Question: i would really appreciated if answer this question quickly thank you all. i dont want to any excel solution i want to hand solution i

i would really appreciated if answer this question quickly thank you all. i dont want to any excel solution i want to hand solution i want to learn thank you all.

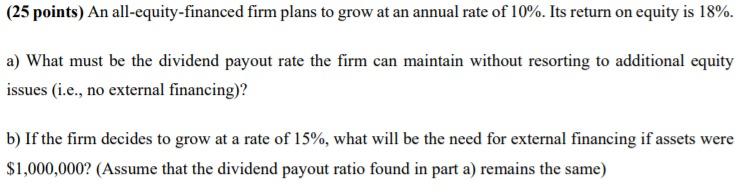

(25 points) An all-equity-financed firm plans to grow at an annual rate of 10%. Its return on equity is 18%. a) What must be the dividend payout rate the firm can maintain without resorting to additional equity issues (i.e., no external financing)? b) If the firm decides to grow at a rate of 15%, what will be the need for external financing if assets were $1,000,000? (Assume that the dividend payout ratio found in part a) remains the same)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts