Question: I ... ** YOUR 93% 05:07 chegg.com/homework- :D = Chegg Study Find solutions for your homewo business / finance / finance questions and answers /

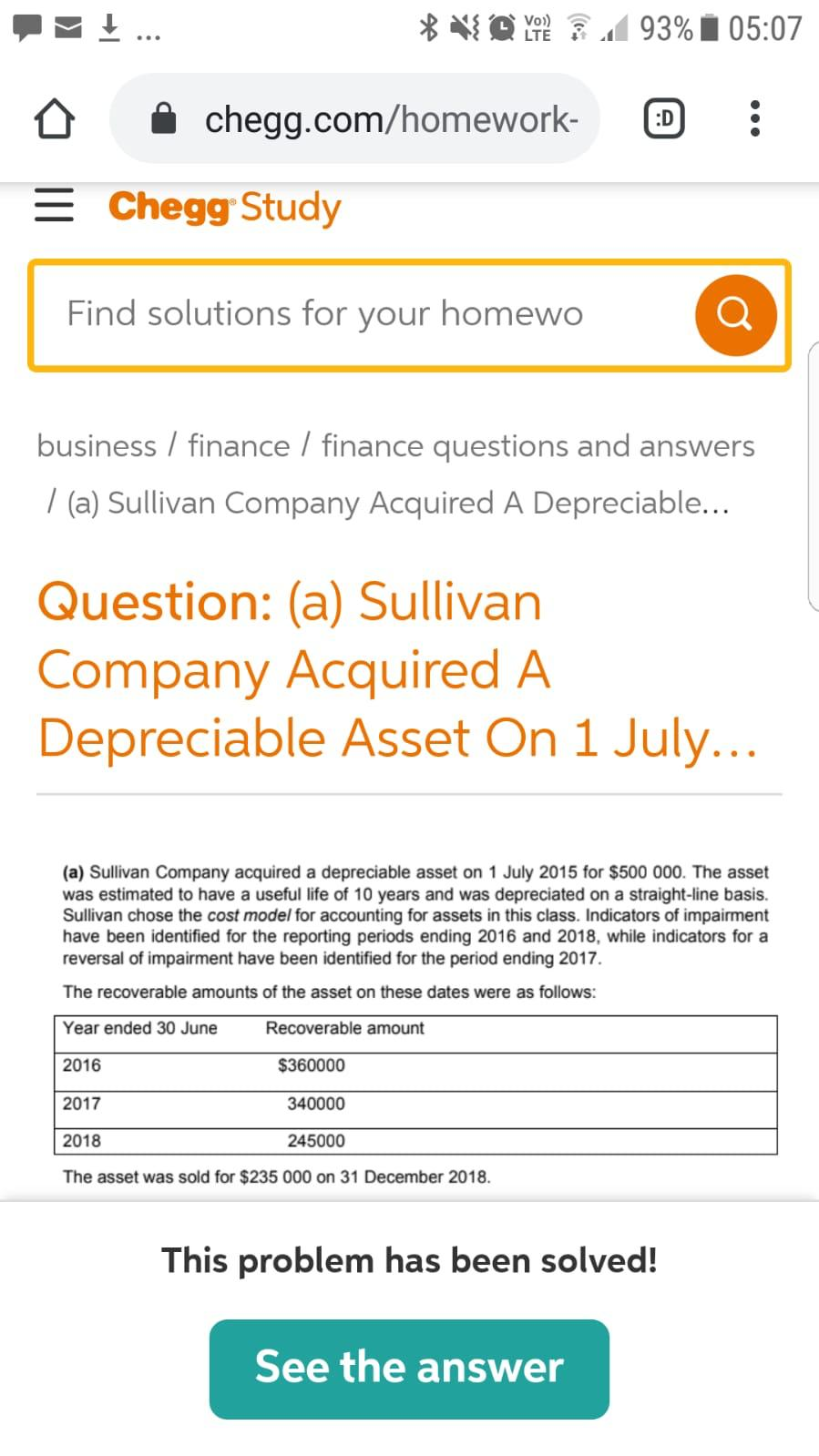

I ... ** YOUR 93% 05:07 chegg.com/homework- :D = Chegg Study Find solutions for your homewo business / finance / finance questions and answers / (a) Sullivan Company Acquired A Depreciable... Question: (a) Sullivan Company Acquired A Depreciable Asset On 1 July... (a) Sullivan Company acquired a depreciable asset on 1 July 2015 for $500 000. The asset was estimated to have a useful life of 10 years and was depreciated on a straight-line basis. Sullivan chose the cost model for accounting for assets in this class. Indicators of impairment have been identified for the reporting periods ending 2016 and 2018, while indicators for a reversal of impairment have been identified for the period ending 2017. The recoverable amounts of the asset on these dates were as follows: Year ended 30 June Recoverable amount 2016 $360000 2017 340000 2018 245000 The asset was sold for $235 000 on 31 December 2018. This problem has been solved! See the answer I ... ** YOUR 93% 05:07 chegg.com/homework- :D = Chegg Study Find solutions for your homewo business / finance / finance questions and answers / (a) Sullivan Company Acquired A Depreciable... Question: (a) Sullivan Company Acquired A Depreciable Asset On 1 July... (a) Sullivan Company acquired a depreciable asset on 1 July 2015 for $500 000. The asset was estimated to have a useful life of 10 years and was depreciated on a straight-line basis. Sullivan chose the cost model for accounting for assets in this class. Indicators of impairment have been identified for the reporting periods ending 2016 and 2018, while indicators for a reversal of impairment have been identified for the period ending 2017. The recoverable amounts of the asset on these dates were as follows: Year ended 30 June Recoverable amount 2016 $360000 2017 340000 2018 245000 The asset was sold for $235 000 on 31 December 2018. This problem has been solved! See the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts