Question: I would like to ask how do you know what WACC formula to use, as I noticed the WACC formulas used in the two questions

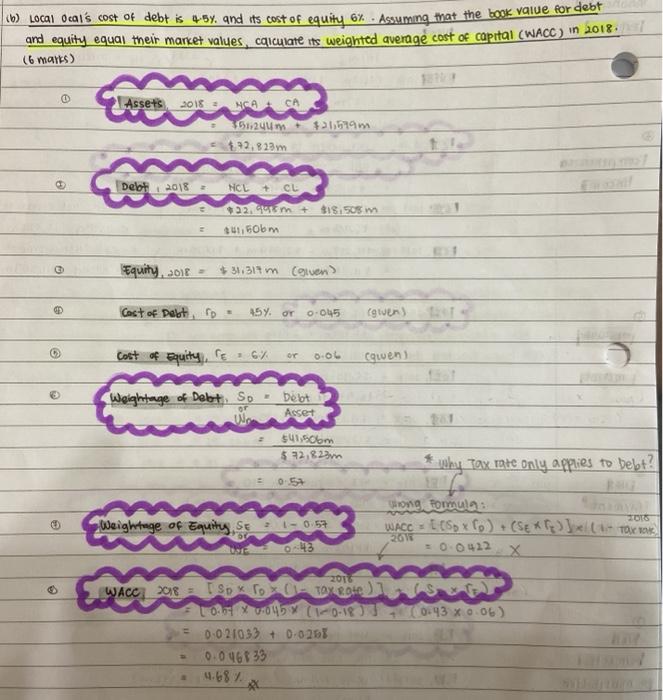

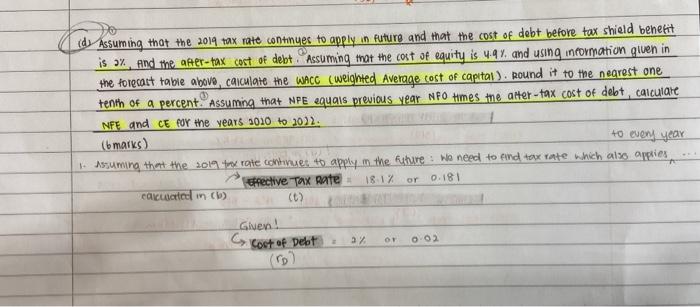

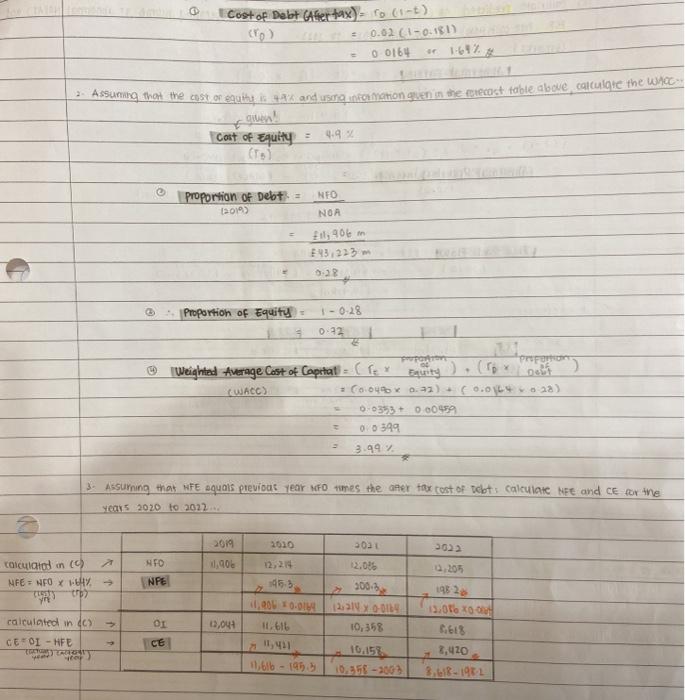

(6) Local Ocals cost of debt is 4.5% and its cost of equity 6%. Assuming that the book value for debt and equity equal their market values, calculate its weighted average cost of capital (WACC) in 2018 (6 marks) 0 Assets 2018 $21,079 5551,24 m. $72,823 m Debt 2018 HCL + CL $18.505 W 22.99 m + $1,50m Equity, 2018 $34.311 m Cowen Cast of Debt fp 154. or 0.045 (gen) they are Cost of Equity, E6% or 0.06 cowen Weightage of DebtSo or Delot Asset $41500m $ 72,822m * by tax rate only applies to belt? 05 TOTO Weightage of Equitus SE 1-0.57 One Tormula: WACC - (Solo) +(SE * -TOX Bike 2015 = 0.0422 x 43 2010 WACC 2018 Spro ) ) 02 045 (120-130.43 0.0L) 0.021033 + 0.0207 0.046939 1.68% de Assuming that the 2019 tax rate continues to apply in future and that the cost of debt before tax shield benefit is 3%, and the after-tax cost of debt. Assuming that the cost of equity is 4-4 Y and using information given in the forecast table above, calculate the WACC (weighted Average cost of capital). Round it to the negrest one tenth of a percent. Assuming that NPE equals previous year NFO times the after-tax cost of debt, calculare NFE and CE for the years 2020 to 30). (b marks) to every year 1. Assuming that the 2019 rate comes to apply the future: We need to end tox rate which also applies Efective Tax aate: Caructed in (b) Given! Cost of Debt 002 or 0.181 (0) 3 O Cost of Debt Cler tax-ro Cint) = 0.02 (1-0.181) 0 0164 3. Assuring that the cast or equip is 4% and ustanecamation gsen in de plecart table above calcunique the WACC Cost of Equity 4.9 NFO proportion of Debt 2019) NOA 1,90 m 13,223 Proportion of Equity 1-0.28 0.92 1 Weighted Average Cost of Capital ( Bait (WACC) = 0.048 x 0.22) + (0.0164622) 0:033 + 0.0099 0 0 399 3.99 % 3. Assuming that NFE aquals previous Year Momes the per tax cost of dots Calculate Nee and ce for the SOS 2020 to 2022 2019 2020 30 FO 1,906 calculaid in NFENFOX HY. NPE 45-3 2000-01 300 12.310 00 10,358 0 13,04 11.610 calculated in CE FOI -HFE CE 13.01.2001 6.6% 3,420 3.1.18-1972 1,6lb - 1995 10.258-2003 WACC Formula WACC = [6 Equity ) + )] xf2-Tax Rate ) Weightage of Equity X Cost of Equity) + 111 Weightage of Debt X Cost of Debt PS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts