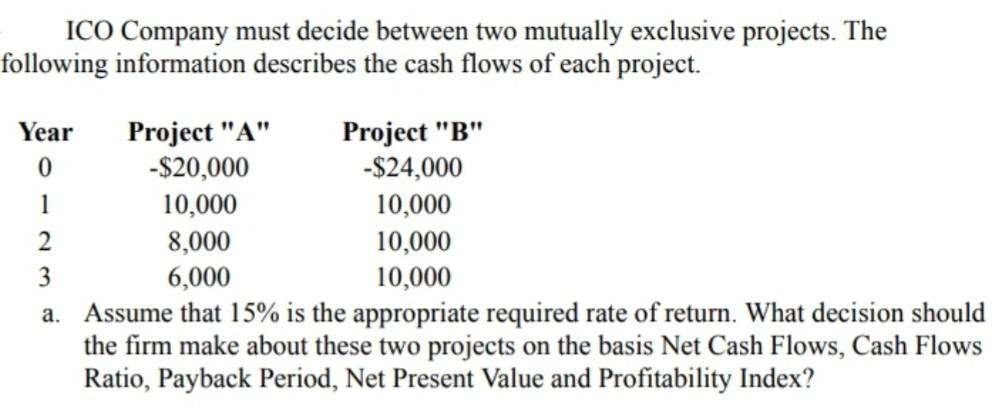

Question: ICO Company must decide between two mutually exclusive projects. The following information describes the cash flows of each project. 10,000 Year Project A Project B

ICO Company must decide between two mutually exclusive projects. The following information describes the cash flows of each project. 10,000 Year Project "A" Project "B" 0 -$20,000 -$24,000 1 10,000 10,000 2 8,000 3 6,000 10,000 a. Assume that 15% is the appropriate required rate of return. What decision should the firm make about these two projects on the basis Net Cash Flows, Cash Flows Ratio, Payback Period, Net Present Value and Profitability Index

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts