Question: Question 1.2 Ex Post Beta Coefficient It is May 1, 2020. The latest stock price for Red Rock Mining Company (RRM.TO) is $14.01. Issued capital

Question 1.2 Ex Post Beta Coefficient

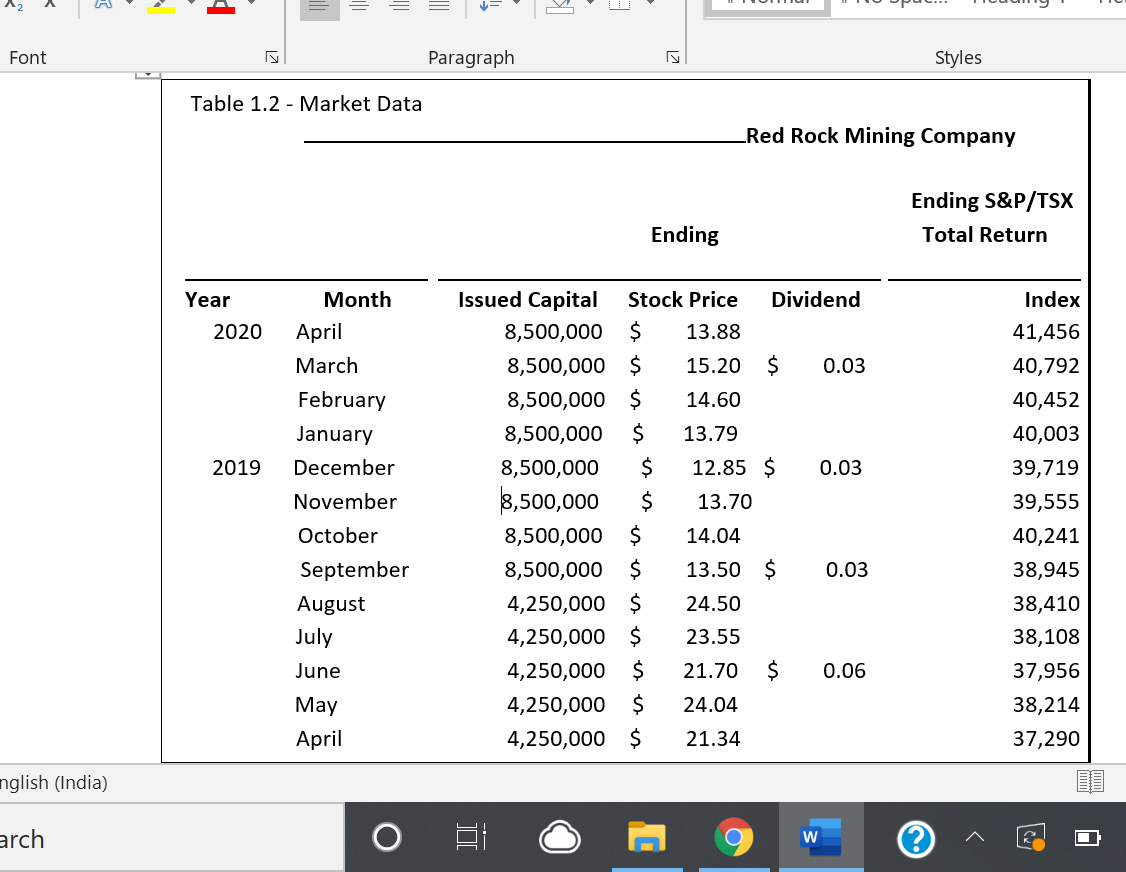

It is May 1, 2020. The latest stock price for Red Rock Mining Company (RRM.TO) is $14.01. Issued capital is equal to the number of shares outstanding for Red Rock Mining Company in the month as illustrated in Table 1.2. The expected return on the market in 2020 is 10%, and the risk-free rate is 1.1%.

Table 1.2 provides historical monthly data for Red Rock Mining Company Limited and for the index values for the S&P/TSX Total Return Index over the same period.

| Required:

|

|

. Font Paragraph Styles Table 1.2 - Market Data _Red Rock Mining Company Ending S&P/TSX Total Return Ending Year 2020 Month April March February January December November October September August 2019 Issued Capital Stock Price Dividend 8,500,000 $ 13.88 8,500,000 $ 15.20 $ 0.03 8,500,000 $ 14.60 8,500,000 $ 13.79 8,500,000 $ 12.85 $ 0.03 |8,500,000 $ 13.70 8,500,000 $ 14.04 8,500,000 $ 13.50 $ 0.03 4,250,000 $ 24.50 4,250,000 $ 23.55 4,250,000 $ 21.70 $ 0.06 4,250,000 $ 24.04 4,250,000 $ 21.34 Index 41,456 40,792 40,452 40,003 39,719 39,555 40,241 38,945 38,410 38,108 37,956 38,214 37,290 July June May April nglish (India) arch O O 9 w ^ E O . Font Paragraph Styles Table 1.2 - Market Data _Red Rock Mining Company Ending S&P/TSX Total Return Ending Year 2020 Month April March February January December November October September August 2019 Issued Capital Stock Price Dividend 8,500,000 $ 13.88 8,500,000 $ 15.20 $ 0.03 8,500,000 $ 14.60 8,500,000 $ 13.79 8,500,000 $ 12.85 $ 0.03 |8,500,000 $ 13.70 8,500,000 $ 14.04 8,500,000 $ 13.50 $ 0.03 4,250,000 $ 24.50 4,250,000 $ 23.55 4,250,000 $ 21.70 $ 0.06 4,250,000 $ 24.04 4,250,000 $ 21.34 Index 41,456 40,792 40,452 40,003 39,719 39,555 40,241 38,945 38,410 38,108 37,956 38,214 37,290 July June May April nglish (India) arch O O 9 w ^ E O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts