Question: I will give thumbs up for the correct answer. Jackson Traders is considering two mutually exclusive projects with the following cash flows. The crossover rate

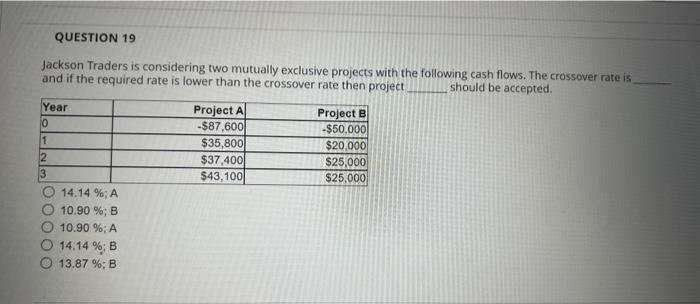

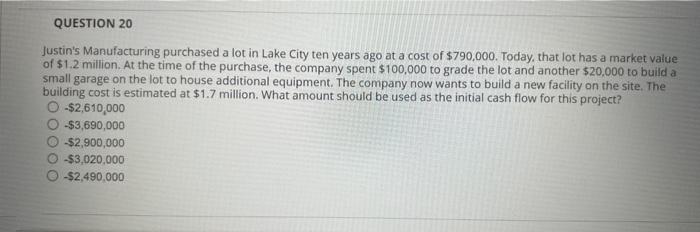

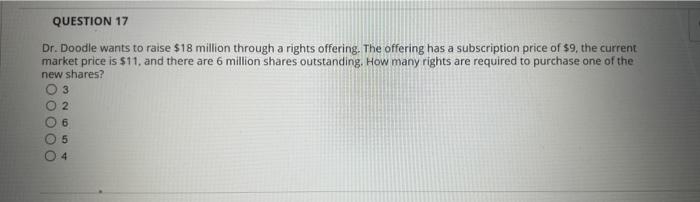

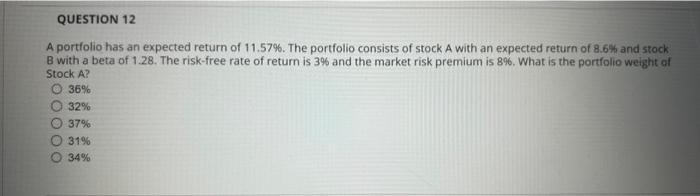

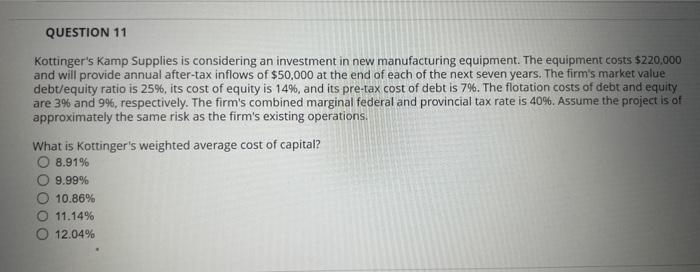

Jackson Traders is considering two mutually exclusive projects with the following cash flows. The crossover rate is and if the required rate is lower than the crossover rate then project should be accepted. 14.14%;A10.90%;B10.90%;A14.14%;B13.87%;B Justin's Manufacturing purchased a lot in Lake City ten years ago at a cost of $790,000. Today, that lot has a market value of $1.2 milion. At the time of the purchase, the company spent $100,000 to grade the lot and another $20,000 to build a small garage on the lot to house additional equipment. The company now wants to build a new facility on the site. The building cost is estimated at $1.7 million. What amount should be used as the initial cash flow for this project? $2,610,000$3,690,000$2,900,000$3,020,000$2,490,000 Dr. Doodle wants to raise $18 million through a rights offering. The offering has a subscription price of $9, the current market price is $11, and there are 6 million shares outstanding. How many rights are required to purchase one of the new shares? 3 2 6 5 4 A portfolio has an expected return of 11.57\%. The portfolio consists of stock A with an expected return of 8.6% and stock B with a beta of 1.28. The risk-free rate of return is 3% and the market risk premium is 8%. What is the portfolio weight of Stock A? 36% 32% 37% 31% 34% Kottinger's Kamp Supplies is considering an investment in new manufacturing equipment. The equipment costs $220,000 and will provide annual after-tax inflows of $50,000 at the end of each of the next seven years. The firm's market value debt/equity ratio is 25%, its cost of equity is 14%, and its pre-tax cost of debt is 7%. The flotation costs of debt and equity are 3% and 9%, respectively. The firm's combined marginal federal and provincial tax rate is 40%. Assume the project is of approximately the same risk as the firm's existing operations. What is Kottinger's weighted average cost of capital? 8.91% 9.99% 10.86% 11.14% 12.04%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts