Question: Identify the choice that best completes the statement or answers the question. 1. Which of the following institutional investors will most likely have the longest

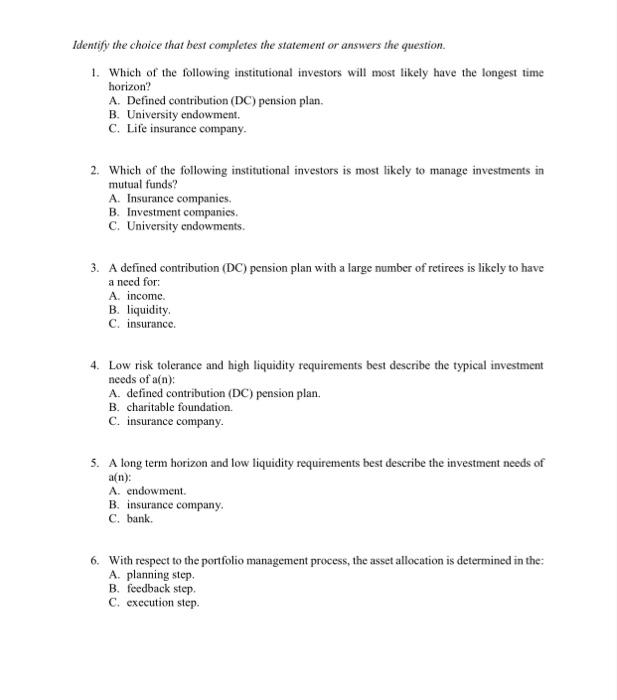

Identify the choice that best completes the statement or answers the question. 1. Which of the following institutional investors will most likely have the longest time horizon? A. Defined contribution (DC) pension plan. B. University endowment. C. Life insurance company. 2. Which of the following institutional investors is most likely to manage investments in mutual funds? A. Insurance companies. B. Investment companies. C. University endowments. 3. A defined contribution (DC) pension plan with a large number of retirees is likely to have a need for: A. income. B. liquidity C. insurance 4. Low risk tolerance and high liquidity requirements best describe the typical investment needs of a(n): A. defined contribution (DC) pension plan. B. charitable foundation. C. insurance company. 5. A long term horizon and low liquidity requirements best describe the investment needs of an): A. endowment. B. insurance company c. bank. 6. With respect to the portfolio management process, the asset allocation is determined in the A. planning step. B. feedback step C. execution step

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts