Question: i want the step 3 ) redo requirements using fifo method process costing EXERCISE 1: DMI oni Logicco is a fast-growing manufacturer of computer chips.

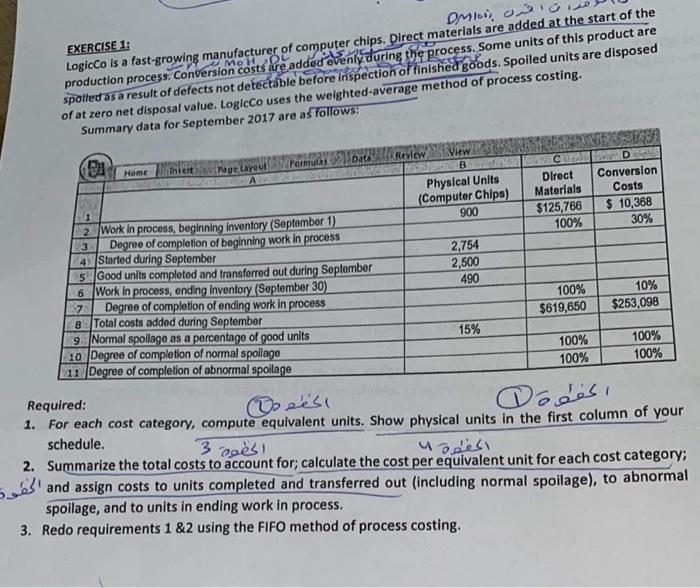

EXERCISE 1: DMI oni Logicco is a fast-growing manufacturer of computer chips. Direct materials are added at the start of the production process. Conversion costs are added ovenly during the process. Some units of this product are spotted as a result of defects not detectable before inspection of finished goods. Spoiled units are disposed of at zero net disposal value. LogicCo uses the weighted average method of process costing. Summary data for September 2017 are as follows: 8 Home Thiert DH Review Page Layout C D Physical Units Direct Conversion Materials Costs (Computer Chips) 900 2 Work in process, beginning inventory (September 1) $125,766 $ 10,368 30% 3 100% Degree of completion of beginning work in process 4. Started during September 2,754 5. Good units completed and transferred out during September 2,500 6 Work in process, ending Inventory (September 30) 490 7 Degree of completion of ending work in process 100% 10% 8 Total costs added during September $619,650 $253,098 9 Normal spollage as a percentage of good units 15% 10 Degree of completion of normal spoilage 100% 100% 11 Degree of completion of abnormal spoilage 100% 100% Required: Doeesi 1. For each cost category, compute equivalent units. Show physical units in the first column of your Codsi schedule. 2. Summarize the total costs to account for calculate the cost per equivalent unit for each cost category: 53 and assign costs to units completed and transferred out (including normal spoilage), to abnormal spoilage, and to units in ending work in process. 3. Redo requirements 1&2 using the FIFO method of process costing. 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts