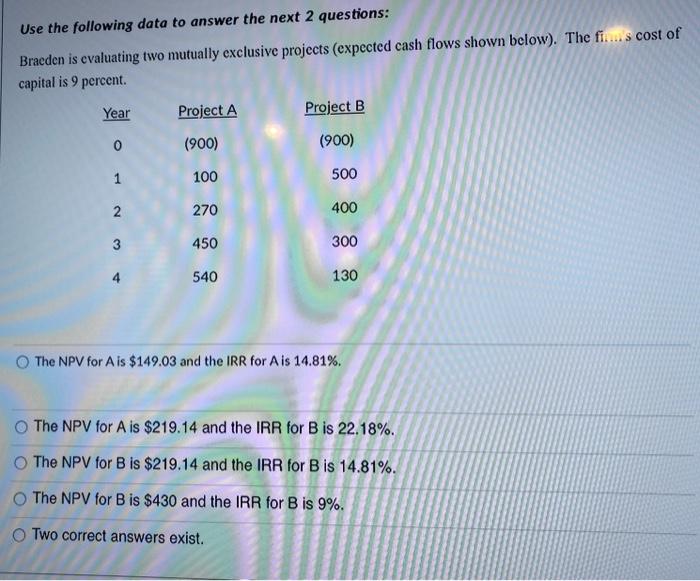

Question: Use the following data to answer the next 2 questions: Braeden is evaluating two mutually exclusive projects (expected cash flows shown below). The fil... scost

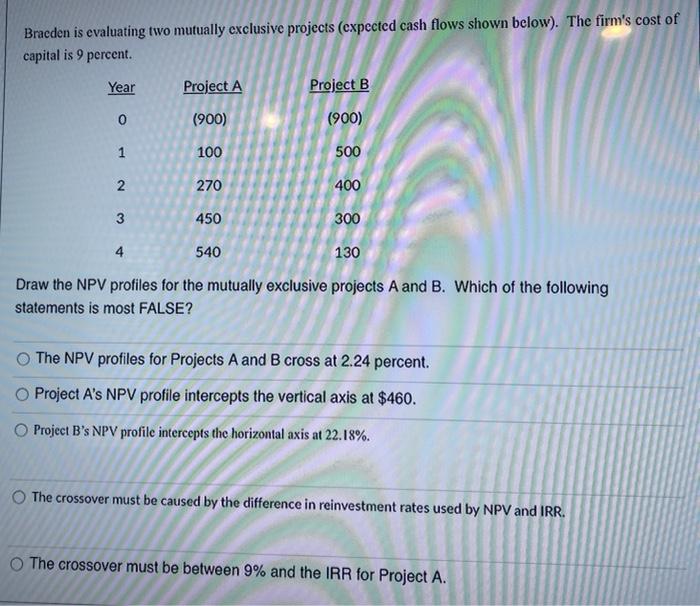

Use the following data to answer the next 2 questions: Braeden is evaluating two mutually exclusive projects (expected cash flows shown below). The fil... scost of capital is 9 percent. Year Project A Project B 0 (900) (900) 1 100 500 2 270 400 3 450 300 540 130 The NPV for Ais $149.03 and the IRR for Ais 14.81%. The NPV for A is $219.14 and the IRR for B is 22.18%. The NPV for B is $219.14 and the IRR for B is 14.81%. The NPV for B is $430 and the IRR for B is 9%. Two correct answers exist. Bracden is evaluating two mutually exclusive projects (expected cash flows shown below). The firm's cost of capital is 9 percent. Year Project A Project B 0 (900) (900) 1 100 500 2 270 400 3 450 300 4 540 130 Draw the NPV profiles for the mutually exclusive projects A and B. Which of the following statements is most FALSE? The NPV profiles for Projects A and B cross at 2.24 percent. Project A's NPV profile intercepts the vertical axis at $460. Project B's NPV profile intercepts the horizontal axis at 22.18%. The crossover must be caused by the difference in reinvestment rates used by NPV and IRR. The crossover must be between 9% and the IRR for Project A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts