Question: I would appreciate the worked out steps for each answer please. I believe the answers are B and A. Use the following information for the

I would appreciate the worked out steps for each answer please. I believe the answers are B and A.

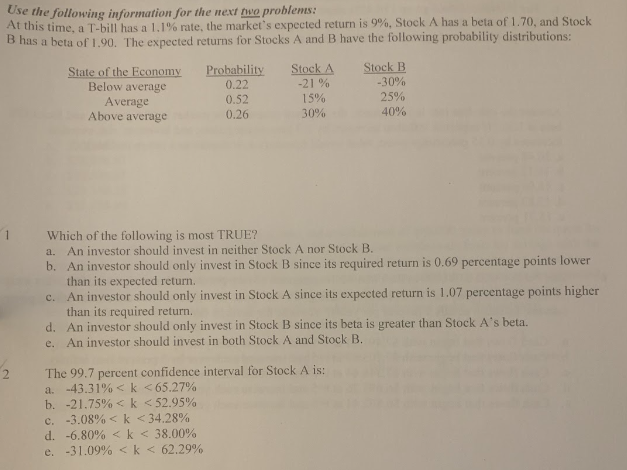

Use the following information for the next two problems: At this time, a T-bill has a 1.1% rate, the market's expected return is 9%, Stock A has a beta of 1.70 , and Stock B has a beta of 1.90. The expected returns for Stocks A and B have the following probability distributions: Which of the following is most TRUE? a. An investor should invest in neither Stock A nor Stock B. b. An investor should only invest in Stock B since its required return is 0.69 percentage points lower than its expected return. c. An investor should only invest in Stock A since its expected return is 1.07 percentage points higher than its required return. d. An investor should only invest in Stock B since its beta is greater than Stock A''s beta. e. An investor should invest in both Stock A and Stock B. The 99.7 percent confidence interval for Stock A is: a. 43.31%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts