Question: Softek Corporation forms a separate legal entity, Startek, to develop new technology. The entity is funded by $4,000,000 in outside equity and $26,000,000 in debt.

Softek Corporation forms a separate legal entity, Startek, to develop new technology. The entity is funded by $4,000,000 in outside equity and $26,000,000 in debt. Softek guarantees Starteks debt. The entity is expected to generate the following cash flows at the end of one year:

Softek Corporation forms a separate legal entity, Startek, to develop new technology. The entity is funded by $4,000,000 in outside equity and $26,000,000 in debt. Softek guarantees Starteks debt. The entity is expected to generate the following cash flows at the end of one year:

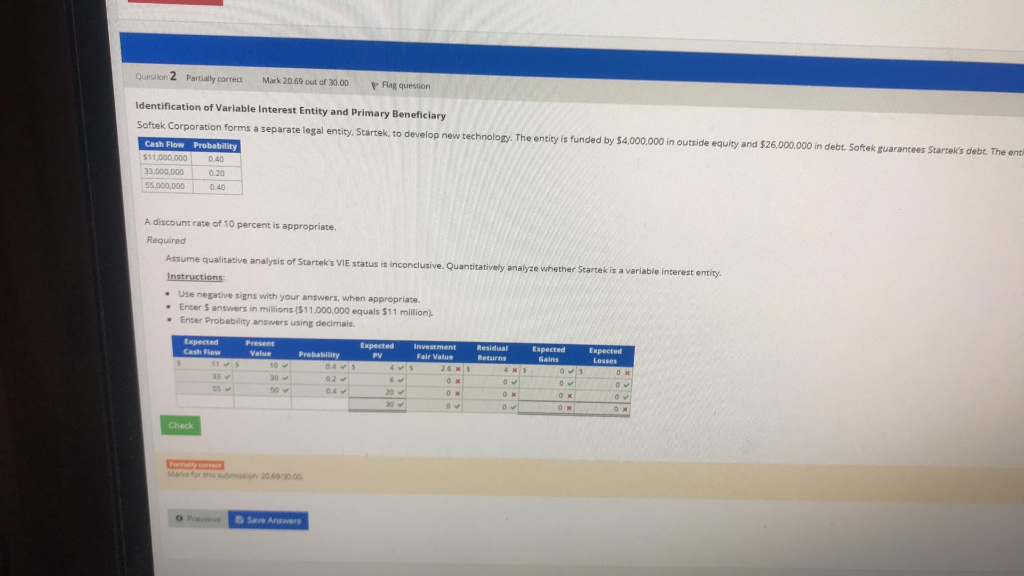

Quest 2 Partially correc Mark 20.69 out of 30.00 P Flag question Identification of Variable Interest Entity and Primary Beneficiary Softek Corporation forms a separate legal entity, Startek, to develop new technology. The entity is funded by $4,000,000 in outside equity and $26,000,000 in debt. Softek guarantees Startek's debt. The enti Cash Flow Probability 511,000,000 0.40 33,000,000 0.20 55.000.000 0.40 A discount rate of 10 percent is appropriate Required Assume qualitative analysis of Startek's VIE status is inconclusive. Quantitatively analyze whether Startek is a variable interest entity. Instructions Use negative signs with your answers, when appropriate Enter 5 answers in millions ($11,000,000 equals $11 million). Enter Probability answers using decimals. Expected Cash Flow Present Value Probability 04 Expected PV Investment Fair Value 26 M Residual Returns 4 X O Expected Gains OS Expected Losses OX 0 O 04 6 20 30 OM OX O 0 OM OM Check Marie forum 200.00 G D Save Answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts