Question: question 3 and 4 Question 3 (10 points) A firm plans to build a plant on land it owns. The firm paid $200,000 for the

question 3 and 4

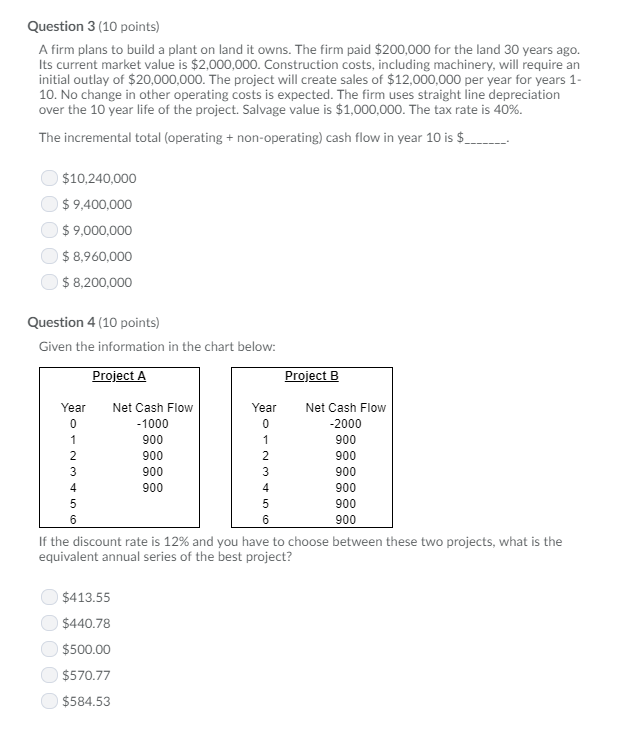

Question 3 (10 points) A firm plans to build a plant on land it owns. The firm paid $200,000 for the land 30 years ago. Its current market value is $2,000,000. Construction costs, including machinery, will require an initial outlay of $20,000,000. The project will create sales of $12,000,000 per year for years 1- 10. No change in other operating costs is expected. The firm uses straight line depreciation over the 10 year life of the project. Salvage value is $1,000,000. The tax rate is 40%. The incremental total (operating + non-operating cash flow in year 10 is $ $10,240,000 $9,400,000 9,000,000 $8,960,000 $ 8,200,000 Question 4 (10 points) Given the information in the chart below: Project A Project EB Year Net Cash Flow -1000 900 900 900 900 Year Net Cash Flow 2000 900 900 900 900 900 900 4 If the discount rate is 12% and you have to choose between these two projects, what is the equivalent annual series of the best project? $413.55 $440.78 500.00 $570.77 $584.53

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts