Question: I want the answer for question 3 and question 4 please. An A-rated corporate loan with a maturity of three years. A - rated corporate

I want the answer for question 3 and question 4 please.

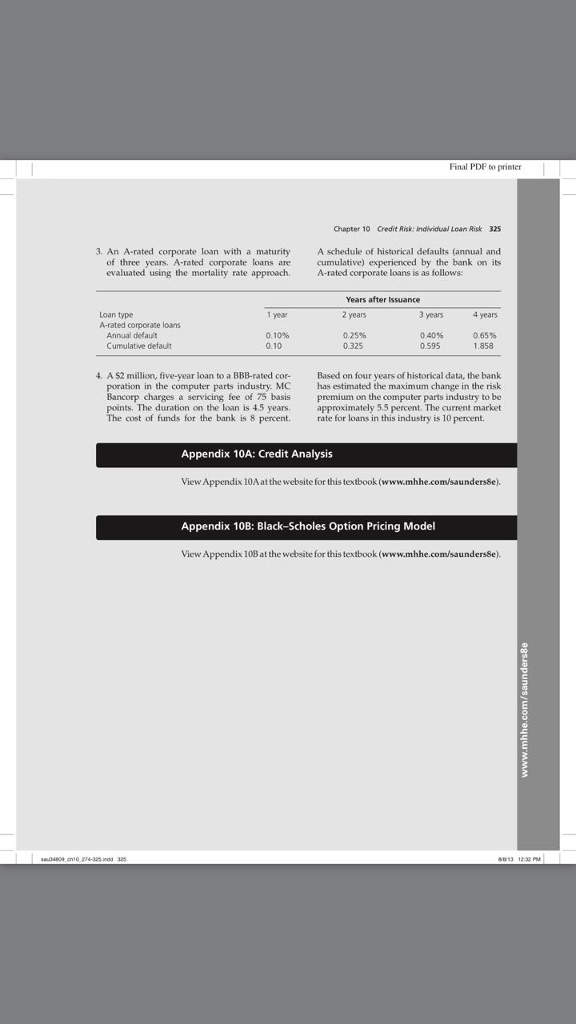

An A-rated corporate loan with a maturity of three years. A - rated corporate loans are evaluated using the mortality rate approach. A $2 million, five-year loan to a BBB-rated corporation in the computer parts industry. MC Bancorp charges a servicing fee of 75 basis points. The duration on the loan is 4.5 years. The cost of funds for the bank is 8 percent. A schedule of historical defaults (annual and cumulative) experienced by the bank on its A-rated corporate loans is as follows: Based on four years of historical data, the bank has estimated the maximum change in the risk premium on the computer parts industry to be approximately 5.5 percent. The current market rate for loans in this industry is 10 percent. An A-rated corporate loan with a maturity of three years. A - rated corporate loans are evaluated using the mortality rate approach. A $2 million, five-year loan to a BBB-rated corporation in the computer parts industry. MC Bancorp charges a servicing fee of 75 basis points. The duration on the loan is 4.5 years. The cost of funds for the bank is 8 percent. A schedule of historical defaults (annual and cumulative) experienced by the bank on its A-rated corporate loans is as follows: Based on four years of historical data, the bank has estimated the maximum change in the risk premium on the computer parts industry to be approximately 5.5 percent. The current market rate for loans in this industry is 10 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts