Question: Need help with this whole question? examples in help me solve this are templates Homework: chapter 18 Question 2, E18-30 (similar Part 1 of 9

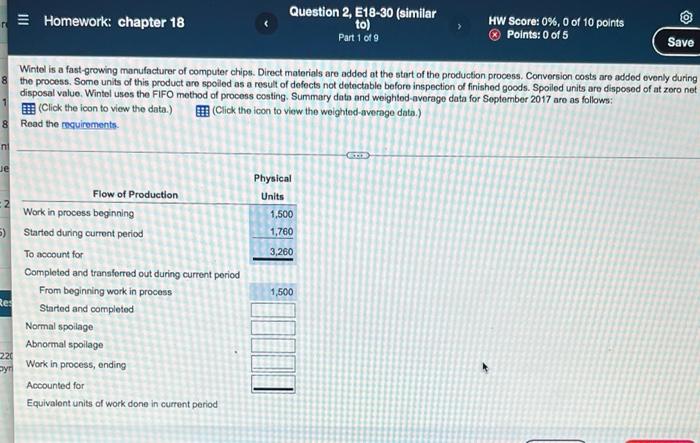

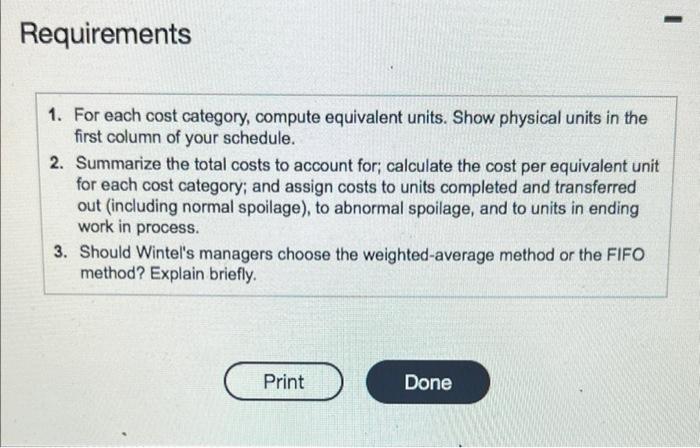

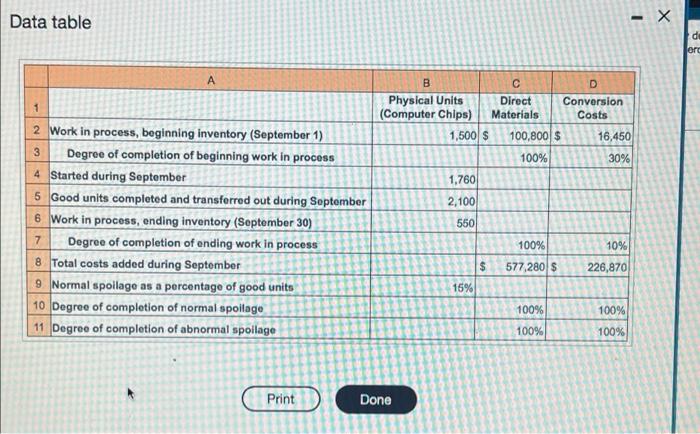

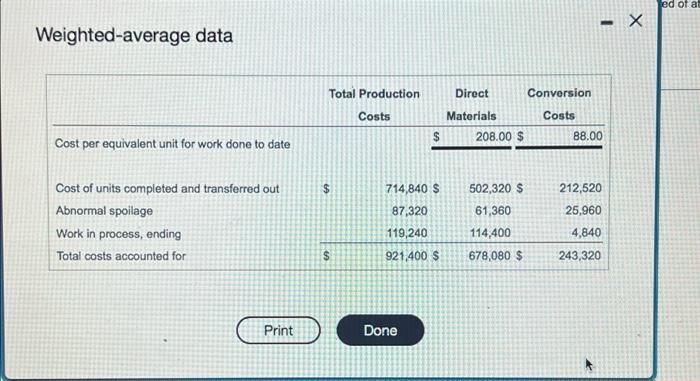

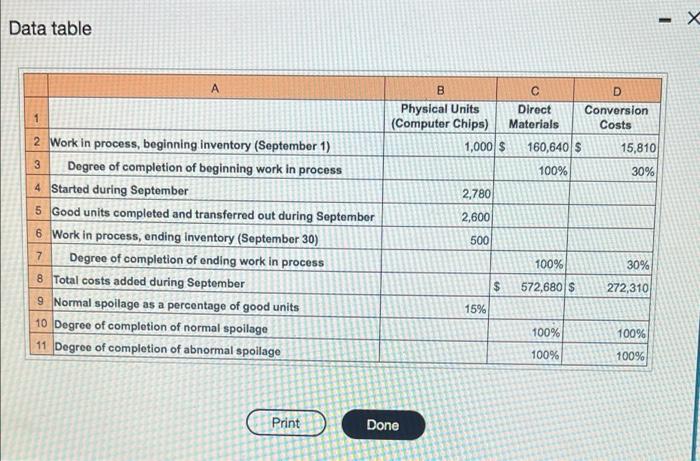

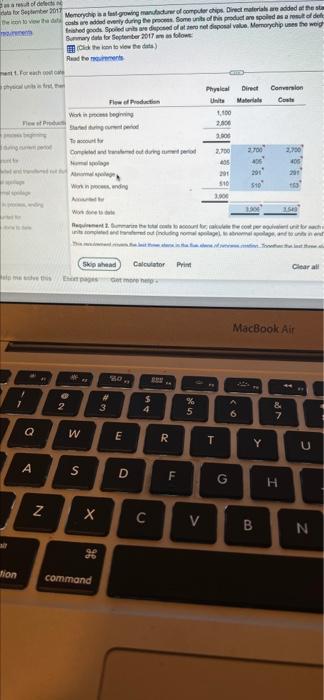

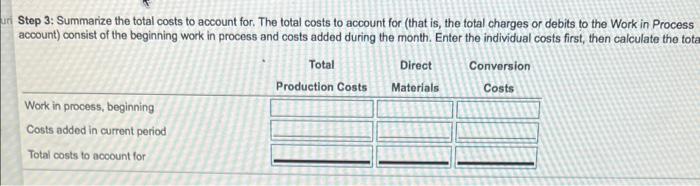

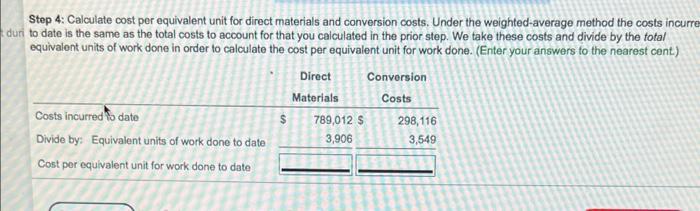

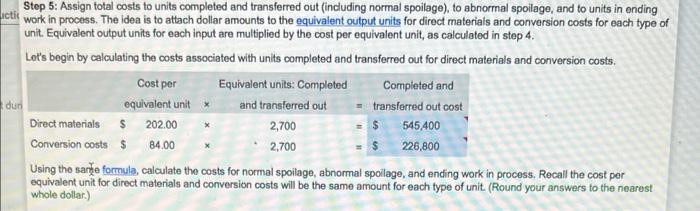

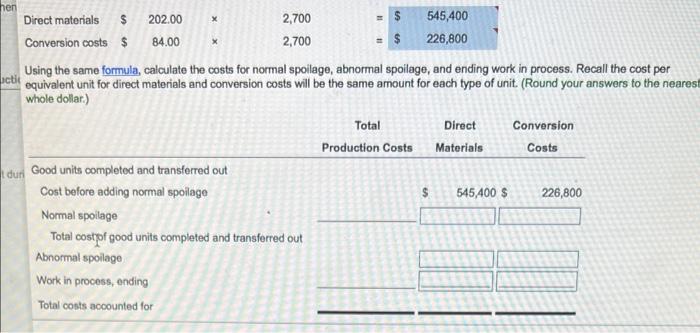

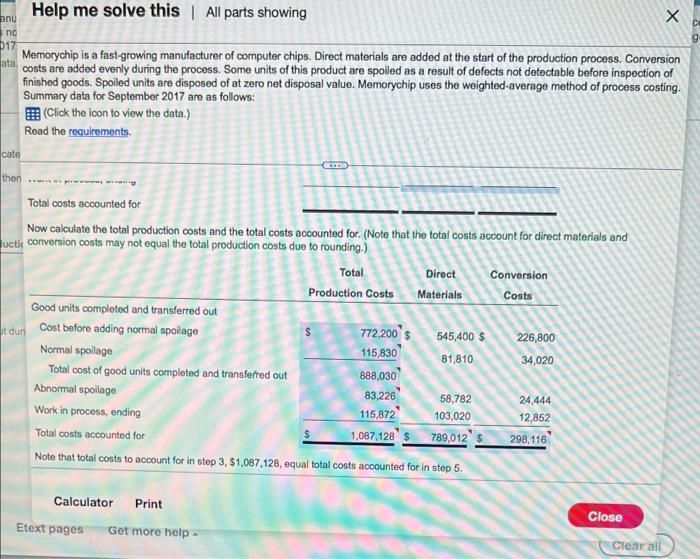

Homework: chapter 18 Question 2, E18-30 (similar Part 1 of 9 to) HW Score: 0%, 0 of 10 points Points: 0 of 5 Save Winitel is a fast-growing manufacturer of computer chips. Direct materials are added at the start of the production process. Conversion costs are added evenly during 8 the process. Some units of this product are spoiled as a result of defects not detectable before inspection of finished goods. Spoiled units are disposed of at zoro not disposal value. Winteluines the FIFO method of process conting, Summary data and weighted average data for September 2017 are as follows: Click the icon to view the data.) Click the icon to view the weighted-average data.) n & Read the requirements n CS je 2 Physical Units 1,500 1,760 5) 3,260 Flow of Production Work in process beginning Started during current period To account for Completed and transformed out during current period From beginning work in process Started and completed Normal spoilage Abnormal spoilage Work in process, ending 1,500 Re: 226 ST | Accounted for Equivalent units of work done in current period Requirements 1. For each cost category, compute equivalent units. Show physical units in the first column of your schedule. 2. Summarize the total costs to account for; calculate the cost per equivalent unit for each cost category; and assign costs to units completed and transferred out (including normal spoilage), to abnormal spoilage, and to units in ending work in process. 3. Should Wintel's managers choose the weighted average method or the FIFO method? Explain briefly. Print Done - Data table X d orc B C D Physical Units Direct Conversion (Computer Chips) Materials Costs 1,500 $ 100,800 $ 16,450 100% 30% 1,760 2,100 550 2 Work in process, beginning inventory (September 1) 3 Degree of completion of beginning work in process 4 Started during September 5 Good units completed and transferred out during September 6 Work in process, ending inventory (September 30) Degree of completion of ending work in process 8 Total costs added during September 9 Normal spoilage as a percentage of good units 10 Degree of completion of normal spoilage 11 Degree of completion of abnormal spollage 7 100% 10% $ 577,280 $ 226,870 15% 100% 100% 100% 100% Print Done ed of at - Weighted average data Total Production Costs Direct Conversion Materials Costs 208.00 $ 88.00 $ Cost per equivalent unit for work done to date Cost of units completed and transferred out Abnormal spoilage Work in process, ending Total costs accounted for 714,840 $ 87,320 119,240 502,320 $ 61,360 114,400 678,080 $ 212,520 25,960 4,840 $ 921,400 $ 243,320 Print Done Requirements 1. For each cost category, compute equivalent units. Show physical units in the first column of your schedule. 2. Summarize the total costs to account for calculate the cost per equivalent unit for each cost category; and assign costs to units completed and transferred out (including normal spoilage), to abnormal spoilage, and to units in ending work in process. 3. Should Wintel's managers choose the weighted-average method or the FIFO ethod? Explain briefly. Print Done - X Data table 1 B C D Physical Units Direct Conversion (Computer Chips) Materials Costs 1,000 $ 160,640 $ 15,810 3 100% 30% 2,780 2,600 2 Work in process, beginning inventory (September 1) 3 Degree of completion of beginning work in process 4 Started during September 5 Good units completed and transferred out during September 6 Work in process, ending Inventory (September 30) 7 Degree of completion of ending work in process 8 Total costs added during September 9 Normal spoilage as a percentage of good units 10 Degree of completion of normal spoilage 11 Degree of completion of abnormal spoilage 500 100% 30% $ 572,680 $ 272,310 15% 100% 100% 100% 100% Print Done stoffe for Setare 2017 Memorych growing manufadow of computers Direct materials are added at the Delen vowed ty during the profone i podiel are sold as a modele Trashed goods Sporedni dodatne isposal volce Mertorych uses the weig Summary data for fener 2017 nos fotowe de to vote dut) Read the res For the ht Physical Direct Conversion Flow Production Unite use Wote 1.100 Breed 2.00 2.000 Onung 200 2.700 200 510 1.000 200 510 Wind Retriever is.com dinding romans Skip when Calculator Print Clear Game MacBook Air 30 2 2 3 4 % 5 us 6 & 7 Q W E R T Y U A S D F G . T N Z C V B N dion command uiri Step 3: Summarize the total costs to account for. The total costs to account for that is, the total charges or debits to the Work in Process account) consist of the beginning work in process and costs added during the month. Enter the individual costs first, then calculate the tota Total Direct Conversion Production Costs Materials Costs Work in process, beginning Costs added in current period Total costs to account for Step 4: Calculate cost per equivalent unit for direct materials and conversion costs. Under the weighted average method the costs incurre duri to date is the same as the total costs to account for that you calculated in the prior step. We take these costs and divide by the total equivalent units of work done in order to calculate the cost per equivalent unit for work done. (Enter your answers to the nearest cent.) Direct Conversion Materials Costs Costs incurred to date $ 789,012 s 298,116 Divide by: Equivalent units of work done to date 3,906 3,549 Cost per equivalent unit for work done to date Step 5: Assign total costs to units completed and transferred out (including normal spoilago), to abnormal spoilage, and to units in onding Lict work in process. The idea is to attach dollar amounts to the equivalent output units for direct materials and conversion costs for each type of unit . Equivalent output units for each input are multiplied by the cost per equivalent unit, as calculated in step 4. Let's begin by calculating the costs associated with units completed and transferred out for direct materials and conversion costs. Cost per Equivalent units: Completed Completed and dun equivalent unit and transferred out = transferred out oost Direct materials S 202.00 2,700 $ 545,400 Conversion costs $ 84.00 2,700 226,800 Using the sare formula, calculate the costs for normal spoilage, abnormal spoilage, and ending work in process. Recall the cost per equivalent unit for direct materials and conversion costs will be the same amount for each type of unit. (Round your answers to the nearest whole dollar.) $ X Loctit hen Direct materials $ 202.00 2,700 545,400 Conversion costs $ 84.00 2,700 $ 226,800 Using the same formula, calculate the costs for normal spoilage, abnormal spoilage, and ending work in process. Recall the cost per equivalent unit for direct materials and conversion costs will be the same amount for each type of unit. (Round your answers to the nearest whole dollar.) Total Direct Conversion Production Costs Materials Costs dur Good units completed and transferred out Cost before adding normal spoilago 545,400 $ 226,800 Normal spoilage Total costpf good units completed and transferred out Abnormal spoilage Work in process, ending Total costs accounted for Help me solve this all parts showing anu no 017 Memorychip is a fast-growing manufacturer of computer chips. Direct materials are added at the start of the production process. Conversion ata costs are added evenly during the process. Some units of this product are spoiled as a result of defects not detectable before inspection of finished goods. Spoiled units are disposed of at zoro net disposal value. Memorychip uses the weighted average method of process costing. Summary data for September 2017 are as follows: Click the icon to view the data.) Read the requirements cate then Total costs accounted for Now calculate the total production costs and the total costs accounted for. (Note that the total costs account for direct materials and uctie conversion costs may not equal the total production costs due to rounding.) Total Direct Conversion Production Costs Materials Costs Good units completed and transferred out Cost before adding normal spolage 772,200 $ 545,400 $ 226,800 Normal spoilage 115,830 81,810 34,020 Total cost of good units completed and transferred out 888,030 Abnormal spoilage 83,226 58,782 24.444 Work in process, ending 115,872 103,020 12,852 Total costs accounted for 1.087 128 $ 789,012 298,116 Note that total costs to account for in step 3, 51,087,128, equal total costs accounted for in step 5. It dun S Calculator Print Close Etext pages Get more help Clear all

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts