Question: I will thumbs up Figure out the net present value of the following 5 choices through the year 2009. (Use a discount rate of 30%

I will thumbs up

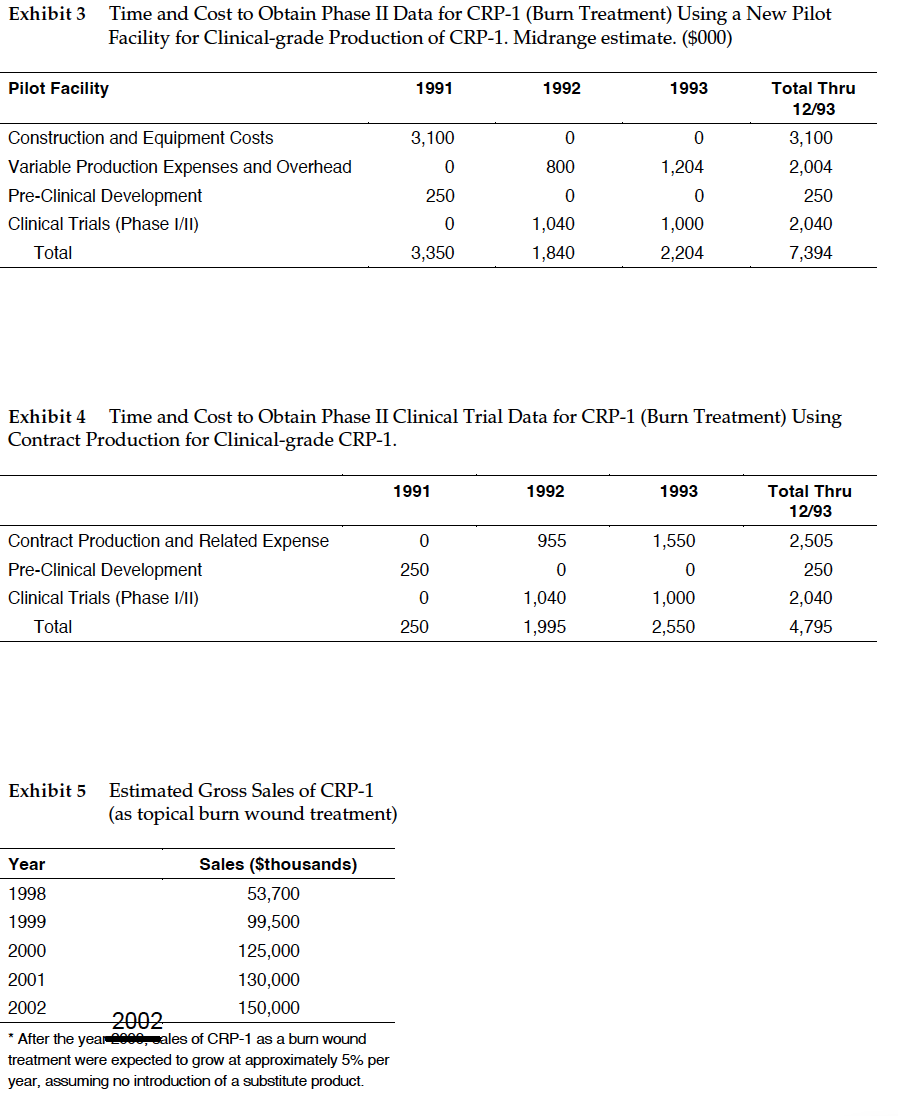

Figure out the net present value of the following 5 choices through the year 2009. (Use a discount rate of 30% and attach an Excel page to show what numbers you utilized and how you did the NPV computation.

Phase I/II Production Phase III Production

(a) Nucleon Nucleon

(b) Nucleon Licensee

(c) Contractor Nucleon

(d) Contractor Licensee

(e) Licensee Licensee

Compare options (a) through (e) using two criteria:

- Which choice has the largest NPV?

- Figure out what Nucleons competitive advantage(s) would be if it chooses each of the five options (for example, if Nucleon chooses Option (e) then manufacturing capabilities are unlikely to be part of Nucleons competitive advantage). Also comment on the ability of Nucleon to sustain the advantage implied with each of the five options.

- The timeframe for NPV calculation should be 1991-2009. You should calculate net cashflow for each year in each option.

Based on your analysis of NPV and competitive advantage, which option do you recommend?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts