Question: i would like an explaintation how did they get the value of finance cost 2833 and 3023 and the non and current liabities that are

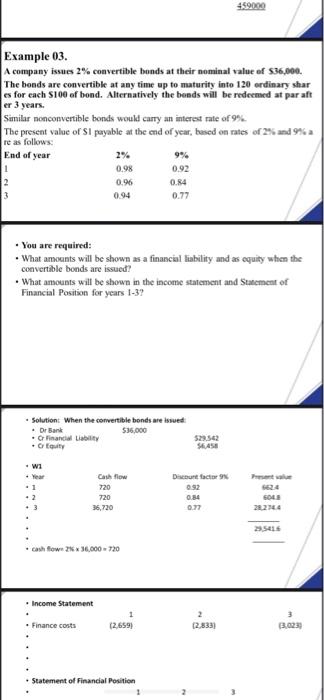

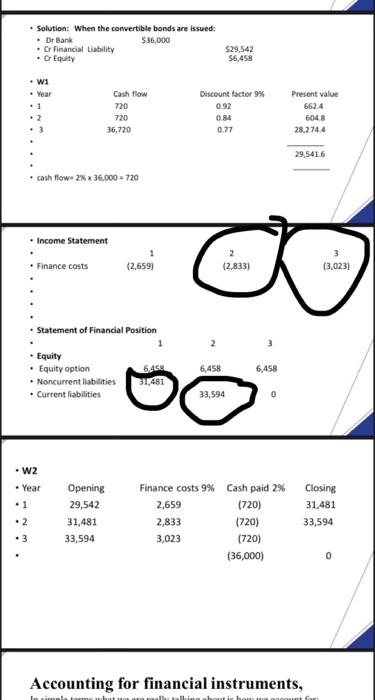

459020 Example 03. A company issues 2% convertible bonds at their nominal value of $36,000. The bonds are convertible at any time up to maturity into 120 ordinary shar es for each S106 of bond. Alternatively the bonds will be redeemed at par af er 3 years. Similar nonconvertible bonds would carty an interest rate of 9% The present value of S1 payable at the end of year, based on rates of 2% and 9% a re as follows: End of year 99% 1 0.98 0.92 2 0.96 0.84 0.94 0.77 3 . You are required: What amounts will be shown as a financial liability and as equity when the convertible bonds are issued? What amounts will be shown in the income statement and Statement of Financial Position for years 1-3? Solution. When the convertible bonds are issued Dr Bank 53,000 Financially Ei W Discount factor 1 Cash flow 720 720 1.720 0.84 0.72 604 2021 cash flow 36,000 720 Income Statement 1 (2.6591 Finance costs 12,832) 3,0233 Statement of Financial Position Solution: When the convertible bonds are issued: Dr Bank $36,000 Financial Liability . Equity $29,542 $6,458 W1 Year . 2 Cash flow 720 720 36,720 Discount factor 9% 0.92 0.84 0.77 Present value 6624 6048 28.274.4 29,5416 . cash flow 2% * 36,000 = 720 Income Statement 2 12,833) Finance costs (2.659) (3,023) Statement of Financial Position 6,458 6,458 Equity Equity option . Noncurrent liabilities . Current liabilities 31,481 33,594 0 W2 Year Opening 29,542 31,481 33,594 Finance costs 9% Cash paid 2% 2,659 (720) 2,833 (720) 3,023 (720) (36,000) Closing 31,481 33,594 .2 3 0 Accounting for financial instruments, halb

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts