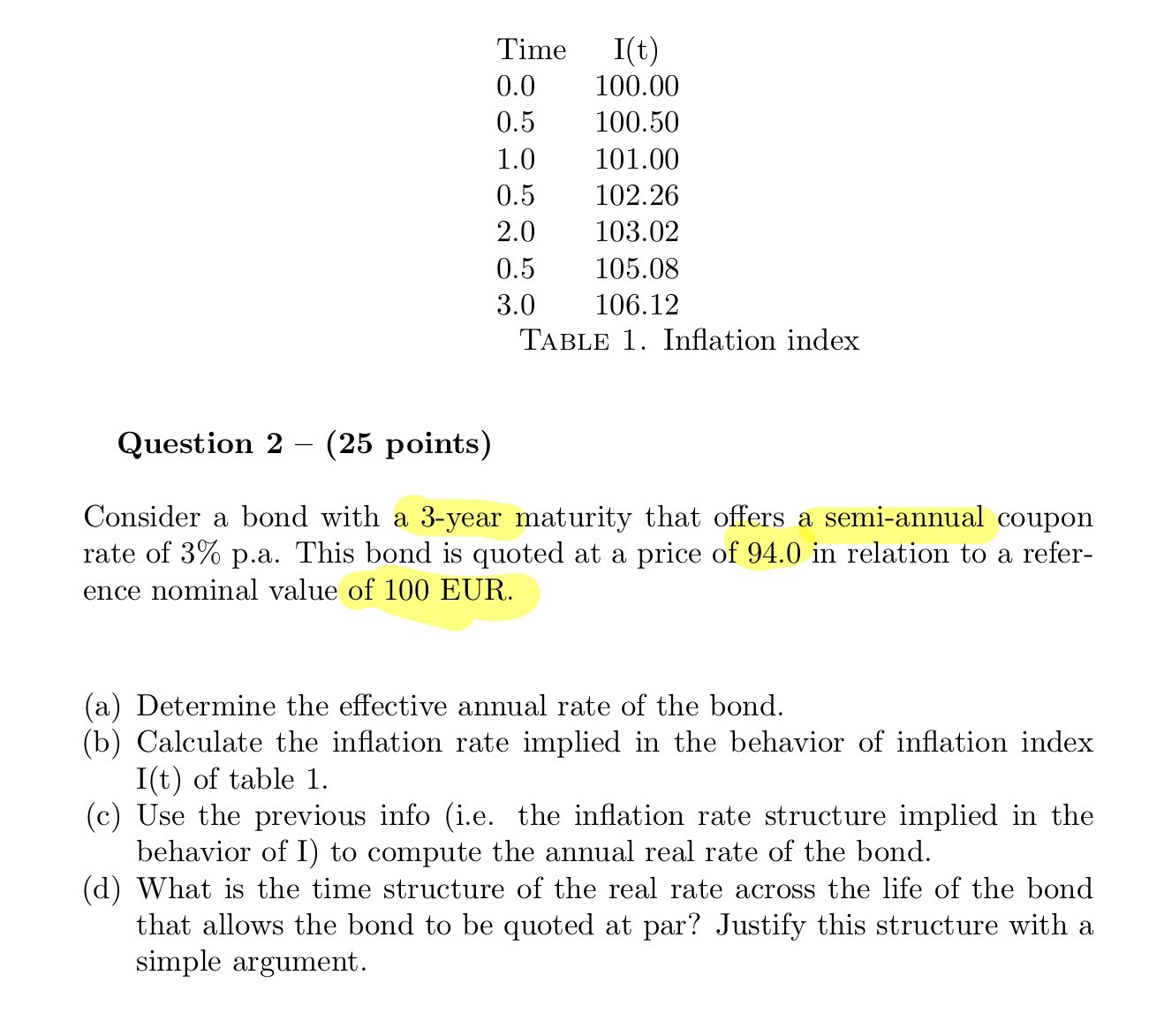

Question: 'I'ABLE 1. Inflation index Question 2(25 points ) Consider a bond with a 3-year maturity that offers a semi-annual coupon rate of 3% p.a. This

'I'ABLE 1. Inflation index Question 2(25 points ) Consider a bond with a 3-year maturity that offers a semi-annual coupon rate of 3% p.a. This bond is quoted at a price of 94.0 in relation to a reference nominal value of 100 EUR. (a) Determine the effective annual rate of the bond. (b) Calculate the inflation rate implied in the behavior of inflation index I(t) of table 1. (c) Use the previous info (i.e. the inflation rate structure implied in the behavior of I) to compute the annual real rate of the bond. (d) What is the time structure of the real rate across the life of the bond that allows the bond to be quoted at par? Justify this structure with a simple argument

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts