Question: I will add the part (b) when this part (a) is answered. Thank you so much. *** -15 E Question 8 of 8 Brooks Clinic

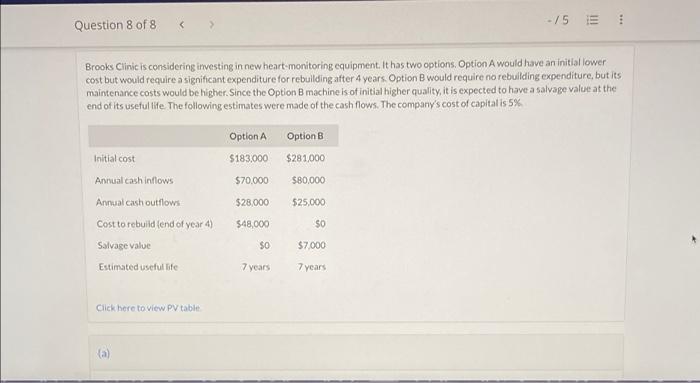

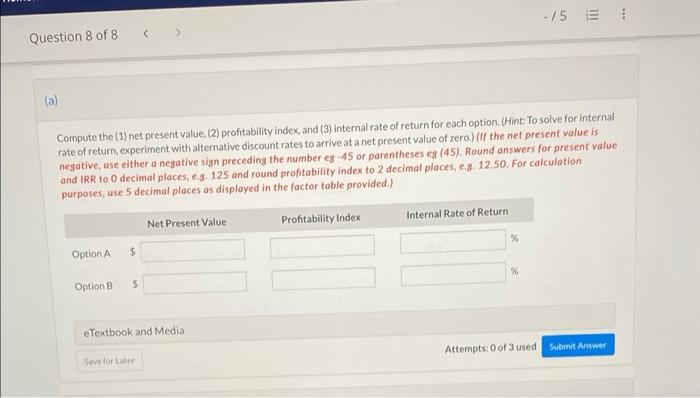

*** -15 E Question 8 of 8 Brooks Clinic is considering investing in new heart-monitoring equipment. It has two options. Option A would have an initial lower cost but would require a significant expenditure for rebuilding after 4 years. Option B would require no rebuilding expenditure, but its maintenance costs would be higher. Since the Option B machine is of initial higher quality, it is expected to have a salvage value at the end of its useful life. The following estimates were made of the cash flows. The company's cost of capital is 5% Option A Option B Initial cost $183,000 $281,000 Annual cash inflows $70,000 $80,000 Annual cash outflows $28,000 $25,000 Cost to rebuild (end of year 4) $48,000 SO Salvage value $0 $7,000 Estimated useful life 7 years 7 years Click here to view PV table (a) Question 8 of 8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts