Question: On Jamuary 1 . 2 0 2 4 , Robertson Construction leased several items of equipment under a two - year operating lease agreement from

On Jamuary Robertson Construction leased several items of equipment under a twoyear operating lease agreement from Jarmison Leasing. which routinely finances equipment for other firms at an annual interest rate of The contract calls for four rent payments of $ each, payable semiannually on June and December each year. The equfpment wes aceutred by Jamison Leasing at a cost of $ and was expected to have a useful life of years with no residual value. Both firms record amortization and depreciation semi annually.

Required:

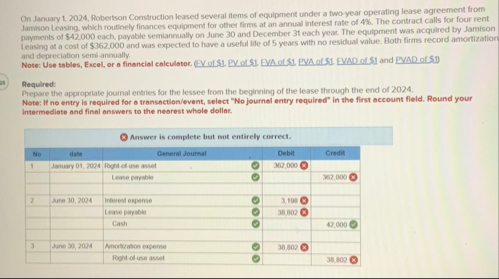

Prepare the appropriate joumal entrics for the lessee from the beginning of the lease through the end of

Note: If ne entry is required for a transectionevent select No journal entry required" in the first account field. Round your intermediate and final answers to the nearest whole dellas.

Answer is complete but not entirely correct.

tableNodase,rment fournt,Gebit,CreditJenuary Roght ot use assel,Lease payybin,,June Intorel espense,Lease paymbie,Cash,,Jane Amortzation experse,Foight oluse asset,,Journal entry worksheet

Record the beginning of the lease for Robertson Construction.

Note: Finter debits before credits.

tableSNolDate,Account Tite,Debit,CreditJanuary Rughtofuse assel,Lease payable,,Journal entry worksheet

Record the lease payment for Robertson Construction.

Note: Inter debits before credts.

tableDownSeneral Journal,Debit,CreditJune Interest experse,Sase payable,Cash,,

Journal entry worksheet

Record the amortization or depreciation expense for Robertson Construction.

Note: Inter debits before credits.

tableDateGeneral Journal,Debit,CreditJune Amortuation expense,Rightofuse assel,,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock