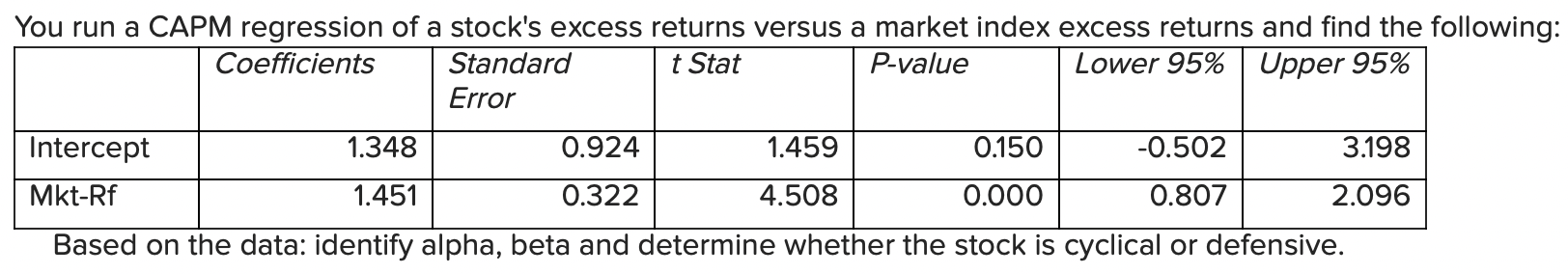

Question: identify alpha, beta and determine whether the stock is cyclical or defensive You run a CAPM regression of a stock's excess returns versus a market

identify alpha, beta and determine whether the stock is cyclical or defensive

You run a CAPM regression of a stock's excess returns versus a market index excess returns and find the following: Coefficients Standard t Stat P-value Lower 95% Upper 95% Error Intercept 1.348 0.924 1.459 0.150 -0.502 3.198 Mkt-Rf 1.451 0.322 4.508 0.000 0.807 2.096 Based on the data: identify alpha, beta and determine whether the stock is cyclical or defensive

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts