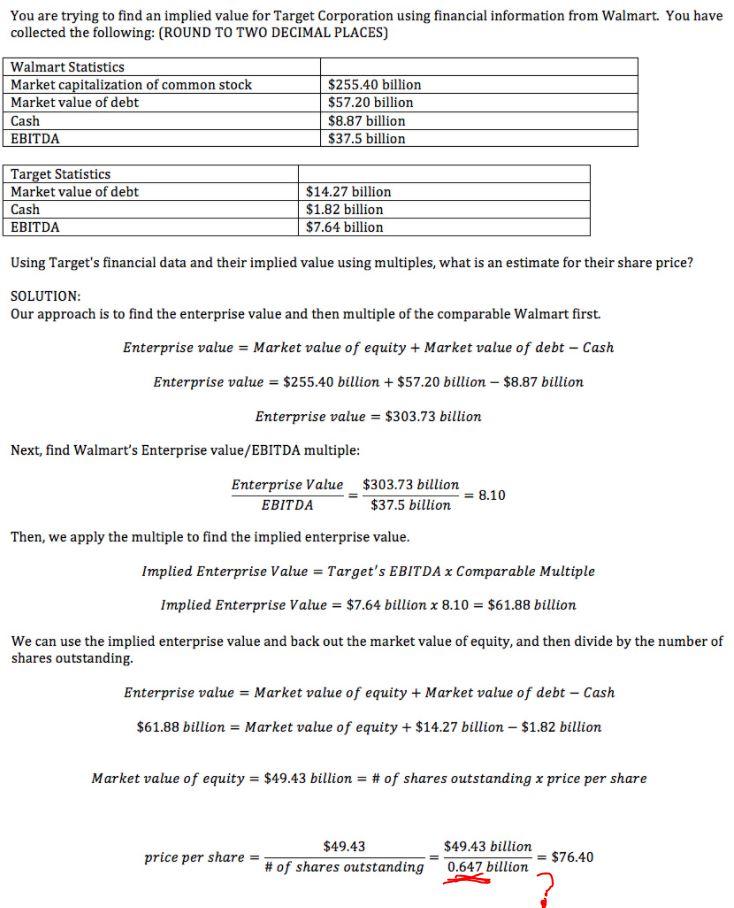

Question: I understand the process but was wondering where the # of shares came from. Can you guys solve this problem and tell me if you

I understand the process but was wondering where the # of shares came from.

Can you guys solve this problem and tell me if you guys can find where the # of shares came from?

It seems like an error but I wanna make sure it's not my mistake.

Thank you!

You are trying to find an implied value for Target Corporation using financial information from Walmart. You have collected the following: (ROUND TO TWO DECIMAL PLACES) Walmart Statistics Market capitalization of common stock Market value of debt Cash EBITDA $255.40 billion $57.20 billion $8.87 billion $37.5 billion Target Statistics Market value of debt Cash EBITDA $14.27 billion $1.82 billion $7.64 billion Using Target's financial data and their implied value using multiples, what is an estimate for their share price? SOLUTION: Our approach is to find the enterprise value and then multiple of the comparable Walmart first. Enterprise value = Market value of equity + Market value of debt - Cash Enterprise value = $255.40 billion + $57.20 billion - $8.87 billion Enterprise value = $303.73 billion Next, find Walmart's Enterprise value/EBITDA multiple: Enterprise Value $303.73 billion 8.10 EBITDA $37.5 billion Then, we apply the multiple to find the implied enterprise value. Implied Enterprise Value = Target's EBITDA x Comparable Multiple Implied Enterprise Value = $7.64 billion x 8.10 = $61.88 billion We can use the implied enterprise value and back out the market value of equity, and then divide by the number of shares outstanding. Enterprise value = Market value of equity + Market value of debt - Cash $61.88 billion = Market value of equity + $14.27 billion - $1.82 billion Market value of equity = $49.43 billion = # of shares outstanding x price per share $49.43 price per share = # of shares outstanding $49.43 billion = $76.40 0.647 billion You are trying to find an implied value for Target Corporation using financial information from Walmart. You have collected the following: (ROUND TO TWO DECIMAL PLACES) Walmart Statistics Market capitalization of common stock Market value of debt Cash EBITDA $255.40 billion $57.20 billion $8.87 billion $37.5 billion Target Statistics Market value of debt Cash EBITDA $14.27 billion $1.82 billion $7.64 billion Using Target's financial data and their implied value using multiples, what is an estimate for their share price? SOLUTION: Our approach is to find the enterprise value and then multiple of the comparable Walmart first. Enterprise value = Market value of equity + Market value of debt - Cash Enterprise value = $255.40 billion + $57.20 billion - $8.87 billion Enterprise value = $303.73 billion Next, find Walmart's Enterprise value/EBITDA multiple: Enterprise Value $303.73 billion 8.10 EBITDA $37.5 billion Then, we apply the multiple to find the implied enterprise value. Implied Enterprise Value = Target's EBITDA x Comparable Multiple Implied Enterprise Value = $7.64 billion x 8.10 = $61.88 billion We can use the implied enterprise value and back out the market value of equity, and then divide by the number of shares outstanding. Enterprise value = Market value of equity + Market value of debt - Cash $61.88 billion = Market value of equity + $14.27 billion - $1.82 billion Market value of equity = $49.43 billion = # of shares outstanding x price per share $49.43 price per share = # of shares outstanding $49.43 billion = $76.40 0.647 billion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts