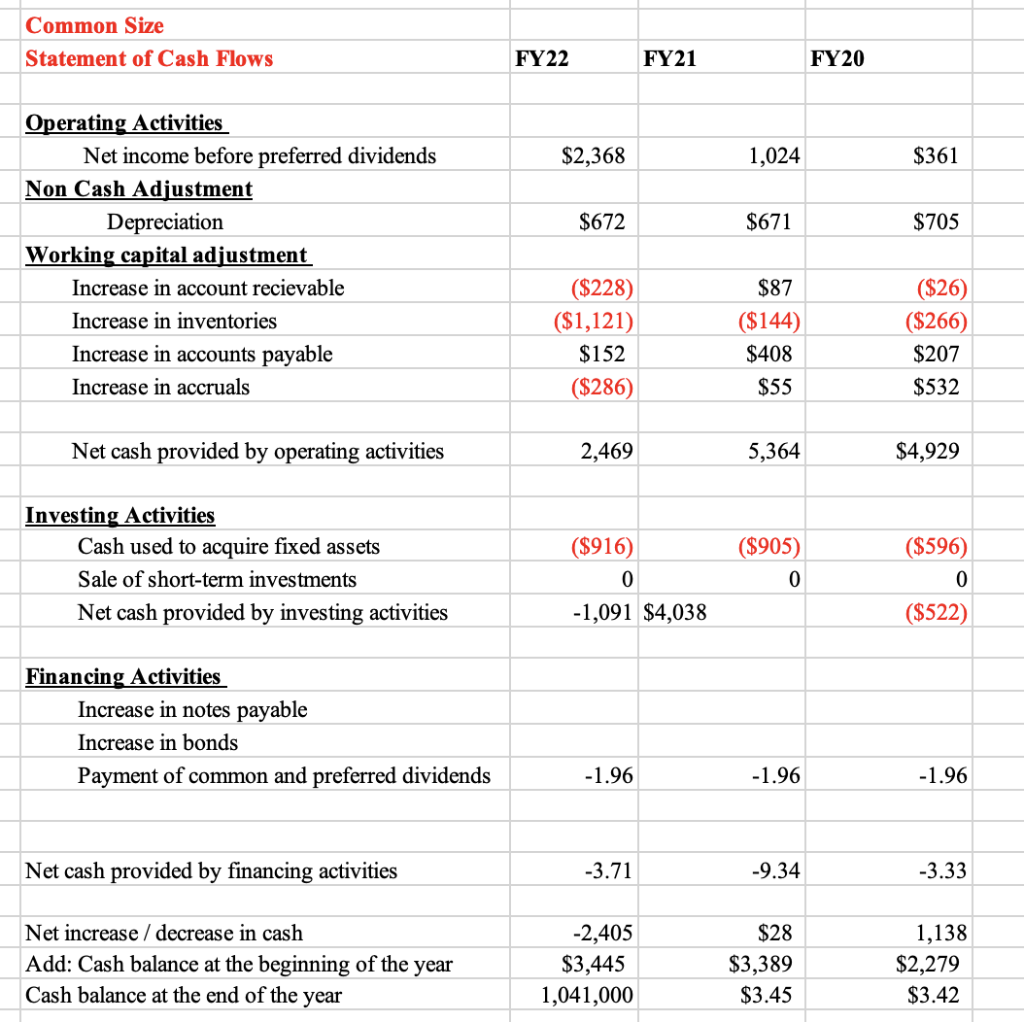

Question: I was told information was missing but im not sure what information is missing. I am trying to calculate the common size for the data.

I was told information was missing but im not sure what information is missing. I am trying to calculate the common size for the data. Thank you.

I was told information was missing but im not sure what information is missing. I am trying to calculate the common size for the data. Thank you.

Common Size Statement of Cash Flows FY22 FY21 FY20 Operating Activities Net income before preferred dividends Non Cash Adjustment \begin{tabular}{|c|r|r|r|} \hline Depreciation & $672 & $671 & $705 \\ \hline Working capital adjustment & & & \\ \hline Increase in account recievable & ($228) & $87 & ($26) \\ \hline Increase in inventories & ($1,121) & ($144) & ($266) \\ \hline Increase in accounts payable & $152 & $408 & $207 \\ \hline Increase in accruals & ($286) & $55 & $532 \\ \hline Net cash provided by operating activities & & & \\ \hline \end{tabular} Investing Activities Cash used to acquire fixed assets Sale of short-term investments ($905)0($596)0 Net cash provided by investing activities ($522) Financing Activities Increase in notes payable Increase in bonds Payment of common and preferred dividends 1.96 1.96 1.96 Net cash provided by financing activities Net increase / decrease in cash Add: Cash balance at the beginning of the year Cash balance at the end of the year \begin{tabular}{|r|r|r|} \hline-3.71 & -9.34 & -3.33 \\ \hline2,405 & & \\ \hline$3,445 & $3,389 & 1,138 \\ \hline 1,041,000 & $3.45 & $2,279 \\ \hline \end{tabular} Common Size Statement of Cash Flows FY22 FY21 FY20 Operating Activities Net income before preferred dividends Non Cash Adjustment \begin{tabular}{|c|r|r|r|} \hline Depreciation & $672 & $671 & $705 \\ \hline Working capital adjustment & & & \\ \hline Increase in account recievable & ($228) & $87 & ($26) \\ \hline Increase in inventories & ($1,121) & ($144) & ($266) \\ \hline Increase in accounts payable & $152 & $408 & $207 \\ \hline Increase in accruals & ($286) & $55 & $532 \\ \hline Net cash provided by operating activities & & & \\ \hline \end{tabular} Investing Activities Cash used to acquire fixed assets Sale of short-term investments ($905)0($596)0 Net cash provided by investing activities ($522) Financing Activities Increase in notes payable Increase in bonds Payment of common and preferred dividends 1.96 1.96 1.96 Net cash provided by financing activities Net increase / decrease in cash Add: Cash balance at the beginning of the year Cash balance at the end of the year \begin{tabular}{|r|r|r|} \hline-3.71 & -9.34 & -3.33 \\ \hline2,405 & & \\ \hline$3,445 & $3,389 & 1,138 \\ \hline 1,041,000 & $3.45 & $2,279 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts