Question: I want answer very soon please send me answer Question #05 Here is the condensed 2019 balance sheet for Info-Tech Company in thousands of Rupees

I want answer very soon

please send me answer

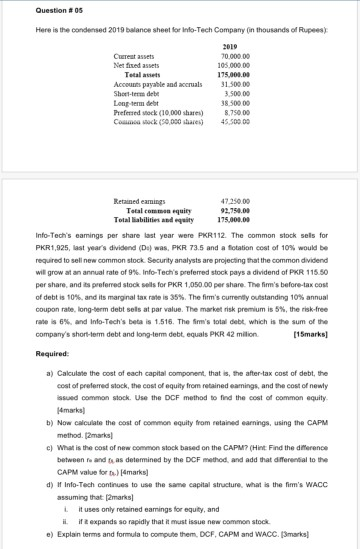

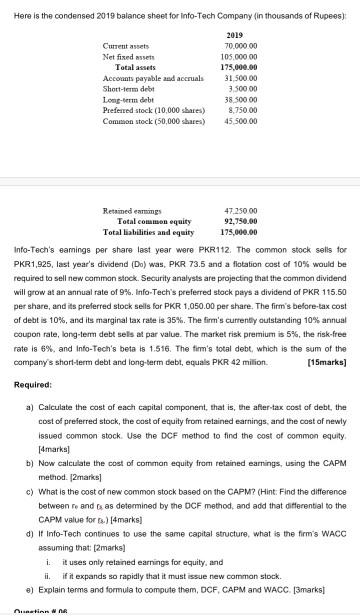

Question #05 Here is the condensed 2019 balance sheet for Info-Tech Company in thousands of Rupees Current assets Net fixed assets Total assets Accounts payable and accruals Short-term debe Long-term debt Preferred stock (10,000 shares) Cosima vock (50.000 shares) 2010 70 000 00 105 000 00 175,000.00 31.500.00 3.500.00 38.500.00 8.750,00 45 500 00 Retained earings 47250.00 Total com equiry 92.750.00 Total liabilities and equity 175,000.00 Info-Tech's eamings per share last year were PKR112. The common stock sels for PKR1,925, last year's dividend (D) was, PKR 73.5 and a fotation cost of 10% would be required to sell new common stock Security analysts are projecting that the common dividend will grow at an annual rate of 9%. Info-Tech's preferred stock pays a dividend of PKR 115.50 per share, and its preferred stock sells for PKR 1,050.00 per share. The firm's before-tax cost of debt is 10% and its marginal tax rate is 35%. The firm's currently outstanding 10% annual coupon rate, long-term debt sels at par value. The market risk premium is 5%, the risk-free rate is 6% and Info-Tech's beta is 1.516. The firm's total debt, which is the sum of the company's short-term debt and long-term debt, equals PKR 42 milion [15marks! Required: a) Calculate the cost of each capital component, that is, the after-tax cost of debt, the cost of preferred stock, the cost of equity from retained earings, and the cost of newly issued common stock. Use the DCF method to find the cost of common equity 14marks) b) Now calculate the cost of common equity from retained earnings, using the CAPM method. (2 marks! c) What is the cost of new common stock based on the CAPM? (Hint: Find the difference between re and as determined by the DCF method, and add that differential to the CAPM value for t..) [marks) d) of Info-Tech continues to use the same capital structure, what is the firm's WACC assuming that marks it uses only retained earnings for equity, and ii. if expands so rapidly that it must issue new common stock e) Explain terms and formula to compute them. DCF, CAPM and WACC. 3marks) Here is the condensed 2019 balance sheet for Info-Tech Company (in thousands of Rupees); Current assets Net fixed assets Total assets Accounts payable and accruals Short-term debt Long-term debt Preferred stock (10,000 shares) Common stock (50,000 shares) 2019 70.00000 105.000.00 175.000.00 31.500.00 3.50000 38.500.00 8.750 00 45.500.00 Retnined earings 47.250.00 Total common equity 92.750.00 Total liabilities and equity 175,000.00 Info-Tech's earnings per share last year were PKR112. The common stock sells for PKR1,925, last year's dividend (D) was, PKR 73.5 and a flotation cost of 10% would be required to sell new common stock. Security analysts are projecting that the common dividend will grow at an annual rate of 9%. Info-Tech's preferred stock pays a dividend of PKR 115.50 per share, and its preferred stock sells for PKR 1,050.00 per share. The firm's before-tax cost of debt is 10%, and its marginal tax rate is 35%. The firm's currently outstanding 10% annual coupon rate, long-term debt sells at par value. The market risk premium is 5%, the risk-free rate is 6%, and Info-Tech's beta is 1.516. The firm's total debt, which is the sum of the company's short-term debt and long-term debt, equals PKR 42 million [15marks) Required: a) Calculate the cost of each capital component, that is, the after-tax cost of debt, the cost of preferred stock, the cost of equity from retained earnings, and the cost of newly issued common stock. Use the DCF method to find the cost of common equity [4marks] b) Now calculate the cost of common equity from retained earnings, using the CAPM method. (2 marks] c) What is the cost of new common stock based on the CAPM? (Hint: Find the difference between re and is as determined by the DCF method, and add that differential to the CAPM value for s.) [4 marks] d) If Info-Tech continues to use the same capital structure, what is the firm's WACC assuming that: (2marks) it uses only retained earnings for equity, and ii. if it expands so rapidly that it must issue new common stock. e) Explain terms and formula to compute them, DCF, CAPM and WACC 13marks] i. nisaatinn

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts