Question: Hello, please advise, thanks Please read below: Question #6 Here is the condensed 2019 balance sheet for Sunrise Company (in thousands of dollars): 2019 Current

Hello, please advise, thanks

Please read below:

Question #6

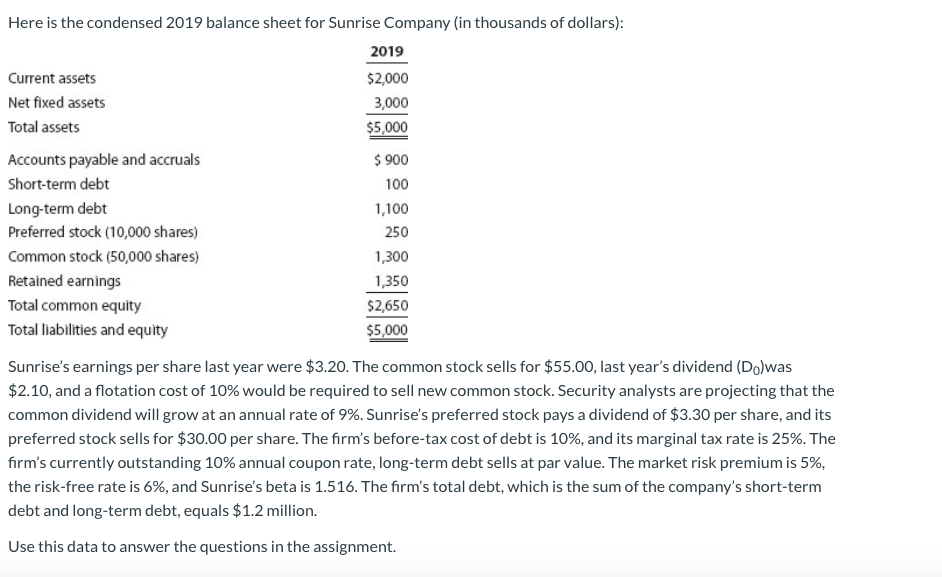

Here is the condensed 2019 balance sheet for Sunrise Company (in thousands of dollars): 2019 Current assets $2,000 Net fixed assets 3,000 Total assets $5,000 Accounts payable and accruals Short-term debt Long-term debt Preferred stock (10,000 shares) Common stock (50,000 shares) Retained earnings Total common equity Total liabilities and equity $ 900 100 1,100 250 1,300 1,350 $2,650 $5,000 Sunrise's earnings per share last year were $3.20. The common stock sells for $55.00, last year's dividend (Do)was $2.10, and a flotation cost of 10% would be required to sell new common stock. Security analysts are projecting that the common dividend will grow at an annual rate of 9%. Sunrise's preferred stock pays a dividend of $3.30 per share, and its preferred stock sells for $30.00 per share. The firm's before-tax cost of debt is 10%, and its marginal tax rate is 25%. The firm's currently outstanding 10% annual coupon rate, long-term debt sells at par value. The market risk premium is 5%, the risk-free rate is 6%, and Sunrise's beta is 1.516. The firm's total debt, which is the sum of the company's short-term debt and long-term debt, equals $1.2 million. Use this data to answer the questions in the assignment. Question 6 12.5 pts What is the cost of new common stock based on the CAPM? (Hint: Find the difference between re andrs as determined by the DCF method, and add that differential to the CAPM value for rs.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts