Question: Identification of Variable Interest Entity and Primary Beneficiary Softek Corporation forms a separate legal entity, Startek, to develop new technology. The entity is funded by

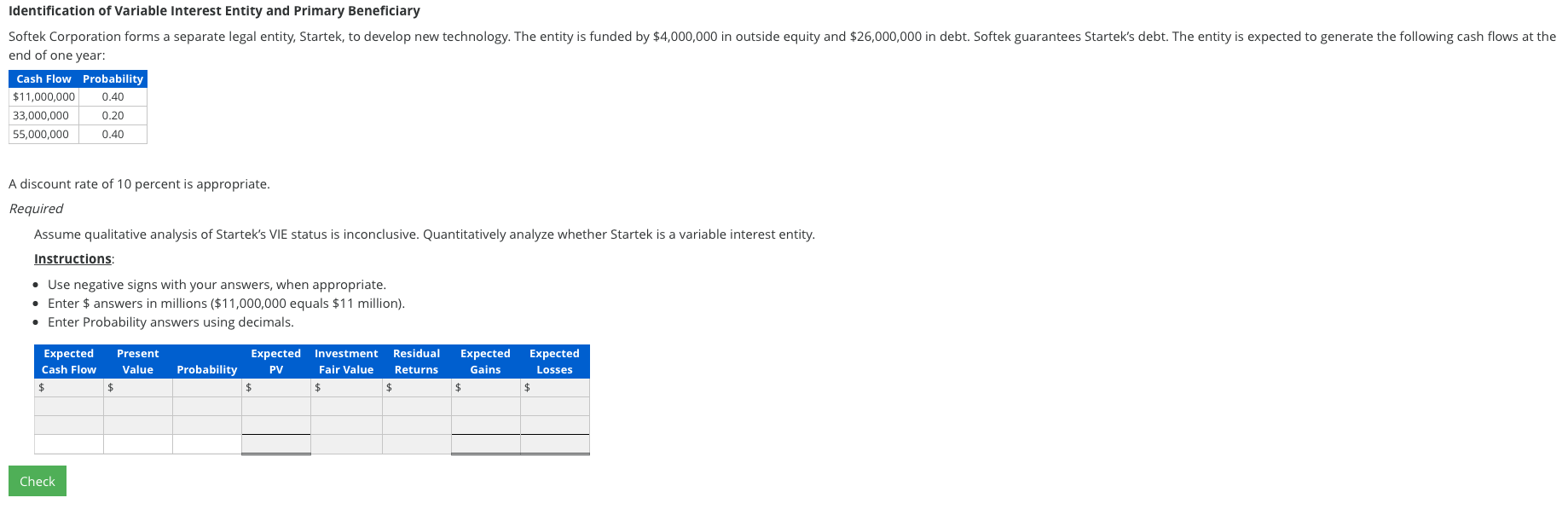

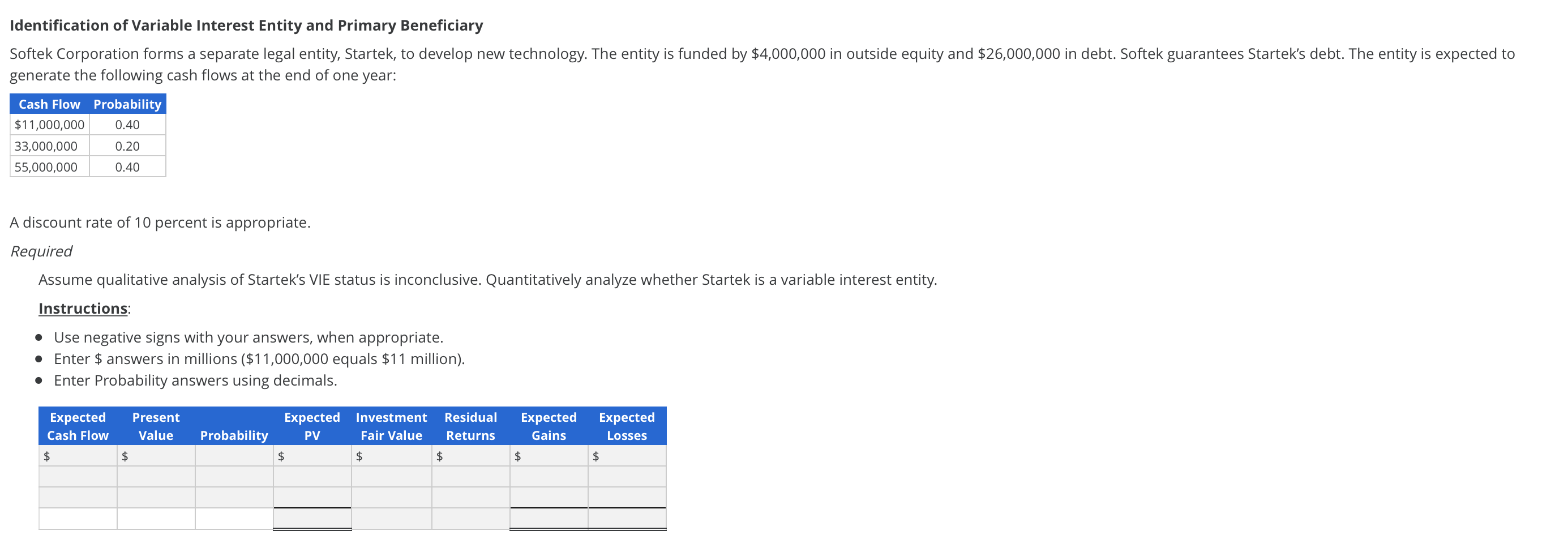

Identification of Variable Interest Entity and Primary Beneficiary Softek Corporation forms a separate legal entity, Startek, to develop new technology. The entity is funded by $4,000,000 in outside equity and $26,000,000 in debt. Softek guarantees Startek's debt. The entity is expected to generate the following cash flows at the end of one year: Cash Flow Probability $11,000,000 0.40 33,000,000 0.20 55,000,000 0.40 A discount rate of 10 percent is appropriate. Required Assume qualitative analysis of Startek's VIE status is inconclusive. Quantitatively analyze whether Startek is a variable interest entity. Instructions Use negative signs with your answers, when appropriate. Enter $answers in millions ($11,000,000 equals $11 million). Enter Probability answers using decimals. Expected Expected Expected Present Expected Investment Residual Cash Flow Value Probability Fair Value Gains PV Returns Losses Check Identification of Variable Interest Entity and Primary Beneficiary Softek Corporation forms a separate legal entity, Startek, to develop new technology. The entity is funded by $4,000,000 in outside equity and $26,000,000 in debt. Softek guarantees Startek's debt. The entity is expected to generate the following cash flows at the end of one year: Cash Flow Probability $11,000,000 0.40 33,000,000 0.20 55,000,000 0.40 A discount rate of 10 percent is appropriate. Required Assume qualitative analysis of Startek's VIE status is inconclusive. Quantitatively analyze whether Startek is a variable interest entity. Instructions: Use negative signs with your answers, when appropriate. Enter $ answers in millions ($11,000,000 equals $11 million) Enter Probability answers using decimals. Residual Expected Present Expected Investment Expected Expected Cash Flow Value Probability Fair Value Gains PV Returns Losses $ $ $ $ $ $ $ Identification of Variable Interest Entity and Primary Beneficiary Softek Corporation forms a separate legal entity, Startek, to develop new technology. The entity is funded by $4,000,000 in outside equity and $26,000,000 in debt. Softek guarantees Startek's debt. The entity is expected to generate the following cash flows at the end of one year: Cash Flow Probability $11,000,000 0.40 33,000,000 0.20 55,000,000 0.40 A discount rate of 10 percent is appropriate. Required Assume qualitative analysis of Startek's VIE status is inconclusive. Quantitatively analyze whether Startek is a variable interest entity. Instructions Use negative signs with your answers, when appropriate. Enter $answers in millions ($11,000,000 equals $11 million). Enter Probability answers using decimals. Expected Expected Expected Present Expected Investment Residual Cash Flow Value Probability Fair Value Gains PV Returns Losses Check Identification of Variable Interest Entity and Primary Beneficiary Softek Corporation forms a separate legal entity, Startek, to develop new technology. The entity is funded by $4,000,000 in outside equity and $26,000,000 in debt. Softek guarantees Startek's debt. The entity is expected to generate the following cash flows at the end of one year: Cash Flow Probability $11,000,000 0.40 33,000,000 0.20 55,000,000 0.40 A discount rate of 10 percent is appropriate. Required Assume qualitative analysis of Startek's VIE status is inconclusive. Quantitatively analyze whether Startek is a variable interest entity. Instructions: Use negative signs with your answers, when appropriate. Enter $ answers in millions ($11,000,000 equals $11 million) Enter Probability answers using decimals. Residual Expected Present Expected Investment Expected Expected Cash Flow Value Probability Fair Value Gains PV Returns Losses $ $ $ $ $ $ $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts