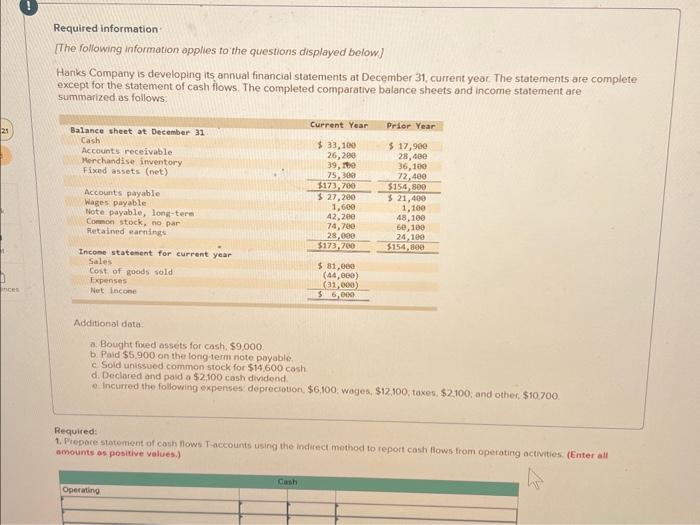

Question: I would like help with this problem thank you Required information [The following information applies ro the questions displayed below] Hanks Company is developing its

![following information applies ro the questions displayed below] Hanks Company is developing](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e7b01b4f228_93066e7b01ae2678.jpg)

Required information [The following information applies ro the questions displayed below] Hanks Company is developing its annual financial statements at December 31 , current year. The statements are complete except for the statement of cash flows. The completed comparative balance sheets and income statement are summarized as follows: Additional dota: a. Bought fored ossets for cash, $9,000 b Paid $5.900 on the long term note payable c. Sold unissued common stock for $14.600cash d. Declared and paid a $2,100 cosh dividend e Incurred the following expenses depreciotion, $6,100, wages, $12100, taxes, $2100; and other, $10,700. Required: 1. Prepoce stotement of cosh fows T-accounts using the indirect method to report cosh flows from operating activities. (Enter all omounts as positive values.) Additional data a. Bought fixed assets for casb. $9,000. b. Paid $5,900 on the long-term note payable. c. Sold unissued common stock for $14,600cash d. Declared and paid a $2,100 cash dividend. e. Incurted the following expenses depreciation, $6,100, wages, $12,100; taxes, $2,100, and other, $10700 Required: Prepare statement of cash flows T-accounts using the indirect method to report cash flows from operating activities. (Enter all amounts as positive values.) Required information [The following information applies ro the questions displayed below] Hanks Company is developing its annual financial statements at December 31 , current year. The statements are complete except for the statement of cash flows. The completed comparative balance sheets and income statement are summarized as follows: Additional dota: a. Bought fored ossets for cash, $9,000 b Paid $5.900 on the long term note payable c. Sold unissued common stock for $14.600cash d. Declared and paid a $2,100 cosh dividend e Incurred the following expenses depreciotion, $6,100, wages, $12100, taxes, $2100; and other, $10,700. Required: 1. Prepoce stotement of cosh fows T-accounts using the indirect method to report cosh flows from operating activities. (Enter all omounts as positive values.) Additional data a. Bought fixed assets for casb. $9,000. b. Paid $5,900 on the long-term note payable. c. Sold unissued common stock for $14,600cash d. Declared and paid a $2,100 cash dividend. e. Incurted the following expenses depreciation, $6,100, wages, $12,100; taxes, $2,100, and other, $10700 Required: Prepare statement of cash flows T-accounts using the indirect method to report cash flows from operating activities. (Enter all amounts as positive values.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts