Question: I would like assistance with this question 3:34 PM A tdsb.elearningontario.ca Journalize the following transactions, using the general journal page below. Calculate and add the

I would like assistance with this question

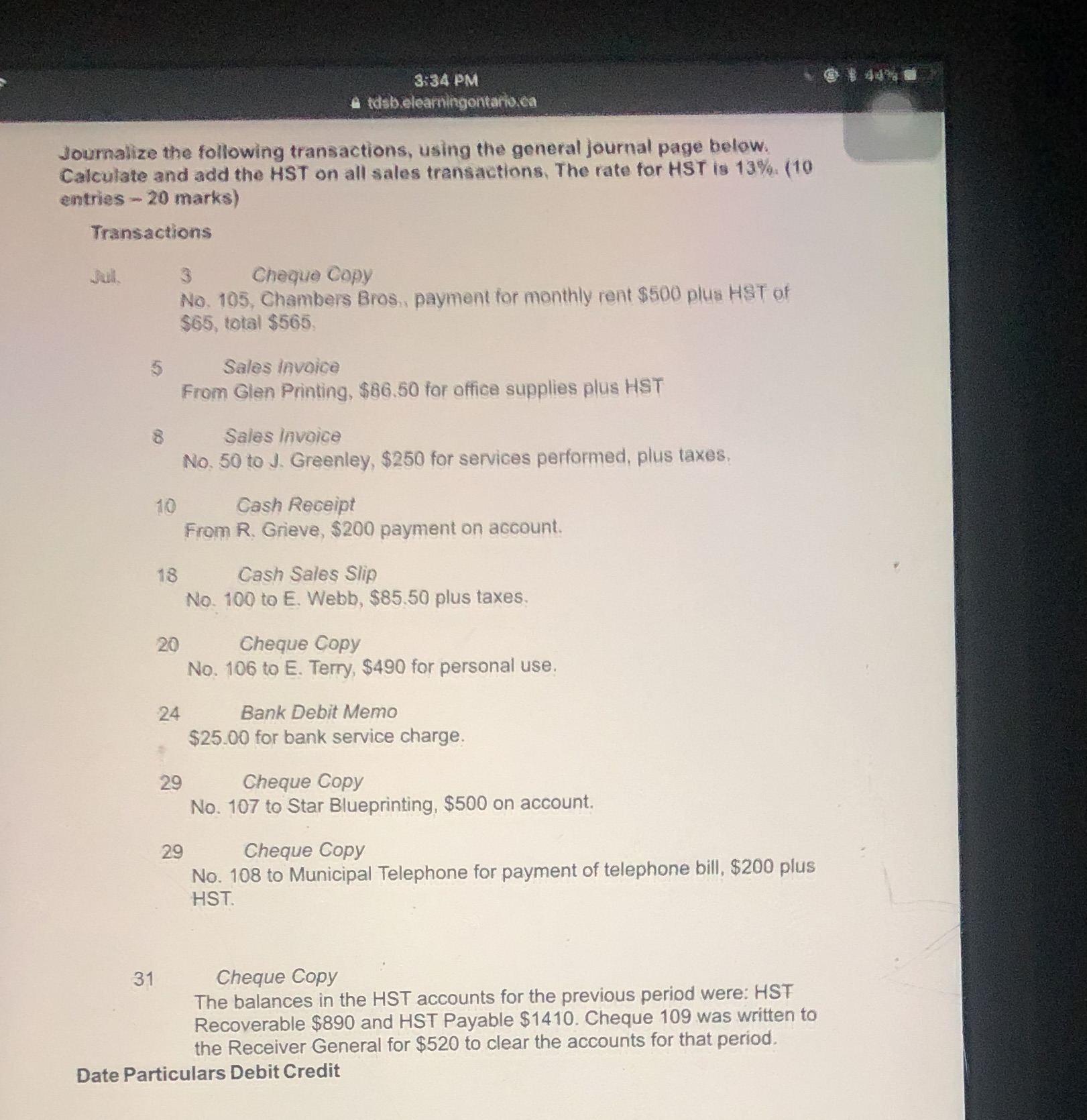

3:34 PM A tdsb.elearningontario.ca Journalize the following transactions, using the general journal page below. Calculate and add the HST on all sales transactions, The rate for HST is 13%%. (10 entries - 20 marks) Transactions Jull 3 Cheque Copy No. 105, Chambers Bros., payment for monthly rent $500 plus HST of $65, total $565. 5 Sales Invoice From Glen Printing, $86.50 for office supplies plus HST 8 Sales Invoice No. 50 to J. Greenley, $250 for services performed, plus taxes, 10 Cash Receipt From R. Grieve, $200 payment on account. 18 Cash Sales Slip No. 100 to E. Webb, $85.50 plus taxes. 20 Cheque Copy No. 106 to E. Terry, $490 for personal use. 24 Bank Debit Memo $25.00 for bank service charge. 29 Cheque Copy No. 107 to Star Blueprinting, $500 on account. 29 Cheque Copy No. 108 to Municipal Telephone for payment of telephone bill, $200 plus HST. 31 Cheque Copy The balances in the HST accounts for the previous period were: HST Recoverable $890 and HST Payable $1410. Cheque 109 was written to the Receiver General for $520 to clear the accounts for that period. Date Particulars Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts