Question: I will thumbs up Required information Exercise 11-1 (Static) Depreciation methods [LO11-2] [The following information applies to the questions displayed below.] On January 1,2024 ,

![[LO11-2] [The following information applies to the questions displayed below.] On January](https://s3.amazonaws.com/si.experts.images/answers/2024/09/66e15f097b250_96066e15f08e68ee.jpg)

I will thumbs up

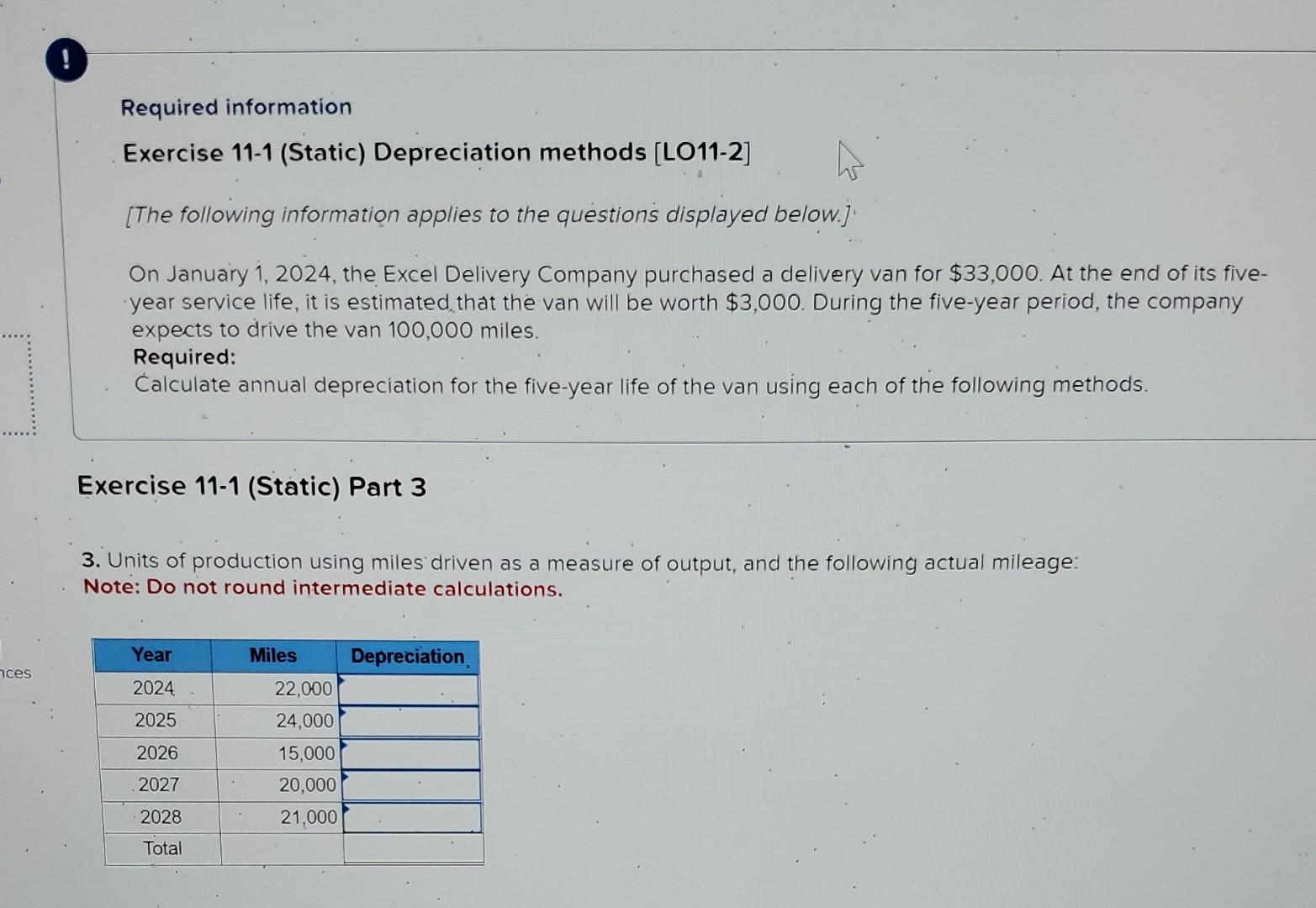

Required information Exercise 11-1 (Static) Depreciation methods [LO11-2] [The following information applies to the questions displayed below.] On January 1,2024 , the Excel Delivery Company purchased a delivery van for $33,000. At the end of its fiveyear service life, it is estimated that the van will be worth \$3,000. During the five-year period, the company expects to drive the van 100,000 miles. Required: Calculate annual depreciation for the five-year life of the van using each of the following methods. Exercise 11-1 (Static) Part 3 3. Units of production using miles driven as a measure of output, and the following actual mileage: Note: Do not round intermediate calculations. Required information Exercise 11-1 (Static) Depreciation methods [LO11-2] [The following information applies to the questions displayed below.] On January 1, 2024, the Excel Delivery Company purchased a delivery van for $33,000. At the end of its fiveyear service life, it is estimated that the van will be worth $3,000. During the five-year period, the company expects to drive the van 100,000 miles. Required: Calculate annual depreciation for the five-year life of the van using each of the following methods. Exercise 11-1 (Static) Part 1 1. Straight line

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts