Question: I would be very happy if you do the operations on the paper in detail and if you explain the reasons YEAR O YEAR 1

I would be very happy if you do the operations on the paper in detail and if you explain the reasons

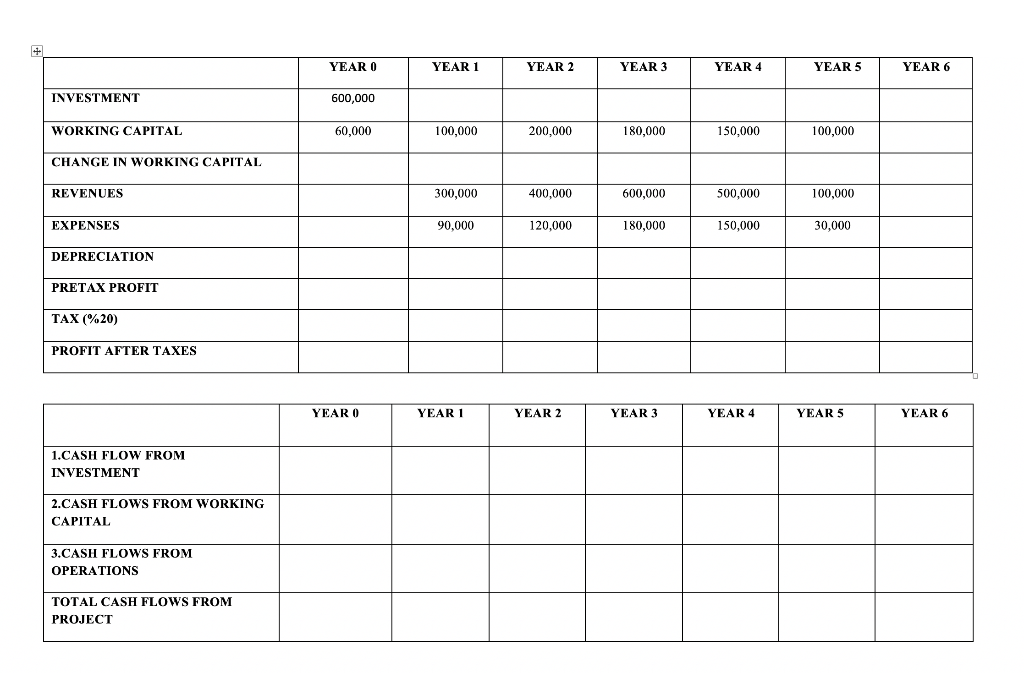

YEAR O YEAR 1 YEAR 2 YEAR YEAR 3 YEAR 4 YEAR 5 YEAR 6 INVESTMENT 600,000 WORKING CAPITAL 60,000 100,000 200,000 180,000 150,000 100,000 CHANGE IN WORKING CAPITAL REVENUES 300,000 400,000 600,000 500,000 100,000 EXPENSES 90,000 120,000 180,000 150,000 30,000 DEPRECIATION PRETAX PROFIT TAX (%20) PROFIT AFTER TAXES YEAR O YEAR 1 EAR YEAR 2 EAR YEAR 3 YEAR 4 YEARS EAR: YEAR 6 1.CASH FLOW FROM INVESTMENT 2.CASH FLOWS FROM WORKING CAPITAL 3.CASH FLOWS FROM OPERATIONS TOTAL CASH FLOWS FROM PROJECT YEAR O YEAR 1 YEAR 2 YEAR YEAR 3 YEAR 4 YEAR 5 YEAR 6 INVESTMENT 600,000 WORKING CAPITAL 60,000 100,000 200,000 180,000 150,000 100,000 CHANGE IN WORKING CAPITAL REVENUES 300,000 400,000 600,000 500,000 100,000 EXPENSES 90,000 120,000 180,000 150,000 30,000 DEPRECIATION PRETAX PROFIT TAX (%20) PROFIT AFTER TAXES YEAR O YEAR 1 EAR YEAR 2 EAR YEAR 3 YEAR 4 YEARS EAR: YEAR 6 1.CASH FLOW FROM INVESTMENT 2.CASH FLOWS FROM WORKING CAPITAL 3.CASH FLOWS FROM OPERATIONS TOTAL CASH FLOWS FROM PROJECT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts