Question: I want to ask for help with my case study we are only given 1 week to make it but we don't have enough time

I want to ask for help with my case study we are only given 1 week to make it but we don't have enough time since we are having a lot of school activities I really hope someone can help

I want to ask for help with my case study we are only given 1 week to make it but we don't have enough time since we are having a lot of school activities I really hope someone can help

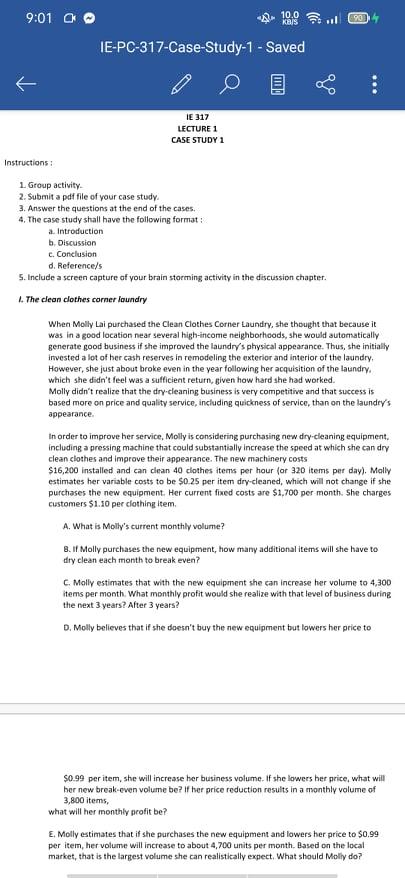

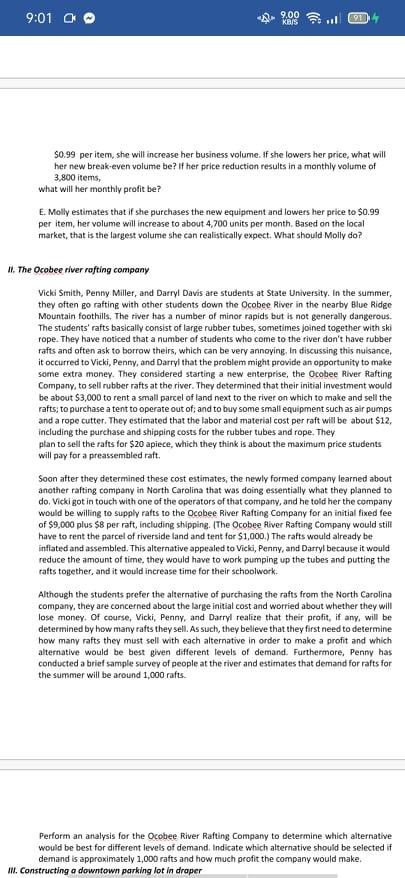

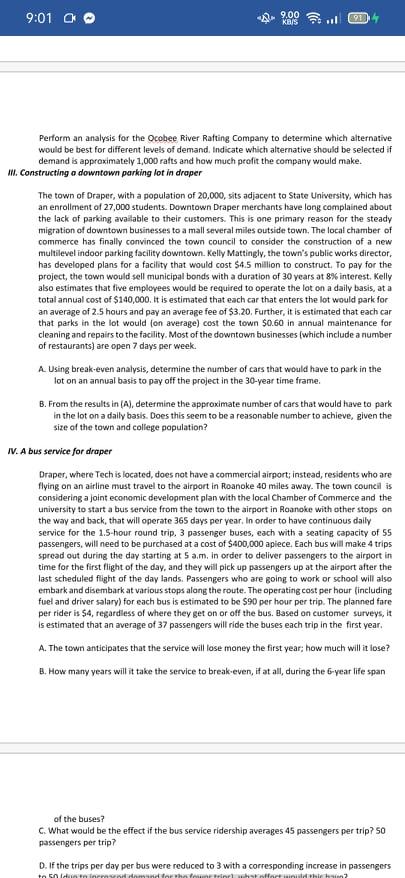

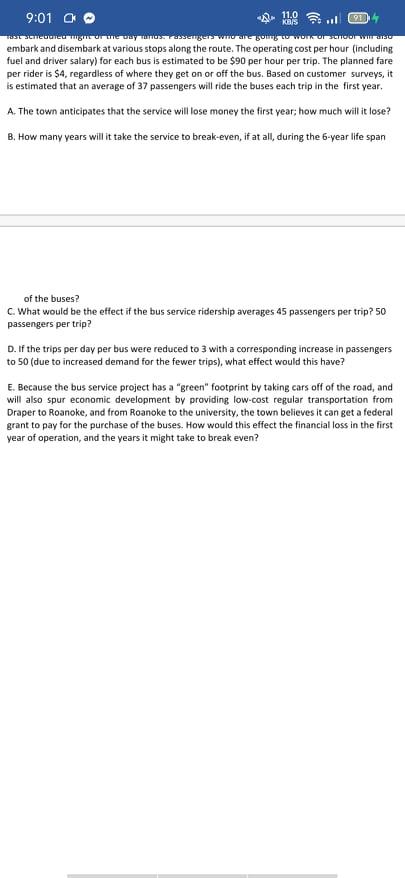

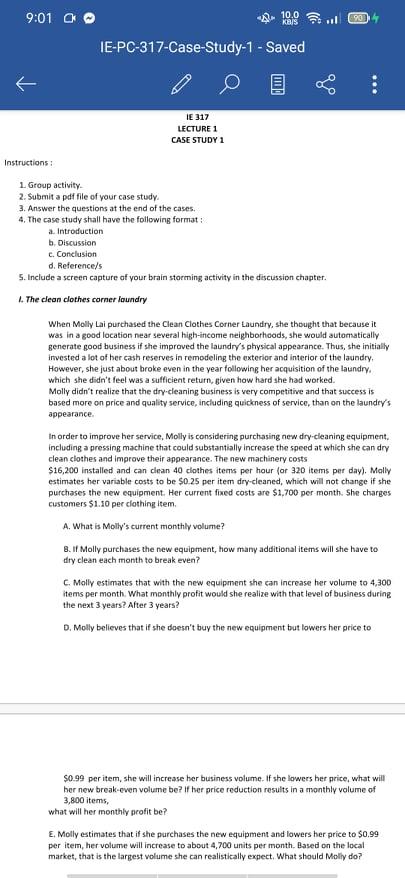

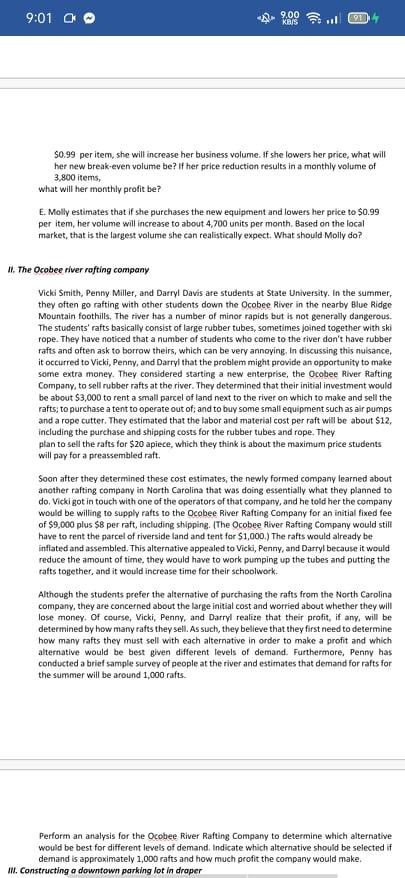

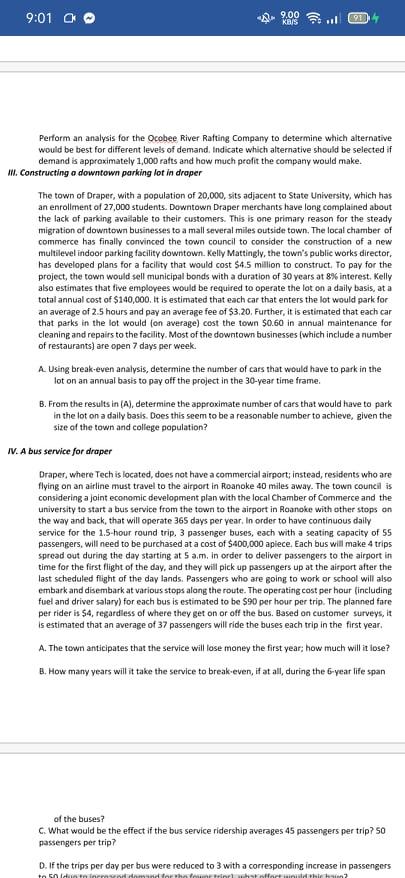

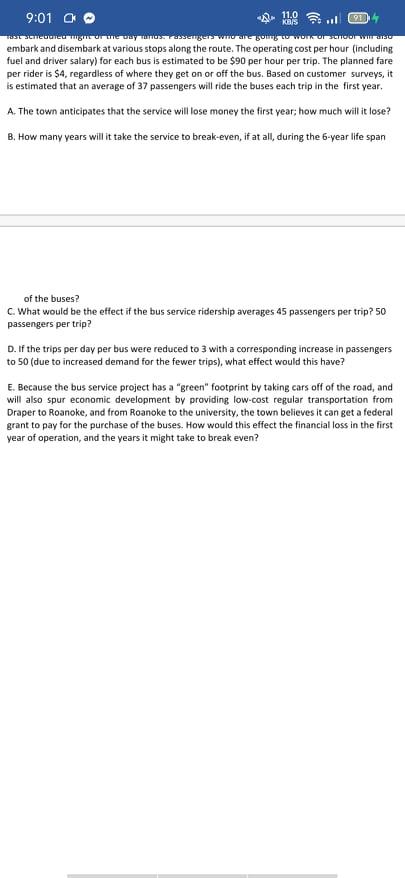

9:01 O 10.0.1 90 KB/S IE-PC-317-Case Study-1 - Saved eo IE 317 LECTURE 1 CASE STUDY 1 Instructions: 1. Group activity 2. Submit a pdf file of your case study 3. Answer the questions at the end of the cases. 4. The case study shall have the following format: a. Introduction b. Discussion c. Conclusion d. Reference/s 5. Include a screen capture of your brainstorming activity in the discussion Chapter L. The clean clothes corner loundry When Molly Lal purchased the Clean Clothes Corner Laundry, she thought that because it was in a good location near several high-income neighborhoods, she would automatically generate good business if she improved the laundry's physical appearance. Thus, she initially invested a lot of her cash reserves in remodeling the exterior and interior of the laundry, However, she just about broke even in the year following her acquisition of the laundry. which she didn't feel was a sufficient return, given how hard she had worked. Molly didn't realize that the dry-cleaning business is very competitive and that success is based more on price and quality service, including quickness of service, than on the laundry's appearance In order to improve her service, Molly is considering purchasing new dry-cleaning equipment. including a pressing machine that could substantially increase the speed at which she can dry clean clothes and improve their appearance. The new machinery costs $16,200 installed and can clean 40 clothes items per hour (or 320 items per day). Mally estimates her variable costs to be $0.25 per item dry-cleaned, which will not change if she purchases the new equipment. Her current fixed costs are $1,700 per month. She charges customers $1.10 per clothing Item A. What is Molly's current monthly volume? 8. If Molly purchases the new equipment, how many additional items will she have to dry clean each month to break even? C. Molly estimates that with the new equipment she can increase her volume to 4,300 items per month. What monthly profit would she realize with that level of business during the next 3 years? After 3 years? D. Molly believes that if she doesn't buy the new equipment but lowers her price to $0.99 per item, she will increase her business volume. If she lowers her price, what will her new break-even volume be? if her price reduction results in a monthly volume of 3,800 items, what will her monthly profit be? E. Molly estimates that if she purchases the new equipment and lowers her price to $0.99 per item, her volume will increase to about 4,700 units per month. Based on the local market, that is the largest volume she can realistically expect. What should Molly do? 9.00 9:01 am 91 $0.99 per item, she will increase her business volume. If she lowers her price, what will her new break-even volume be? If her price reduction results in a monthly volume of 3,800 items, what will her monthly profit be? E. Molly estimates that if she purchases the new equipment and lowers her price to $0.99 per item, her volume will increase to about 4,700 units per month. Based on the local market, that is the largest volume she can realistically expect. What should Molly do? II. The Ocobee river rafting company Vicki Smith, Penny Miller, and Darryl Davis are students at State University. In the summer, they often go rafting with other students down the Ocobee River in the nearby Blue Ridge Mountain foothills. The river has a number of minor rapids but is not generally dangerous The students' rafts basically consist of large rubber tubes, sometimes joined together with ski rope. They have noticed that a number of students who come to the river don't have rubber rafts and often ask to borrow theirs, which can be very annoying, in discussing this nuisance, it occurred to Vicki, Penny, and Darryl that the problem might provide an opportunity to make some extra money. They considered starting a new enterprise, the Ocobee River Rafting Company, to sell rubber rafts at the river. They determined that their initial investment would be about $3,000 to rent a small parcel of land next to the river on which to make and sell the rafts; to purchase a tent to operate out of; and to buy some small equipment such as air pumps and a rope cutter. They estimated that the labor and material cost per raft will be about $12, including the purchase and shipping costs for the rubber tubes and rope. They plan to sell the rafts for $20 apiece, which they think is about the maximum price students will pay for a preassembled raft. Soon after they determined these cost estimates, the newly formed company learned about another rafting company in North Carolina that was doing essentially what they planned to do. Vicki got in touch with one of the operators of that company, and he told her the company would be willing to supply rafts to the Ocabee River Rafting Company for an initial fixed fee of $9,000 plus $8 per raft, including shipping. (The Ocobee River Rafting Company would still have to rent the parcel of riverside land and tent for $1,000.) The rafts would already be infiated and assembled. This alternative appealed to Vicki, Penny, and Darryl because it would reduce the amount of time, they would have to work pumping up the tubes and putting the rafts together, and it would increase time for their schoolwork. Although the students prefer the alternative of purchasing the rafts from the North Carolina company, they are concerned about the large initial cost and worried about whether they will lose money. Of course, Vicki, Penny, and Darryl realize that their profit, if any, will be determined by how many rafts they sell. As such, they believe that they first need to determine how many rafts they must sell with each alternative in order to make a profit and which alternative would be best given different levels of demand. Furthermore, Penny has conducted a brief sample survey of people at the river and estimates that demand for rafts for the summer will be around 1,000 rafts. Perform an analysis for the Ocobee River Rafting Company to determine which alternative would be best for different levels of demand, Indicate which alternative should be selected if demand is approximately 1,000 rafts and how much profit the company would make. III. Constructing a downtown parking lot in draper 9:01 0 9.00 .. Perform an analysis for the Ocobee River Rafting Company to determine which alternative would be best for different levels of demand Indicate which alternative should be selected if demand is approximately 1,000 rafts and how much profit the company would make. III. Constructing o downtown parking lot in draper The town of Draper, with a population of 20,000, sits adjacent to State University, which has an enrollment of 27,000 students. Downtown Draper merchants have long complained about the lack of parking available to their customers. This is one primary reason for the steady migration of downtown businesses to a mall several miles outside town. The local chamber of commerce has finally convinced the town council to consider the construction of a new multilevel indoor parking facility downtown. Kelly Mattingly, the town's public works director, has developed plans for a facility that would cost $4.5 million to construct. To pay for the project, the town would sell municipal bonds with a duration of 30 years at 8% interest. Kelly also estimates that live employees would be required to operate the lot on a daily basis, at a total annual cost of $140,000. It is estimated that each car that enters the lot would park for an average of 2.5 hours and pay an average fee of $3.20. Further, it is estimated that each car that parks in the lot would on average) cost the town $0.60 in annual maintenance for cleaning and repairs to the facility. Most of the downtown businesses (which include a number of restaurants) are open 7 days per week. A Using break-even analysis, determine the number of cars that would have to park in the lot on an annual basis to pay off the project in the 30-year time frame B. From the results in (A), determine the approximate number of cars that would have to park in the lot on a daily basis. Does this seem to be a reasonable number to achieve, given the size of the town and college population? IV. A bus service for draper Draper, whereTech is located, does not have a commercial airport; instead, residents who are flying on an airline must travel to the airport in Roanoke 40 miles away. The town council is considering a joint economic development plan with the local Chamber of Commerce and the university to start a bus service from the town to the airport in Roanoke with other stops on the way and back, that will operate 365 days per year. In order to have continuous daily service for the 1.5-hour round trip. 3 passenger buses, each with a seating capacity of 55 passengers, will need to be purchased at a cost of $400,000 apiece. Each bus will make 4 trips spread out during the day starting at 5 am. In order to deliver passengers to the airport in time for the first flight of the day, and they will pick up passengers up at the airport after the last scheduled flight of the day lands. Passengers who are going to work or school will also embark and disembark at various stops along the route. The operating cost per hour (including fuel and driver salary) for each bus is estimated to be $90 per hour per trip. The planned fare per rider is $4, regardless of where they get on or off the bus. Based on customer surveys, it is estimated that an average of 37 passengers will ride the buses each trip in the first year. A. The town anticipates that the service will lose money the first year: how much will it lose? B. How many years will it take the service to break-even, it at all during the 6-year life span of the buses? C. What would be the effect if the bus service ridership averages 45 passengers per trip? 50 passengers per trip? D. If the trips per day per bus were reduced to 3 with a corresponding increase in passengers to Idador whatever chalet 11.0 191 9:01 0 TURCJOM U WORCORSCHOOL WHISO embark and disembark at various stops along the route. The operating cost per hour (including fuel and driver salary) for each bus is estimated to be $90 per hour per trip. The planned fare per rider is $4, regardless of where they get on or off the bus. Based on customer surveys, it is estimated that an average of 37 passengers will ride the buses each trip in the first year, A. The town anticipates that the service will lose money the first year; how much will it lose? B. How many years will it take the service to break-even, if at all, during the 6-year life span of the buses? C. What would be the effect if the bus service ridership averages 45 passengers per trip? 50 passengers per trip? D. If the trips per day per bus were reduced to 3 with a corresponding increase in passengers to 50 (due to increased demand for the fewer trips), what effect would this have? E. Because the bus service project has a "green" footprint by taking cars off of the road, and will also spur economic development by providing low-cost regular transportation from Draper to Roanoke, and from Roanoke to the university, the town believes it can get a federal grant to pay for the purchase of the buses. How would this effect the financial loss in the first year of operation, and the years it might take to break even? 9:01 O 10.0.1 90 KB/S IE-PC-317-Case Study-1 - Saved eo IE 317 LECTURE 1 CASE STUDY 1 Instructions: 1. Group activity 2. Submit a pdf file of your case study 3. Answer the questions at the end of the cases. 4. The case study shall have the following format: a. Introduction b. Discussion c. Conclusion d. Reference/s 5. Include a screen capture of your brainstorming activity in the discussion Chapter L. The clean clothes corner loundry When Molly Lal purchased the Clean Clothes Corner Laundry, she thought that because it was in a good location near several high-income neighborhoods, she would automatically generate good business if she improved the laundry's physical appearance. Thus, she initially invested a lot of her cash reserves in remodeling the exterior and interior of the laundry, However, she just about broke even in the year following her acquisition of the laundry. which she didn't feel was a sufficient return, given how hard she had worked. Molly didn't realize that the dry-cleaning business is very competitive and that success is based more on price and quality service, including quickness of service, than on the laundry's appearance In order to improve her service, Molly is considering purchasing new dry-cleaning equipment. including a pressing machine that could substantially increase the speed at which she can dry clean clothes and improve their appearance. The new machinery costs $16,200 installed and can clean 40 clothes items per hour (or 320 items per day). Mally estimates her variable costs to be $0.25 per item dry-cleaned, which will not change if she purchases the new equipment. Her current fixed costs are $1,700 per month. She charges customers $1.10 per clothing Item A. What is Molly's current monthly volume? 8. If Molly purchases the new equipment, how many additional items will she have to dry clean each month to break even? C. Molly estimates that with the new equipment she can increase her volume to 4,300 items per month. What monthly profit would she realize with that level of business during the next 3 years? After 3 years? D. Molly believes that if she doesn't buy the new equipment but lowers her price to $0.99 per item, she will increase her business volume. If she lowers her price, what will her new break-even volume be? if her price reduction results in a monthly volume of 3,800 items, what will her monthly profit be? E. Molly estimates that if she purchases the new equipment and lowers her price to $0.99 per item, her volume will increase to about 4,700 units per month. Based on the local market, that is the largest volume she can realistically expect. What should Molly do? 9.00 9:01 am 91 $0.99 per item, she will increase her business volume. If she lowers her price, what will her new break-even volume be? If her price reduction results in a monthly volume of 3,800 items, what will her monthly profit be? E. Molly estimates that if she purchases the new equipment and lowers her price to $0.99 per item, her volume will increase to about 4,700 units per month. Based on the local market, that is the largest volume she can realistically expect. What should Molly do? II. The Ocobee river rafting company Vicki Smith, Penny Miller, and Darryl Davis are students at State University. In the summer, they often go rafting with other students down the Ocobee River in the nearby Blue Ridge Mountain foothills. The river has a number of minor rapids but is not generally dangerous The students' rafts basically consist of large rubber tubes, sometimes joined together with ski rope. They have noticed that a number of students who come to the river don't have rubber rafts and often ask to borrow theirs, which can be very annoying, in discussing this nuisance, it occurred to Vicki, Penny, and Darryl that the problem might provide an opportunity to make some extra money. They considered starting a new enterprise, the Ocobee River Rafting Company, to sell rubber rafts at the river. They determined that their initial investment would be about $3,000 to rent a small parcel of land next to the river on which to make and sell the rafts; to purchase a tent to operate out of; and to buy some small equipment such as air pumps and a rope cutter. They estimated that the labor and material cost per raft will be about $12, including the purchase and shipping costs for the rubber tubes and rope. They plan to sell the rafts for $20 apiece, which they think is about the maximum price students will pay for a preassembled raft. Soon after they determined these cost estimates, the newly formed company learned about another rafting company in North Carolina that was doing essentially what they planned to do. Vicki got in touch with one of the operators of that company, and he told her the company would be willing to supply rafts to the Ocabee River Rafting Company for an initial fixed fee of $9,000 plus $8 per raft, including shipping. (The Ocobee River Rafting Company would still have to rent the parcel of riverside land and tent for $1,000.) The rafts would already be infiated and assembled. This alternative appealed to Vicki, Penny, and Darryl because it would reduce the amount of time, they would have to work pumping up the tubes and putting the rafts together, and it would increase time for their schoolwork. Although the students prefer the alternative of purchasing the rafts from the North Carolina company, they are concerned about the large initial cost and worried about whether they will lose money. Of course, Vicki, Penny, and Darryl realize that their profit, if any, will be determined by how many rafts they sell. As such, they believe that they first need to determine how many rafts they must sell with each alternative in order to make a profit and which alternative would be best given different levels of demand. Furthermore, Penny has conducted a brief sample survey of people at the river and estimates that demand for rafts for the summer will be around 1,000 rafts. Perform an analysis for the Ocobee River Rafting Company to determine which alternative would be best for different levels of demand, Indicate which alternative should be selected if demand is approximately 1,000 rafts and how much profit the company would make. III. Constructing a downtown parking lot in draper 9:01 0 9.00 .. Perform an analysis for the Ocobee River Rafting Company to determine which alternative would be best for different levels of demand Indicate which alternative should be selected if demand is approximately 1,000 rafts and how much profit the company would make. III. Constructing o downtown parking lot in draper The town of Draper, with a population of 20,000, sits adjacent to State University, which has an enrollment of 27,000 students. Downtown Draper merchants have long complained about the lack of parking available to their customers. This is one primary reason for the steady migration of downtown businesses to a mall several miles outside town. The local chamber of commerce has finally convinced the town council to consider the construction of a new multilevel indoor parking facility downtown. Kelly Mattingly, the town's public works director, has developed plans for a facility that would cost $4.5 million to construct. To pay for the project, the town would sell municipal bonds with a duration of 30 years at 8% interest. Kelly also estimates that live employees would be required to operate the lot on a daily basis, at a total annual cost of $140,000. It is estimated that each car that enters the lot would park for an average of 2.5 hours and pay an average fee of $3.20. Further, it is estimated that each car that parks in the lot would on average) cost the town $0.60 in annual maintenance for cleaning and repairs to the facility. Most of the downtown businesses (which include a number of restaurants) are open 7 days per week. A Using break-even analysis, determine the number of cars that would have to park in the lot on an annual basis to pay off the project in the 30-year time frame B. From the results in (A), determine the approximate number of cars that would have to park in the lot on a daily basis. Does this seem to be a reasonable number to achieve, given the size of the town and college population? IV. A bus service for draper Draper, whereTech is located, does not have a commercial airport; instead, residents who are flying on an airline must travel to the airport in Roanoke 40 miles away. The town council is considering a joint economic development plan with the local Chamber of Commerce and the university to start a bus service from the town to the airport in Roanoke with other stops on the way and back, that will operate 365 days per year. In order to have continuous daily service for the 1.5-hour round trip. 3 passenger buses, each with a seating capacity of 55 passengers, will need to be purchased at a cost of $400,000 apiece. Each bus will make 4 trips spread out during the day starting at 5 am. In order to deliver passengers to the airport in time for the first flight of the day, and they will pick up passengers up at the airport after the last scheduled flight of the day lands. Passengers who are going to work or school will also embark and disembark at various stops along the route. The operating cost per hour (including fuel and driver salary) for each bus is estimated to be $90 per hour per trip. The planned fare per rider is $4, regardless of where they get on or off the bus. Based on customer surveys, it is estimated that an average of 37 passengers will ride the buses each trip in the first year. A. The town anticipates that the service will lose money the first year: how much will it lose? B. How many years will it take the service to break-even, it at all during the 6-year life span of the buses? C. What would be the effect if the bus service ridership averages 45 passengers per trip? 50 passengers per trip? D. If the trips per day per bus were reduced to 3 with a corresponding increase in passengers to Idador whatever chalet 11.0 191 9:01 0 TURCJOM U WORCORSCHOOL WHISO embark and disembark at various stops along the route. The operating cost per hour (including fuel and driver salary) for each bus is estimated to be $90 per hour per trip. The planned fare per rider is $4, regardless of where they get on or off the bus. Based on customer surveys, it is estimated that an average of 37 passengers will ride the buses each trip in the first year, A. The town anticipates that the service will lose money the first year; how much will it lose? B. How many years will it take the service to break-even, if at all, during the 6-year life span of the buses? C. What would be the effect if the bus service ridership averages 45 passengers per trip? 50 passengers per trip? D. If the trips per day per bus were reduced to 3 with a corresponding increase in passengers to 50 (due to increased demand for the fewer trips), what effect would this have? E. Because the bus service project has a "green" footprint by taking cars off of the road, and will also spur economic development by providing low-cost regular transportation from Draper to Roanoke, and from Roanoke to the university, the town believes it can get a federal grant to pay for the purchase of the buses. How would this effect the financial loss in the first year of operation, and the years it might take to break even

I want to ask for help with my case study we are only given 1 week to make it but we don't have enough time since we are having a lot of school activities I really hope someone can help

I want to ask for help with my case study we are only given 1 week to make it but we don't have enough time since we are having a lot of school activities I really hope someone can help