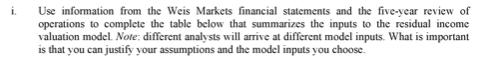

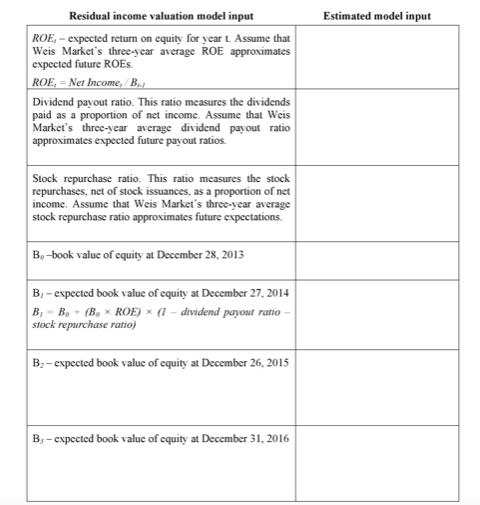

i. Use information from the Weis Markets financial statements and the five-year review of operations to...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

i. Use information from the Weis Markets financial statements and the five-year review of operations to complete the table below that summarizes the inputs to the residual income valuation model. Note: different analysts will arrive at different model inputs. What is important is that you can justify your assumptions and the model inputs you choose. Residual income valuation model input ROE, - expected return on equity for year 1. Assume that Weis Market's three-year average ROE approximates expected future ROES. ROE, = Net Income,/B.. Dividend payout ratio. This ratio measures the dividends paid as a proportion of net income. Assume that Weis Market's three-year average dividend payout ratio approximates expected future payout ratios. Stock repurchase ratio. This ratio measures the stock repurchases, net of stock issuances, as a proportion of net income. Assume that Weis Market's three-year average stock repurchase ratio approximates future expectations. B-book value of equity at December 28, 2013 B₁-expected book value of equity at December 27, 2014 (1 - dividend payout ratio- B₁-B₂ (BROE) stock repurchase ratio) B₂-expected book value of equity at December 26, 2015 B₁-expected book value of equity at December 31, 2016 Estimated model input i. Use information from the Weis Markets financial statements and the five-year review of operations to complete the table below that summarizes the inputs to the residual income valuation model. Note: different analysts will arrive at different model inputs. What is important is that you can justify your assumptions and the model inputs you choose. Residual income valuation model input ROE, - expected return on equity for year 1. Assume that Weis Market's three-year average ROE approximates expected future ROES. ROE, = Net Income,/B.. Dividend payout ratio. This ratio measures the dividends paid as a proportion of net income. Assume that Weis Market's three-year average dividend payout ratio approximates expected future payout ratios. Stock repurchase ratio. This ratio measures the stock repurchases, net of stock issuances, as a proportion of net income. Assume that Weis Market's three-year average stock repurchase ratio approximates future expectations. B-book value of equity at December 28, 2013 B₁-expected book value of equity at December 27, 2014 (1 - dividend payout ratio- B₁-B₂ (BROE) stock repurchase ratio) B₂-expected book value of equity at December 26, 2015 B₁-expected book value of equity at December 31, 2016 Estimated model input

Expert Answer:

Answer rating: 100% (QA)

ROE ROE is the return on equity which measures the rate of return of a companys net income relative ... View the full answer

Related Book For

Accounting for Governmental and Nonprofit Entities

ISBN: 978-1259917059

18th edition

Authors: Jacqueline L. Reck, James E. Rooks, Suzanne Lowensohn, Daniel Neely

Posted Date:

Students also viewed these accounting questions

-

Use information from the latest quarterly earnings release & conference call for bank of America. What was the EPS expected by analysts on Wall Street? What number for EPS did your company...

-

Use information from the latest quarterly earnings release & conference call for Bank of America 1. When did your company LAST announce its quarterly earnings? Tell me the day of the week, the...

-

Use information from the latest quarterly earnings release & conference call for your company. What did management say about your company's margins for the quarter? They might say something about...

-

On November 1, 2021, Sadie's borrows $230,000 from a local bank and signs a note. The note requires interest to be paid annually beginning on August 1, 2022 at 12%. Principal and interest are due in...

-

For each of the transactions in E1-31B, tell whether the transaction was an operating, investing, or financing activity. In E1-31B, 1. Joe Evans used $100,000 of personal savings in exchange for...

-

What recommendations would you make for handling frivolous calls to the hotline?

-

Tyler Companys ASC 932-235 disclosures included the following information: REQUIRED: Using the information for Tyler Company in problems 13, 14, and 15 and in this problem: a. Compute the value of...

-

Omer Asik began operations as a private investigator on January 1, 2012. The trial balance columns of the worksheet for Omer Asik, P.I. at March 31 are as follows. Other data:1. Supplies on hand...

-

The demand curve for cookies is a rightward curve and the quantity demanded is 100 when the price of cookies is $2.00. What happens to consumer surplus when the price is $3.00? What happens to...

-

1. Prepare a payroll register for Mary's Luxury Travel for the week ended March 22, 20--. (In the Taxable Earnings/Unemployment Compensation column, enter the same amounts as in the Social Security...

-

Assume that HASF furniture Inc., as described, currently purchases the chair cushions for its lawn set from an outside vendor for $30 per set. Modern Furnitures chief operations officer wants an...

-

Macy's has decided to hire 1,000 additional sale people from October 1st January 31st to help with the increased holiday traffic in their stores. This is an example of a(n) uncontrollable variable,...

-

Explain the role the following play in a real estate agencyand how the code of conduct regulates each. Buyer seller and agent. And landlord tenant and agent.

-

"In anatomical terminology, which two subcavities are delineated within the dorsal cavity, and how do their respective structures and functions contribute to the integrated organization of the...

-

A firm faces a demand curve given by the equation P = 80 2Q. Its marginal cost of production is $20 per unit. a. Find the profit-maximizing price and quantity. b. Suppose that the firm contemplates...

-

Discuss in detail and with reference to appropriate cases law and legislation what deductions are and how they impact on the taxation payable?

-

Minstrel Manufacturing uses a job costing system. During one month Minstrel bought $219,600 of raw materials on credit; issued materials for production for $213,000 of which $35,400 were indirect....

-

Write a while loop that uses an explicit iterator to accomplish the same thing as Exercise 7.3. Exercise 7.3. Write a for-each loop that calls the addInterest method on each BankAccount object in a...

-

Examine the following tables from the Financial Trend Monitoring Report for the Town of Oakdale for the most recent fiscal year-end. The performance indicators selected are total revenue and revenue...

-

Park City experienced unusual volatility of taxable property values over a particular five-year period. For the first three years of this period, the pre-recession period, average property values in...

-

Choose the best answer. 1. Budgets of government entities a. Are integrated within the financial accounting system. b. Enable governments to demonstrate compliance with laws and to communicate...

-

Find the Laplace transform of the function \[y(t)=\alpha \sin ^{2} t+\beta \cos ^{2} t .\]

-

Consider the dynamic system, a mass, spring and damper structure, discussed in Example 2.1 and shown in Figure 2.9. Find the Transfer Function model of the dynamic system, where \(f(t)\) is the input...

-

Consider a system with the following State-Variable Matrix model where \(x_{1}(t)\) and \(x_{2}(t)\) are the state variables, the \(u(t)\) is the input and \(y(t)\) is the output. Find the Transfer...

Study smarter with the SolutionInn App