Question: i want the answer for question number 2 only 1. Expected Return and Standard Deviation This problem will give you some practice calculating measures of

i want the answer for question number 2 only

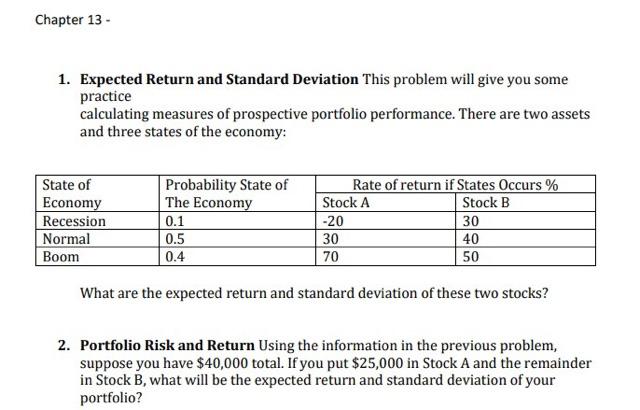

1. Expected Return and Standard Deviation This problem will give you some practice calculating measures of prospective portfolio performance. There are two assets and three states of the economy: What are the expected return and standard deviation of these two stocks? 2. Portfolio Risk and Return Using the information in the previous problem, suppose you have $40,000 total. If you put $25,000 in Stock A and the remainder in Stock B, what will be the expected return and standard deviation of your portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts