Question: Identify the major risks faced by Shaw communication inc and whether it evades its risk exposures or not. This information is generally reported in the

Identify the major risks faced by Shaw communication inc and whether it evades its risk exposures or not. This information is generally reported in the firms annual report or the statements filed with the regulatory body in the firms home country. 2- Collect data on the major risk factors that you have identified from your own research in the question above and the stock return of the firm. Test for a statistical relationship between changes in the risk factors and the stock return (regression analysis in your prep courses). Use the last 5-years worth of daily, or monthly data for your analysis

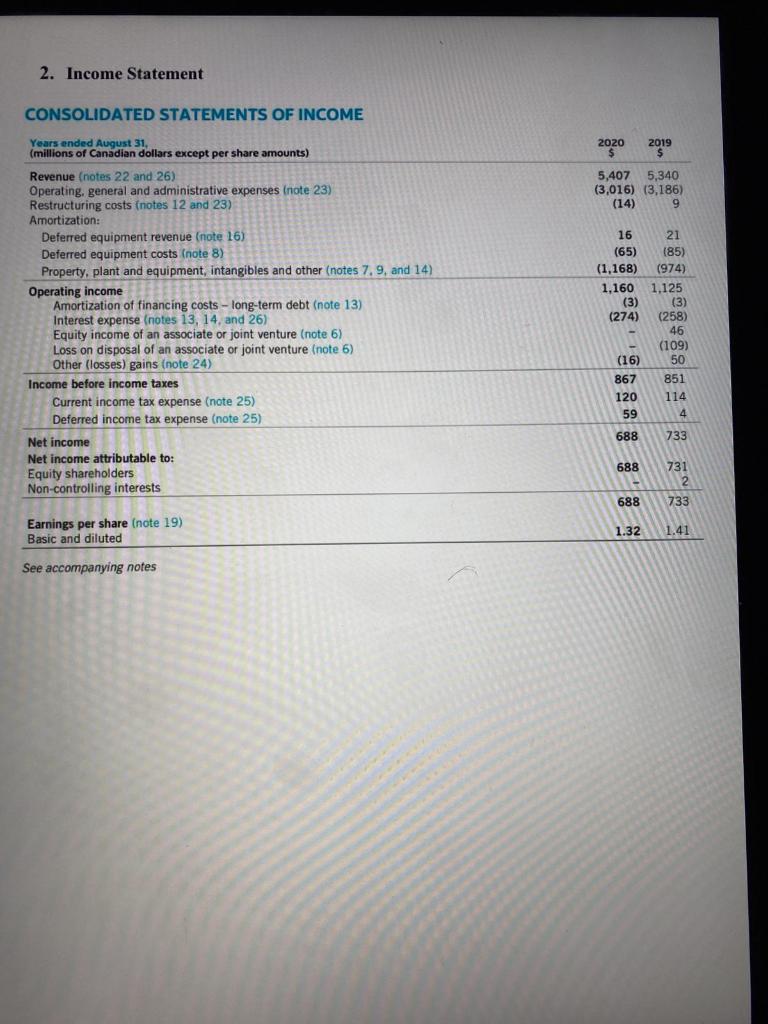

2. Income Statement CONSOLIDATED STATEMENTS OF INCOME 2020 2019 $ 5,407 5,340 (3,016) (3,186) (14) 9 Years ended August 31, (millions of Canadian dollars except per share amounts) Revenue (notes 22 and 26) Operating, general and administrative expenses (note 23) Restructuring costs (notes 12 and 23) Amortization: Deferred equipment revenue (note 16) Deferred equipment costs (note 8) Property, plant and equipment, intangibles and other (notes 7.9, and 14) Operating income Amortization of financing costs - long-term debt (note 13) Interest expense (notes 13, 14, and 26) Equity income of an associate or joint venture (note 6) Loss on disposal of an associate or joint venture (note 6) Other (losses) gains (note 24) Income before income taxes Current income tax expense (note 25) Deferred income tax expense (note 25) Net income Net income attributable to: Equity shareholders Non-controlling interests 16 (65) (1,168) 1.160 (3) (274) 21 (85) (974) 1.125 (3) (258) 46 (109) (16) 867 120 59 50 851 114 4 688 733 688 731 2 688 733 Earnings per share (note 19) Basic and diluted 1.32 1.41 See accompanying notes 2. Income Statement CONSOLIDATED STATEMENTS OF INCOME 2020 2019 $ 5,407 5,340 (3,016) (3,186) (14) 9 Years ended August 31, (millions of Canadian dollars except per share amounts) Revenue (notes 22 and 26) Operating, general and administrative expenses (note 23) Restructuring costs (notes 12 and 23) Amortization: Deferred equipment revenue (note 16) Deferred equipment costs (note 8) Property, plant and equipment, intangibles and other (notes 7.9, and 14) Operating income Amortization of financing costs - long-term debt (note 13) Interest expense (notes 13, 14, and 26) Equity income of an associate or joint venture (note 6) Loss on disposal of an associate or joint venture (note 6) Other (losses) gains (note 24) Income before income taxes Current income tax expense (note 25) Deferred income tax expense (note 25) Net income Net income attributable to: Equity shareholders Non-controlling interests 16 (65) (1,168) 1.160 (3) (274) 21 (85) (974) 1.125 (3) (258) 46 (109) (16) 867 120 59 50 851 114 4 688 733 688 731 2 688 733 Earnings per share (note 19) Basic and diluted 1.32 1.41 See accompanying notes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts