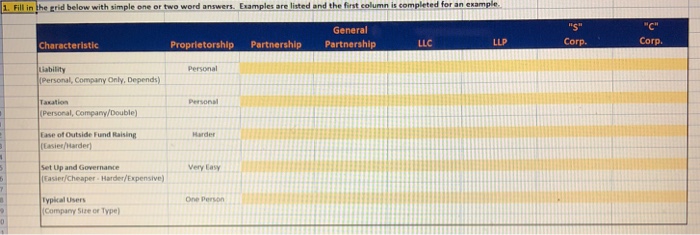

Question: 1. Fill in the grid below with simple one or two word answers. Examples are listed and the first column is completed for an example.

| 1. Fill in the grid below with simple one or two word answers. Examples are listed and the first column is completed for an example. | |||||||||

| Limited | "S" | "C" | |||||||

| Characteristic | Proprietorship | Partnership | Partnership | LLC | LLP | Corp. | Corp. | ||

| Liability | Personal | ||||||||

| (Personal, Company Only, Depends) | |||||||||

| Taxation | Personal | ||||||||

| (Personal, Company/Double) | |||||||||

| Ease of Outside Fund Raising | Harder | ||||||||

| (Easier/Harder) | |||||||||

| Set Up and Governance | Very Easy | ||||||||

| (Easier/Cheaper - Harder/Expensive) | |||||||||

| Typical Users | One Person | ||||||||

| (Company Size or Type) | |||||||||

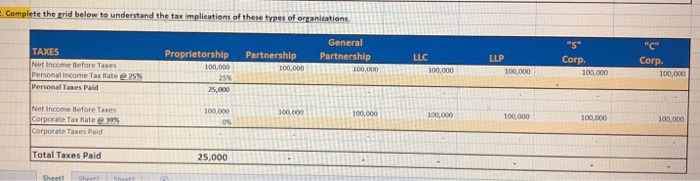

| 2. Complete the grid below to understand the tax implications of these types of organizations. | |||||||||

| Limited | "S" | "C" | |||||||

| TAXES | Proprietorship | Partnership | Partnership | LLC | LLP | Corp. | Corp. | ||

| Net Income Before Taxes | 100,000 | 100,000 | 100,000 | 100,000 | 100,000 | 100,000 | 100,000 | ||

| Corporate Tax Rate @ 39% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | ||

| Corporate Taxes Paid | - | - | - | - | - | - | - | ||

| Net Income Before Taxes | 100,000 | 100,000 | 100,000 | 100,000 | 100,000 | 100,000 | 100,000 | ||

| Personal Income Tax Rate @ 20% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | ||

| Personal Taxes Paid | - | - | - | - | - | - | - | ||

| Total Taxes Paid | Add Formula | ||||||||

1. Fill in the erid below with simple one or two word answers Examples are listed and the first column is completed for an example. S" Corp General Proprietorship Partnership Partnership LLC LLP Corp. Characteristic Liability Personal, Company Only. Depends) Taxation Personal, Company/Double) Ease of Outside Fund Raising Personal Personal asier/Harder) Very Easy Set Up and Governance Fasier/Cheaper Harder/Expensive One Person Typical Users Company Size oe Type

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts