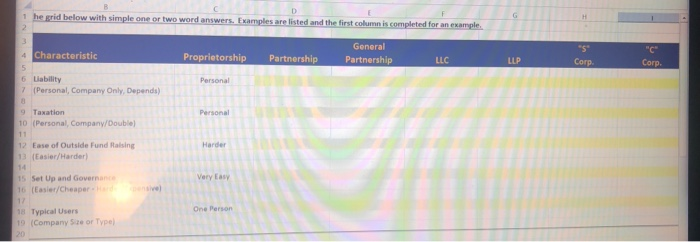

Question: id below with simple one or two wers. Examples are listed and the first column is completed for an example General Partnership Characteristic Proprietorship Partnership

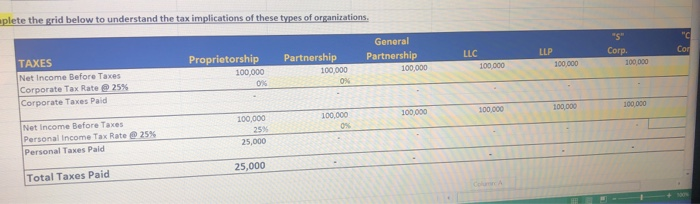

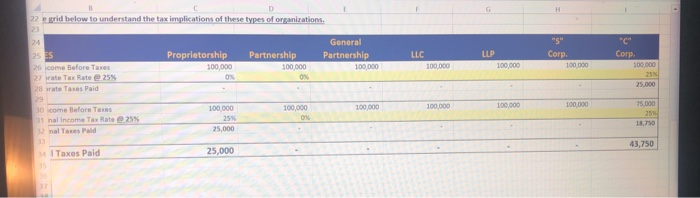

id below with simple one or two wers. Examples are listed and the first column is completed for an example General Partnership Characteristic Proprietorship Partnership LLC Corp Corp, 6 Liability Personal 7 (Personal, Company Only, Depends) 9 Taxation 0 (Personal, Company/Double) Personal Ease of Outside Fund Ralsing Harder Easier/Harder) Set Up and Governan Very Easy 6 (Easier/Cheaper One Person 8 Typical Users 9 (Company Size or Type plete the grid below to understand the tax implications of these types of organizations oRod Partnership TAXES Net Income Before Taxes Corporate Tax Rate @ 25% Corporate Taxes Paid Proprietorship Partnership Corp. 100,000 0% 100,000 0% 100,000 100,000 100000 100,000 100,000 100,000 100,000 0% 100,000 Net income Before Taxes Personal Income Tax Rate @25% Personal Taxes Pald 100,000 25% 25,000 25,000 Total Taxes Paid d below to understand the tax implications of these types of organizations General Partnership "S Corp C" Corp Proprietorship Partnership LLC LLP 100,000 0% 6 icome Before Taxes 28 rate Taxes Paid icomo Before Ties trate Tax Rate e 25% 0% 75,000 18,750 43,750 100,000 100,000 100,000 100,000 25% 25,000 100,000 100,000 nal Income Tax Rate e 25% nal Taxes Paid Taxes Paid 25,000 id below with simple one or two wers. Examples are listed and the first column is completed for an example General Partnership Characteristic Proprietorship Partnership LLC Corp Corp, 6 Liability Personal 7 (Personal, Company Only, Depends) 9 Taxation 0 (Personal, Company/Double) Personal Ease of Outside Fund Ralsing Harder Easier/Harder) Set Up and Governan Very Easy 6 (Easier/Cheaper One Person 8 Typical Users 9 (Company Size or Type plete the grid below to understand the tax implications of these types of organizations oRod Partnership TAXES Net Income Before Taxes Corporate Tax Rate @ 25% Corporate Taxes Paid Proprietorship Partnership Corp. 100,000 0% 100,000 0% 100,000 100,000 100000 100,000 100,000 100,000 100,000 0% 100,000 Net income Before Taxes Personal Income Tax Rate @25% Personal Taxes Pald 100,000 25% 25,000 25,000 Total Taxes Paid d below to understand the tax implications of these types of organizations General Partnership "S Corp C" Corp Proprietorship Partnership LLC LLP 100,000 0% 6 icome Before Taxes 28 rate Taxes Paid icomo Before Ties trate Tax Rate e 25% 0% 75,000 18,750 43,750 100,000 100,000 100,000 100,000 25% 25,000 100,000 100,000 nal Income Tax Rate e 25% nal Taxes Paid Taxes Paid 25,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts