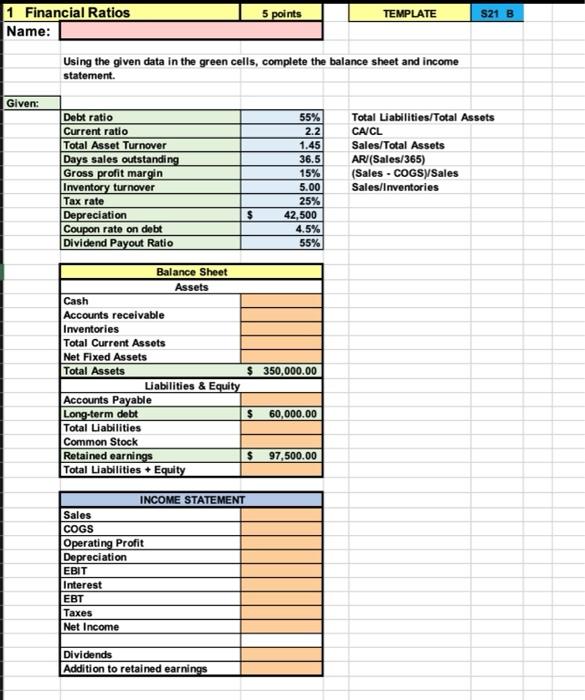

Question: i would like it worked in excel along with the formulas 1 Financial Ratios Name: 5 points TEMPLATE S21 B Using the given data in

1 Financial Ratios Name: 5 points TEMPLATE S21 B Using the given data in the green cells, complete the balance sheet and income statement Given: Debt ratio Current ratio Total Asset Turnover Days sales outstanding Gross profit margin Inventory turnover Tax rate Depreciation Coupon rate on debt Dividend Payout Ratio 55% 2.2 1.45 36.5 15% 5.00 25% 42,500 4.5% 55% Total Liabilities/Total Assets CA/CL Sales/Total Assets ARI(Sales/365) (Sales - COGSY/Sales Sales/Inventories $ Balance Sheet Assets Cash Accounts receivable Inventories Total Current Assets Net Fixed Assets Total Assets $ 350,000.00 Liabilities & Equity Accounts Payable Long-term debt $ 60,000.00 Total Liabilities Common Stock Retained earnings $ 97,500.00 Total Liabilities - Equity INCOME STATEMENT Sales COGS Operating Profit Depreciation EBIT Interest EBT Taxes Net Income Dividends Addition to retained earnings 1 Financial Ratios Name: 5 points TEMPLATE S21 B Using the given data in the green cells, complete the balance sheet and income statement Given: Debt ratio Current ratio Total Asset Turnover Days sales outstanding Gross profit margin Inventory turnover Tax rate Depreciation Coupon rate on debt Dividend Payout Ratio 55% 2.2 1.45 36.5 15% 5.00 25% 42,500 4.5% 55% Total Liabilities/Total Assets CA/CL Sales/Total Assets ARI(Sales/365) (Sales - COGSY/Sales Sales/Inventories $ Balance Sheet Assets Cash Accounts receivable Inventories Total Current Assets Net Fixed Assets Total Assets $ 350,000.00 Liabilities & Equity Accounts Payable Long-term debt $ 60,000.00 Total Liabilities Common Stock Retained earnings $ 97,500.00 Total Liabilities - Equity INCOME STATEMENT Sales COGS Operating Profit Depreciation EBIT Interest EBT Taxes Net Income Dividends Addition to retained earnings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts