Question: I will thumbs up for quality work. Question 21 (1 point) Northfield Casino is considering converting the Polsky Building at University of Akron into a

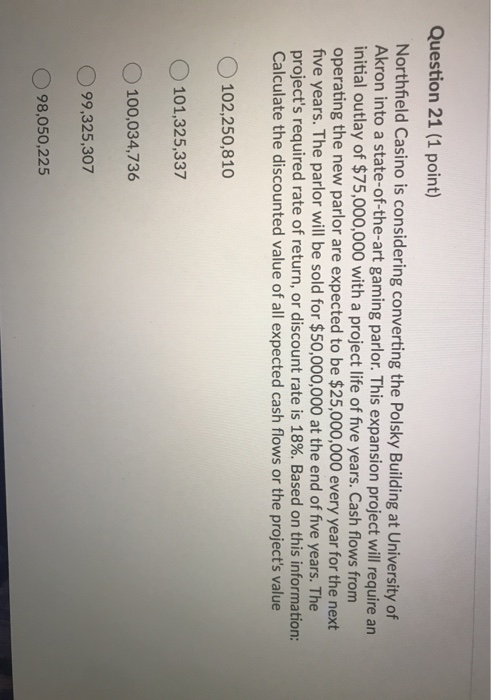

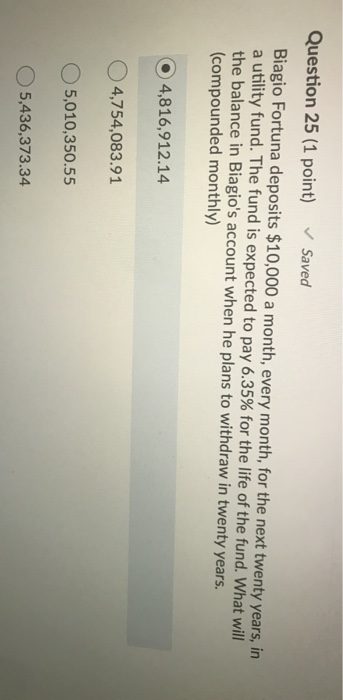

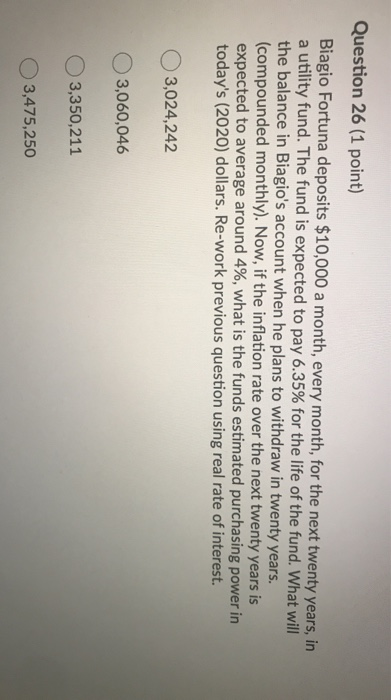

Question 21 (1 point) Northfield Casino is considering converting the Polsky Building at University of Akron into a state-of-the-art gaming parlor. This expansion project will require an initial outlay of $75,000,000 with a project life of five years. Cash flows from operating the new parlor are expected to be $25,000,000 every year for the next five years. The parlor will be sold for $50,000,000 at the end of five years. The project's required rate of return, or discount rate is 18%. Based on this information: Calculate the discounted value of all expected cash flows or the project's value 102,250,810 101,325,337 100,034,736 99,325,307 98,050,225 Question 25 (1 point) Saved Biagio Fortuna deposits $10,000 a month, every month, for the next twenty years, in a utility fund. The fund is expected to pay 6.35% for the life of the fund. What will the balance in Biagio's account when he plans to withdraw in twenty years. (compounded monthly) O 4,816,912.14 4,754,083.91 5,010,350.55 5,436,373.34 Question 26 (1 point) Biagio Fortuna deposits $10,000 a month, every month, for the next twenty years, in a utility fund. The fund is expected to pay 6.35% for the life of the fund. What will the balance in Biagio's account when he plans to withdraw in twenty years. (compounded monthly). Now, if the inflation rate over the next twenty years is expected to average around 4%, what is the funds estimated purchasing power in today's (2020) dollars. Re-work previous question using real rate of interest. 3,024,242 3,060,046 3,350,211 3,475,250

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts