the stock account is expected be an APR of 10.5 percent, and the bond account will earn an APR of 6.1 percent. When you retire, you will combine your money into an account with an APR of 6.9 percent. All interest rates are compounded monthly. How much can you withdraw each month from your account assuming a withdrawal period of 25 years? Solution: Although the stock and bond accounts have different interest rates, we can draw one time line, but we need to remember to apply different interest rates. The time line is: 0 1 360 361 660 L Stock Bond $750 $325 $750 $325 $750 $325 $750 $325 $750 $325 C We need to find the annuity payment in retirement. Our retirement savings ends at the same time the retirement withdrawals begin, so the PV of the retirement withdrawals will be the FV of the retirement savings. So, we find the FV of the stock account and the FV of the bond account and add the two FVs. Stock account: FVA = $750[{[1 + (.105/12)]360 1}(.105/12)] = $1,887,300.74 Bond account: FVA = $325[{[1 + (.061/12)]360 1}/(.061/12)] = $332,782.27 So, the total amount saved at retirement is: $1,887,300.74 + 332,782.27 = $2,220,083.01 Solving for the withdrawal amount in retirement using the PVA equation gives us: PVA = $2,220,083.01 = C[1 {1/[1 + (.069/12)]300;/(.069/12)] C = $2,220,083.01/142.773 C = $15,549.74 withdrawal per month

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts