Question: i want correct answer please as soon as possible. search Laura Dallas and Bryan Adams were students when they formed a partnership several years ago

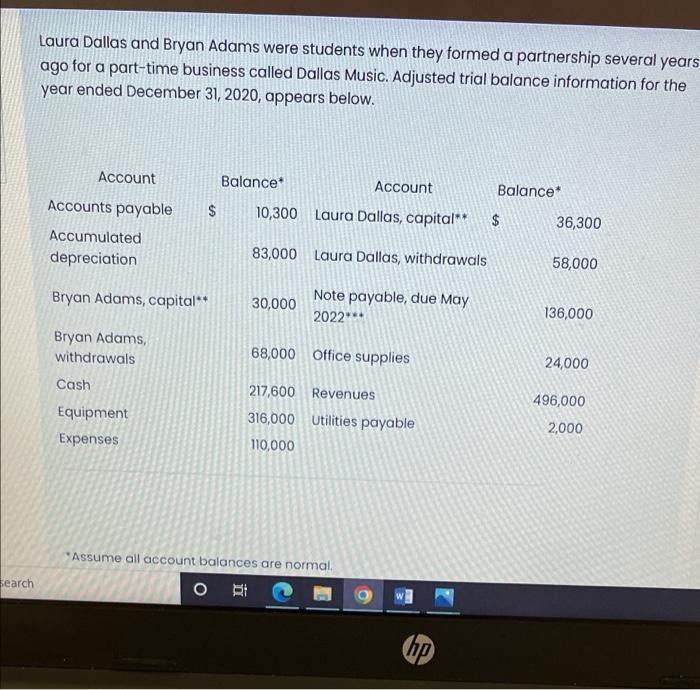

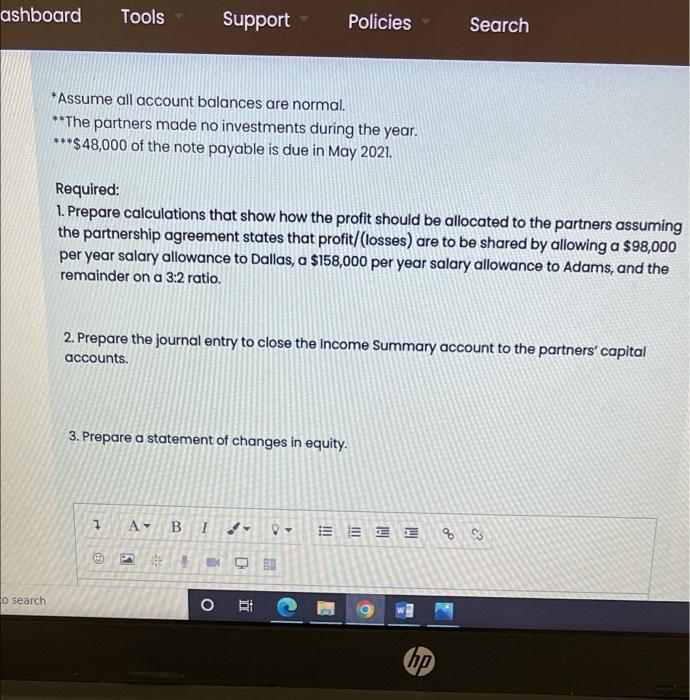

search Laura Dallas and Bryan Adams were students when they formed a partnership several years ago for a part-time business called Dallas Music. Adjusted trial balance information for the year ended December 31, 2020, appears below. Account Balance Account Balance* Accounts payable 10,300 Laura Dallas, capital** $ Accumulated 83,000 Laura Dallas, withdrawals depreciation Bryan Adams, capital** 30,000 Note payable, due May 2022*** Bryan Adams, 68,000 Office supplies withdrawals Cash 217,600 Revenues Equipment 316,000 Utilities payable Expenses 110,000 *Assume all account balances are normal. t O hp 36,300 58,000 136,000 24,000 496,000 2,000 ashboard Tools o search Support Policies Search *Assume all account balances are normal. **The partners made no investments during the year. ***$48,000 of the note payable is due in May 2021. Required: 1. Prepare calculations that show how the profit should be allocated to the partners assuming the partnership agreement states that profit/(losses) are to be shared by allowing a $98,000 per year salary allowance to Dallas, a $158,000 per year salary allowance to Adams, and the remainder on a 3:2 ratio. 2. Prepare the journal entry to close the Income Summary account to the partners' capital accounts. 3. Prepare a statement of changes in equity. A- B I 8- 8 $3 O Bi 13 382 10 EEE 20 hp

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts