Question: If I can get help question the first 3 questions please. Case 1 Hamilton & Jacobs (H&J) is a global investment company, providing start-up capital

If I can get help question the first 3 questions please.

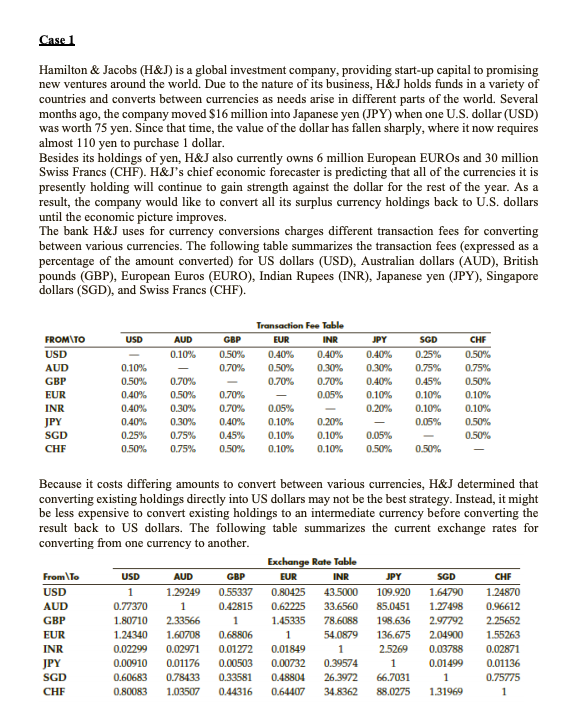

Case 1 Hamilton & Jacobs (H&J) is a global investment company, providing start-up capital to promising new ventures around the world. Due to the nature of its business, H&J holds funds in a variety of countries and converts between currencies as needs arise in different parts of the world. Several months ago, the company moved $16 million into Japanese yen (JPY) when one U.S. dollar (USD) was worth 75 yen. Since that time, the value of the dollar has fallen sharply, where it now requires almost 110 yen to purchase 1 dollar. Besides its holdings of yen, H&J also currently owns 6 million European EUROs and 30 million Swiss Franc (CHF). H&J's chief economic forecaster is predicting that all of the currencies it is presently holding will continue to gain strength against the dollar for the rest of the year. As a result, the company would like to convert all its surplus currency holdings back to U.S. dollars until the economic picture improves. The bank H&J uses for currency conversions charges different transaction fees for converting between various currencies. The following table summarizes the transaction fees (expressed as a percentage of the amount converted) for US dollars (USD), Australian dollars (AUD), British pounds (GBP), European Euros (EURO), Indian Rupees (INR), Japanese yen (JPY), Singapore dollars (SGD), and Swiss Franc (CHF). USD AUD 0.10% GBP 0.50% 0.70% FROM TO USD AUD GBP EUR INR JPY SGD CHF 0.10% 0.50% 0.40% 0.40% 0.40% 0.25% 0.50% Transaction Fee Table EUR INR 0.40% 0.40% 0.50% 0.30% 0.70% 0.70% 0.05% 0.05% 0.10% 0.20% 0.10% 0.10% 0.10% 0.10% JPY 0.40% 0.30% 0.40% 0.10% 0.20% 0.70% 0.50% 0.30% 0.30% 0.75% 0.75% SGD 0.25% 0.75% 0.45% 0.10% 0.10% 0.05% CHF 0.50% 0.75% 0.50% 0.10% 0.10% 0.50% 0.50% 0.70% 0.70% 0.40% 0.45% 0.50% 0.05% 0.50% 0.50% Because it costs differing amounts to convert between various currencies, H&J determined that converting existing holdings directly into US dollars may not be the best strategy. Instead, it might be less expensive to convert existing holdings to an intermediate currency before converting the result back to US dollars. The following table summarizes the current exchange rates for converting from one currency to another. Exchange Rate Table From To USD AUD GBP EUR INR JPY SGD CHF USD 1 1.29249 0.55337 0.80425 43.5000 109.920 1.64790 1.24870 AUD 0.77370 1 0.42815 0.62225 33.6560 85.0451 1.27498 0.96612 GBP 1.80710 2.33566 1 1.45335 78.6088 198.636 2.97792 2.25652 EUR 1.24340 1.60708 0.68806 1 54.0879 136.675 2.04900 1.55263 INR 0.02299 0.02971 0.01272 0.01849 1 2.5269 0.03788 0.02871 JPY 0.00910 0.01176 0.00503 0.00732 0.39574 1 0.01499 0.01136 SGD 0.60683 0.78433 0.33581 0.48804 26.3972 66.7031 1 0.75775 CHF 0.80083 1.03507 0.44316 0.64407 34.8362 88.0275 1.31969 1 The exchange rate table indicates, for instance, that one Japanese yen can be converted into 0.00910 US dollars. So 100,000 yen would produce $910 US. However, the bank's 0.40% fee for this transaction would reduce the net amount received to $910 X (1-0.004) = $906.36. So H&J wants your assistance in determining the best way to convert all of its non-US currency holdings back into US dollars. Answer the following questions: 1. Draw a network flow diagram for this problem. 2. Create a spreadsheet model for this problem and solve it. 3. What is the optimal solution? 4. If H&J converted each non-US currency it owns directly into US dollars, how many US dollars would it have? 5. Suppose H&J wants to perform the same conversion but also leave $5 million in Australian dollars. What is the optimal solution in this caseStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock